On January 10, on Friday, the cryptocurrency market became a witness to small stature, since the data on non-farmer expenses in the United States, not expected, and a decrease in unemployment supported market moods. While macroeconomic data stopped a correctional impulse in bitcoins and most of the main altcoins, such as SOL, a predominant market trend is a bear. Currently, the price of SOLANA shows decisive support, and recent tips for the sale of whales for serious decay.

According to Coingecko, the global market capitalization Crypto is 3.25 trillion dollars, and the 24-hour trade volume is $ 154.4 billion.

Key basic points:

- The reducing trend line drives the current correction trend in Solan Price.

- New addresses on SOLANA decreased by 33.87%, which indicates a reduction in the user activity and a decrease in the adoption in the SOLANA network.

- The level of $ 180, which coincides with the recovery level of 50% Fibonacci and 200-day exponential sliding average, offers suitable OUTBACK support.

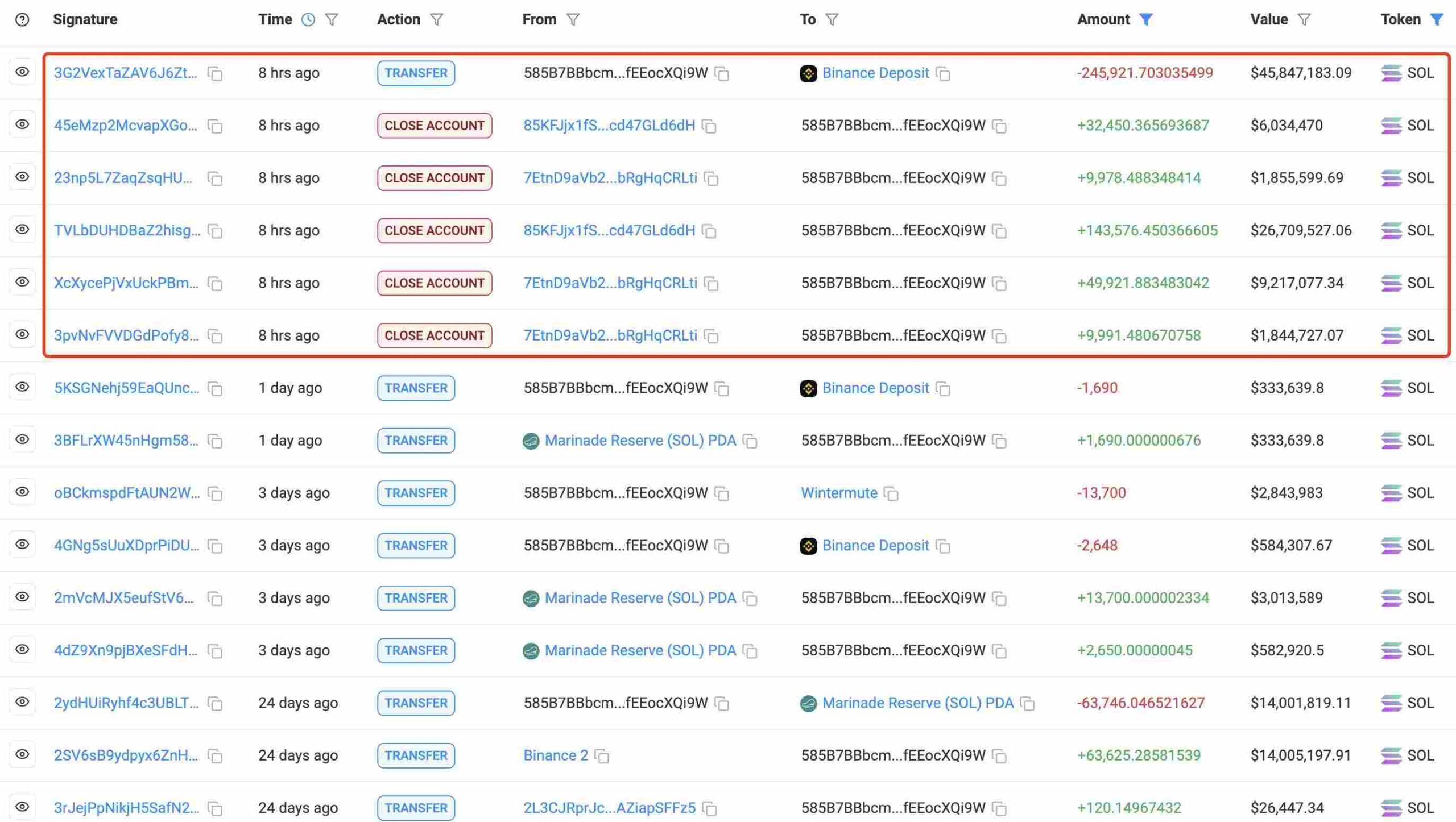

Large transfer of SOL to Binance increases the risk of decline extension

According to loutonchain, Kristo -Kit allocated 245,922 SOL tokens equivalent to 45.85 million dollars, and brought them to the bikant. A large movement of funds to a centralized exchange causes concern about the potential sale, since whales often transmit significant assets for exchanges when planning liquidation.

This transaction may also assume that Kit plans to reduce its effect in SOL with the expectation of further correction.

Supporting a bear thesis, the number of new SOLANA addresses has significantly decreased from 6.2 million to 4.1 million – by 33.87 % – from the end of November. OnChain data obtained from the block indicate a decrease in the user activity and a decrease in the adoption of SOLANA in the network.

Such a decrease often signals a weaker network growth, which can lead to an increase in sales pressure in the SOLANA price.

SOLANA Price Banks Bannail 180 US dollars

Over the past six weeks, Solana Price has experienced a significant correction from $ 264 to 187 – a decrease of 29%. The fall shows several lower formations in daily schedules, which indicates that traders are actively selling for bull tombs, behavior is often found in the set desert trends.

Against the background of a wider market correction and whale sales, the price of SOL is positioned for a breakdown below $ 180 and a 200-day EMA. The fall after a break can lead to accelerated correction to $ 155, and then 132 dollars.

On the contrary, if Solana Price provides support for $ 180, buyers may try to violate the overhead line and cancel the thesis of the bear.