Among the tariff turmoil, the beginning of April, XRP plunged into an unknown, as he lost a critical support zone for $ 2.

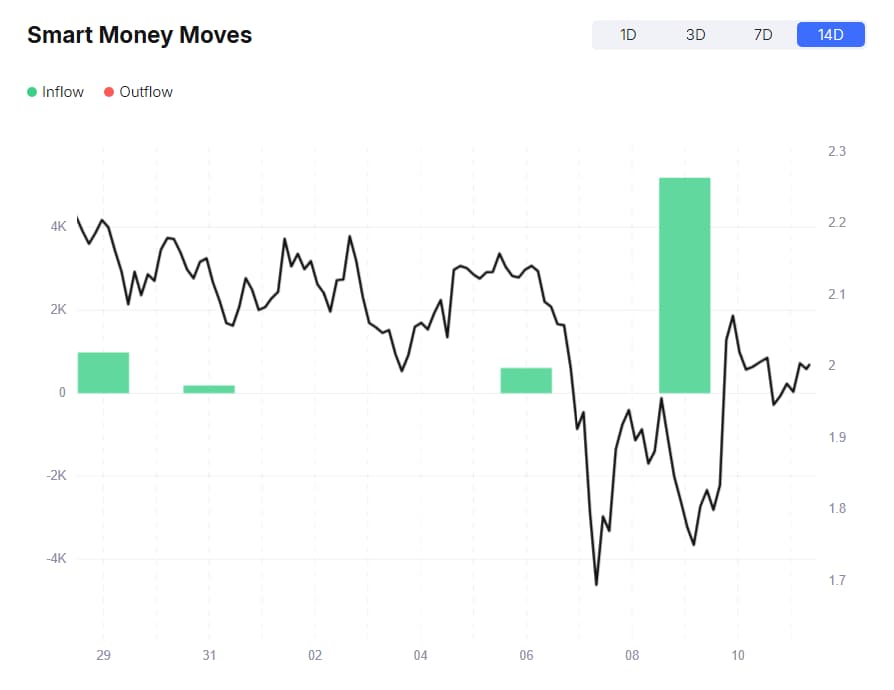

At the same time, traders have trusted token, creating sufficient pressure on the purchase to return it, during the press to $ 2.01, while the Smart Money investors play a key role on April 9, according to Finbold, extracted from Spotonchain April 11.

In particular, “smart money” provided a two -week tributary per day using the advantages of “falling” and stabilizing the XRP above $ 1.75. It is interesting that the data show that these experienced traders were also not sure how low the token would be, since the records do not show significant purchases in April 1.65 $ 1.65.

Indeed, the veterans, according to the visible, were waiting for the market to find the bottom and entered the game only after the XRP made its first reduced correction in its path to restoration.

Is the XRP Smart Money XRP?

Although the purchase of “smart money” in April can be comforting, other data points indicate that the situation would not yet become optimistic.

According to the Finbold report of April 10, the supply of XRP, available on large exchanges of cryptocurrencies, fell to a monthly minimum of 2.74 billion. Although such an installation tends to limit pressure on sale, it can also signal that few believe that the token will take remarkable steps in the foreseeable future.

At the same time, the fall of the volume of trade also indicates that the XRP returns to the relative generation of prices after an increase in activity during a decline caused by a tariff. Nevertheless, this leaves a chance for sudden and large movements among lower liquidity.

Recent trade is not encouraging and indicates that investors should study other types of assets, such as bonds, shares and other digital coins and tokens when measuring whether XRP will move.

External winds overcome the wind XRP

There was no shortage of positive events for the XRP, such as the launch of the exchange fund, dissolved in the field of the exchange fund (ETF), the decay of the target group in the cryptocurrency of the Ministry of Justice (DOJ), as well as the tipping of the IRS rules aimed at the digital assets platforms, but negative and external factors had much more impact on token.

Despite the fact that tariffs do not have a direct impact on cryptocurrencies in the short term and can boast of only the deputy effect in the long run, Liberation Day The announcement ensured a decline in the market for digital assets when XRP lost its long -standing support zones.