Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred when trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content is accurate as of the date of publication, but some offers mentioned may no longer be available.

Solana’s SOL gained over 18% in the last 24 hours to outperform major cryptocurrencies on a dull trading day.

SOL has surpassed $63, a level last seen in May 2022. Daily trading volumes increased by more than 70% to over $3.7 billion, up from an average of $2 billion in early November.

SOL is up 150% since October 1, but is still 77% below its all-time high, according to a cryptocurrency research firm kaikowhich highlighted a surprising factor for Solana’s continued rise.

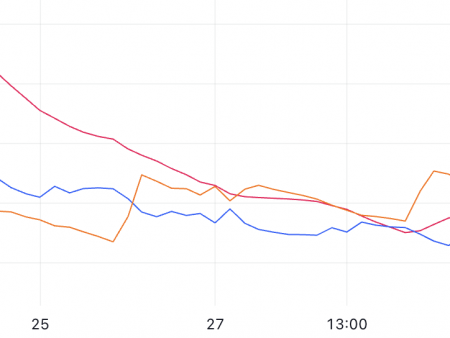

in a cheep, Kaiko noted that SOL’s dizzying rally has continued with limited liquidity. He further adds that liquidity in dollar terms is at its highest level since the FTX collapse.

However, liquidity has been declining in native units, indicating that market makers (MMs) are maintaining a stable level of liquidity.

SOL prices plummeted in November 2022 after the FTX collapse, but hopes for Solana have been revived following the end of the Sam Bankman-Fried trial.

Meanwhile, wallets linked to the bankrupt FTX crypto exchange have transferred more than $102 million in SOL tokens to the crypto exchanges in recent months. Moving to the stock exchanges may indicate selling, but the impact was reversed on Solana’s price, which has so far increased.

Institutional investments in SOL tokens have also increased in recent weeks. Shares of Grayscale Solana Trust (GSOL) reached a nearly 900% premium to where SOL held each stock last week, indicating demand for the token.

According to the latest report from CoinShares, digital asset investment products saw inflows totaling $293 million last week, taking a seven-week streak of inflows past the $1 billion mark. Solana recorded new entries totaling $12 million.