Over the past seven days, the price of Solan (SOL) has fallen by 20%, reducing its market capitalization to $ 85 billion. Technical indicators, such as Ichimoku Cloud and DMI, distinguish a strong bear pulse, while SOL is traded below critical levels and encounters intensive sales pressure.

If the current descending trend continues, Sol Risks Testing supports 159 and $ 147, with a potential fall of up to $ 133, notes a correction of 22.6%. Nevertheless, the recovery can see the resistance of SOL Challenge at the level of 183 US dollars and, if they are broken, aimed at the rebound of up to $ 203, which offers hope for the return of bull impulse.

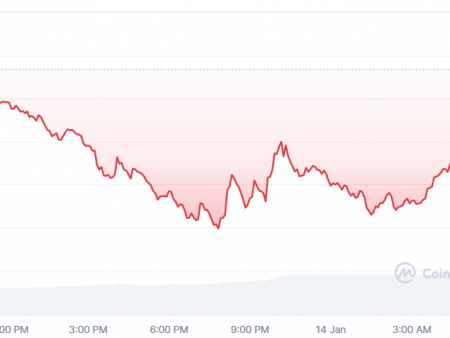

SOLANA ICHIMOKU CLOUD confirms the bear installation

ICHIMOKU cloud diagram for SOLANA reveals bear prospects. Its price is traded significantly below the cloud (kumo), signaling a strong descending pulse. The cloud itself is red and expands, which indicates a growing bear tendency and resistance in front.

In addition, both the transformation line (blue) and the base line (red) are down, with the conversion line under the original line, enhancing the bear installation. This alignment emphasizes the ongoing pressure of sales without direct signs of cancellation.

In addition, the delay (green) is lower than the price and clouds, which further confirms the bear. Conversely, for any restoration, Sol Price should have broken above the cloud.

SOL -T.

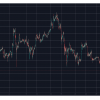

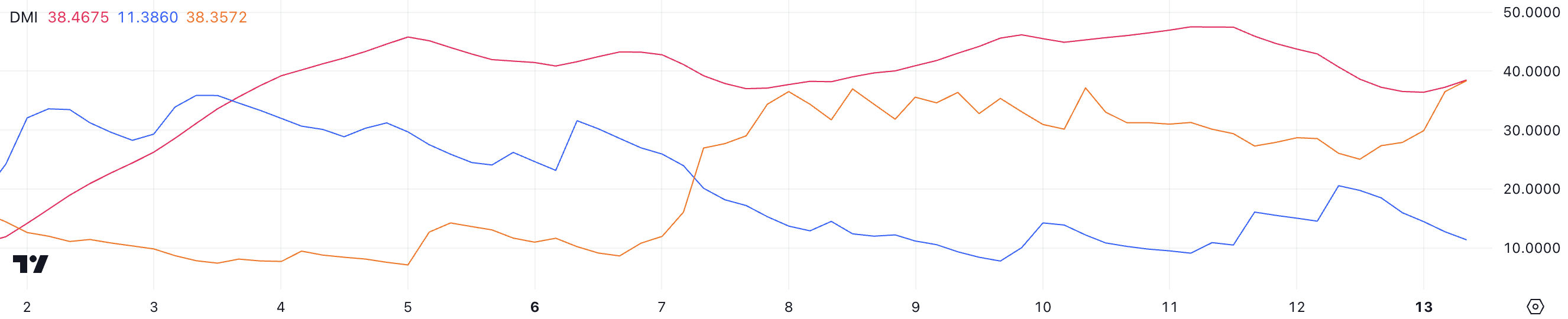

The Sol DMI diagram shows its ADX in 38.4, which indicates a strong trend. ADX (the average direction index) measures the strength of the trend without indicating its direction.

The values above 25 usually indicate a strong trend, and when ADX exceeds 40, it reflects a very strong strength of the trend, regardless of whether the trend is optimistic or bear.

Directed indicators additionally emphasize the bear pressure on SOL. The positive direction index (+DI) dropped sharply from 20.5 to 11.3, signaling a significant weakening of the bull pulse. Meanwhile, the negative direction of the direction (-DI) increased from 26 to 38.3, emphasizing the increase in bear dominance.

Together, these indicators confirm that SOL is firmly in the descending trend, and the strong ADX suggests that the descending trend is unlikely to turn in the short term. If +di does not show signs of recovery or reduction -di, Sol Price may remain under pressure in the near future.

Price Forecast: Can SOLANA below $ 140 in January?

If the current descending trend remains, Solana Price can check its next level of support of $ 159. If this level cannot pass, the price can fall further to $ 147, while the constant strong descending trend potentially reduced it to $ 133, which is 22.6% of the correction from current levels.

On the other hand, if Sol Price manages to restore his impulse, he can challenge the $ 183 resistance. A break above this level can pave the path for rebound to $ 203, which marked a significant recovery.