Solana price broke through the $200 psychological barrier during intraday trading on January 2nd. Amid this extended rally, the Pump.fun platform moved significant volumes of SOL tokens to Kraken.

Although forex inflows typically signal bearish sentiment due to potential selling pressure, the bullish momentum of the Solana rally remains strong, resisting these typical trends.

Solana sees renewed bullish momentum after large deposits

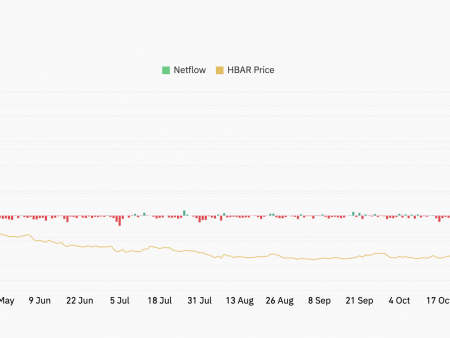

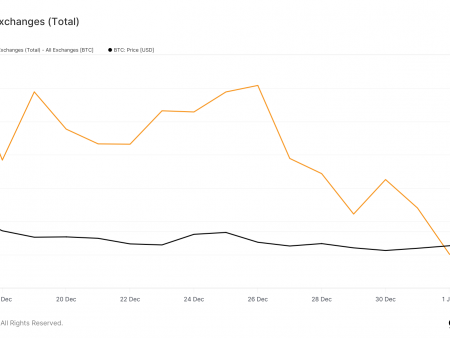

According to Solscan, on January 1, Pump.fun made two large deposits to Kraken. The first transfer of US$22.8 million to SOL occurred at 16:37 UTC, followed by a second deposit of US$32.7 million at 17:45. In addition, network data shows that on January 2, the Solana-based platform designed to easily create and trade memcoins deposited 63,171 SOL ($13.11 million) into Kraken.

Typically, a sharp increase in exchange-traded inflows is a bearish sign and is often a precursor to a decline in prices. However, SOL has seen a surge in demand to offset this surge in supply. Thus, since January 1, its price has maintained an upward trend.

In fact, during the January 2 trading session, SOL broke above the descending parallel channel it had been trading in since November 23. This channel consists of two downward parallel trend lines formed when the price of an asset is in a downward trend.

When an asset’s price breaks the upper boundary of a channel, it signals a potential reversal to bullish momentum, suggesting that the asset may experience an upward price movement.

Moreover, the price of SOL broke above its 20-day exponential moving average (EMA), confirming the increase in demand for the altcoin. The 20-day EMA measures the average price of an asset over the last 20 trading days. It gives more weight to recent prices, making it more sensitive to recent price movements than a simple moving average.

When an asset’s price exceeds the 20-day EMA, it indicates a shift towards bullish momentum, indicating a potential uptrend as market sentiment becomes increasingly positive.

SOL price forecast: altcoin may break through all-time high

On the daily chart, the SOL Moving Average Convergence Divergence (MACD) indicator confirms this bullish forecast. At the time of clicking, the coin’s MACD line (blue) is above its signal line (orange). For context, this bullish crossover occurred on January 1st when Pump.fun began depositing coins into Kraken.

When an asset’s MACD indicator is set up this way, it indicates bullish momentum. This means that the asset’s price can continue to rise because short-term price action is stronger than the long-term trend.

If this continues, SOL price could break through the resistance at $219.31 and reclaim its all-time high of $264.63. Conversely, a surge in selling will invalidate this bullish forecast, stopping the rise in Solana prices. In this case, the price of SOL could fall to $189.24.