Solana (SOL) has become a prominent player in the dynamic world of cryptocurrencies, showing a notable bullish trend and offering substantial profits. Despite a modest 3.6% correction in the price of SOL in the last 24 hours, the blockchain platform’s native token has recorded a significant 43% increase in the last fourteen days.

However, the sustainability of these achievements may be in dangeras SOL price appears poised for a significant drop and deep correction following an impressive 346% rise over the past year.

SOL price vulnerable to significant drop, $30 in sight

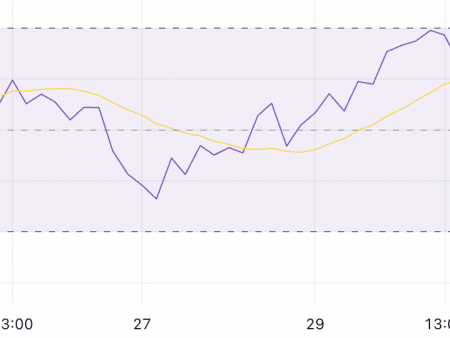

Cryptoanalyst Ali Martinez has shed light on the potential challenges that lie ahead for SOL. Martinez reflexes the TD Sequential indicator, which is currently showing a sell signal on the SOL weekly chart.

The TD Sequential indicator, developed by market technician Thomas DeMark, is a technical analysis tool for identifying potential trend reversals or exhaustion points in price movements.

The indicator consists of consecutive candles that meet specific criteria based on time and price movements. search specific patterns in price actionincluding the arrangement of consecutive highs and lows and the general direction of the trend.

When the TD Sequential Indicator generates a sell signal, as seen in the SOL chart above, it indicates that the token is reaching an exhaustion point in its uptrend, possibly indicating an imminent correction or reversal.

According to Martínez, if the bearish formation If what is represented by the TD Sequential indicator is confirmed, market participants may witness a downward swing in the price of SOL, which could push it towards $45 or even fall as low as $30.

Solana challenges correction concerns

Despite the possibility of a price correction in the coming days or weeks, Solana has demonstrated impressive growth across several fundamental metrics, as revealed by data provided by Token Terminal.

When looking at market capitalization, SOL circulating supply It currently stands at $24,620 million, which denotes a notable increase of 138.78%. Furthermore, the fully diluted market capitalization is estimated at $32.77 billion, reflecting a substantial growth rate of 134.29%.

SOL’s revenue has also grown significantly, with a notable increase of 106.55% in the last 30 days, amounting to $1.26 million. Scaling these figures to annualized revenue of $15.28 million represents a healthy growth rate of 43.10%.

Transaction fees have also played a key role in SOL’s revenue generation. In the last 30 days, transaction fees increased by 106.55% to $2.51 million. This represents a growth rate of 43.10% when extrapolated to annualized fee revenue of $30.56 million.

Solarium growing ecosystem This is further evidenced by an increase in daily active users, which currently average 128,180, reflecting a notable growth rate of 53.6% over the last 30 days.

Furthermore, the platform has seen an average of 82.83 core developers actively contributing to its development, indicating a growth rate of 13.1%.