Solana is faced with the growing pressure of sales, trading at the lowest level since September 2024 after yesterday’s correction in the market. Extreme Fear continues to capture the market, since SOL cannot find strong support, and the bears support control, since the cryptocurrency has reached its record high level in January. Since then, Solana has taken more than 55%, leaving investors vague in relation to their short -term prospects.

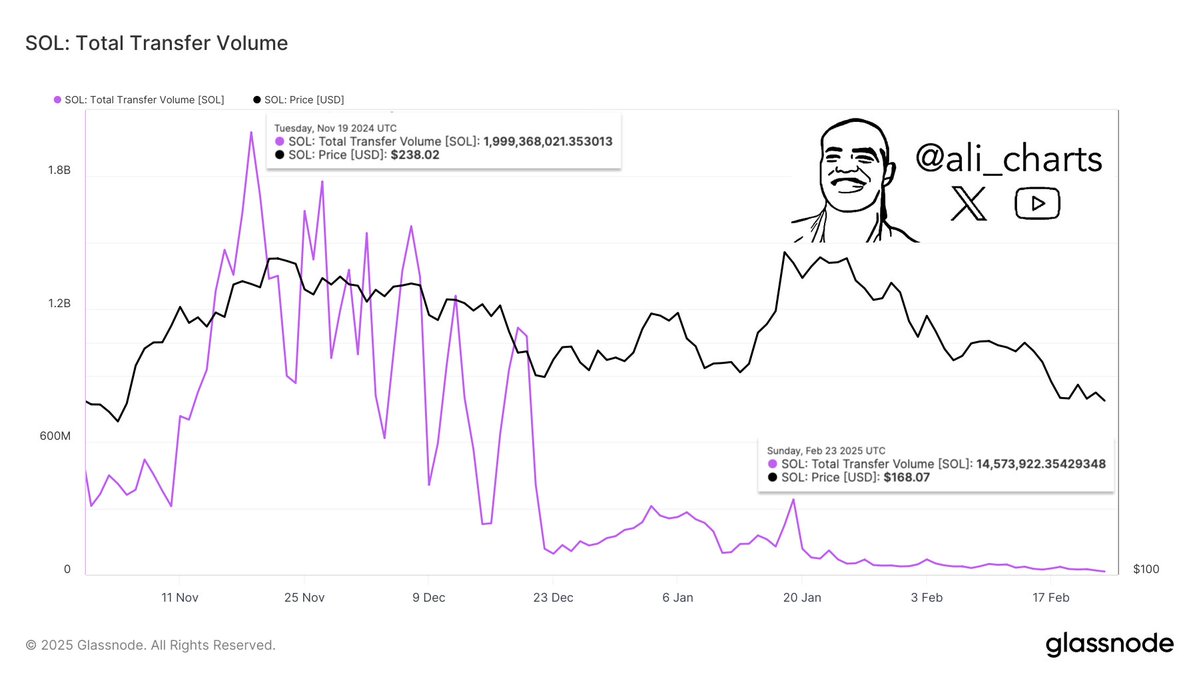

A wider crypto -market remains under pressure, and altcoins are struggling to restore a bull impulse. Analysts warn that further decrease can be on the horizon if SOL cannot hold the key levels. Crypto-expert Ali Martinez shared metrics in a chain on X, showing that the volume of the gear of Solan fell sharply. According to the data, the volume of SOLANA has fallen from $ 1.99 billion in November 2024 to 14.57 million dollars. USA today. This significant decrease involves a sharp decrease in network activity and interest, which causes concern about the current state of the Solan ecosystem.

With a slow slowdown in bear mood and slowed down in the chain, the coming days will be crucial for SOL. If the bulls cannot protect key support levels, Solan can see further drawbacks. Nevertheless, a strong recovery of volume and price action may indicate a renewed percentage and potential for change.

Solana fights below $ 150, as the bears support control

Solana is faced with significant pressure of the sale, with all his might trying to break through above the mark of $ 150, since the bears dominate in price action. A wider sales in the market has caused a great damage to SOL, and some of the coolest reductions are experienced by memes. SOLANA, which previously won the Meme Coin noise cycle, now sees a serious rollback when the speculations disappear.

The price action remains weak because Solana trades below the key levels of demand, which after he supported his long -term bull structure. The bulls lost their impulse, could not establish a strong recovery, while the bears continue to hold the entire market. If SOL cannot stay above the current level of demand, one can expect further drawback in the short term.

Martinez data during the chain emphasize the alarm the tendency to the network activity of Solan. According to Glassnode, SOLANA’s transfer volume fell from $ 1.99 billion in November 2024 to $ 14.57 million. USA today. This dramatic fall indicates a sharp decrease in the use of the network and trading activities, which further reflects the cooling period in the speculations of memes.

In the coming days, it will be critical for Solan. If SOL can hold above the level of demand for key, the recovery stage may begin. Nevertheless, continuing weakness in volume and price action can lead to a further decrease, which will make it necessary for bulls to restore the impulse.

Price struggle of $ 140 against the background of pressure sales

SOLANA (SOL) is traded at the level of $ 141 after it experiences the days of intensive pressure of sales, fighting more than most altcoins in the current decline in the market. A wider crypto -market was faced with extreme volatility, and many assets saw a sharp decrease. Nevertheless, Solan remains one of the worst victims, is not able to establish strong support or pulse for a potential rebound.

If bulls can protect the level of $ 140, there is a chance for short -term recovery. Holding above this important zone of demand can provide the basis to achieve higher resistance levels of key. Nevertheless, feelings remain weak, and any further drawback in bitcoins or a wider market can send SOL to deeper corrections.

If SOLANA cannot maintain its current support, the next critical level for viewing is 130 dollars, where customers can try to intervene again. Nevertheless, a steady gap below this mark will increase the risk of further decrease in zones of lower demand. In the coming days, they will be crucial for the price action of Solana, since investors are waiting to see whether the bulls will be able to return the impulse or the bear will continue to increase the price down.

Dall-E shown image, TradingView diagram