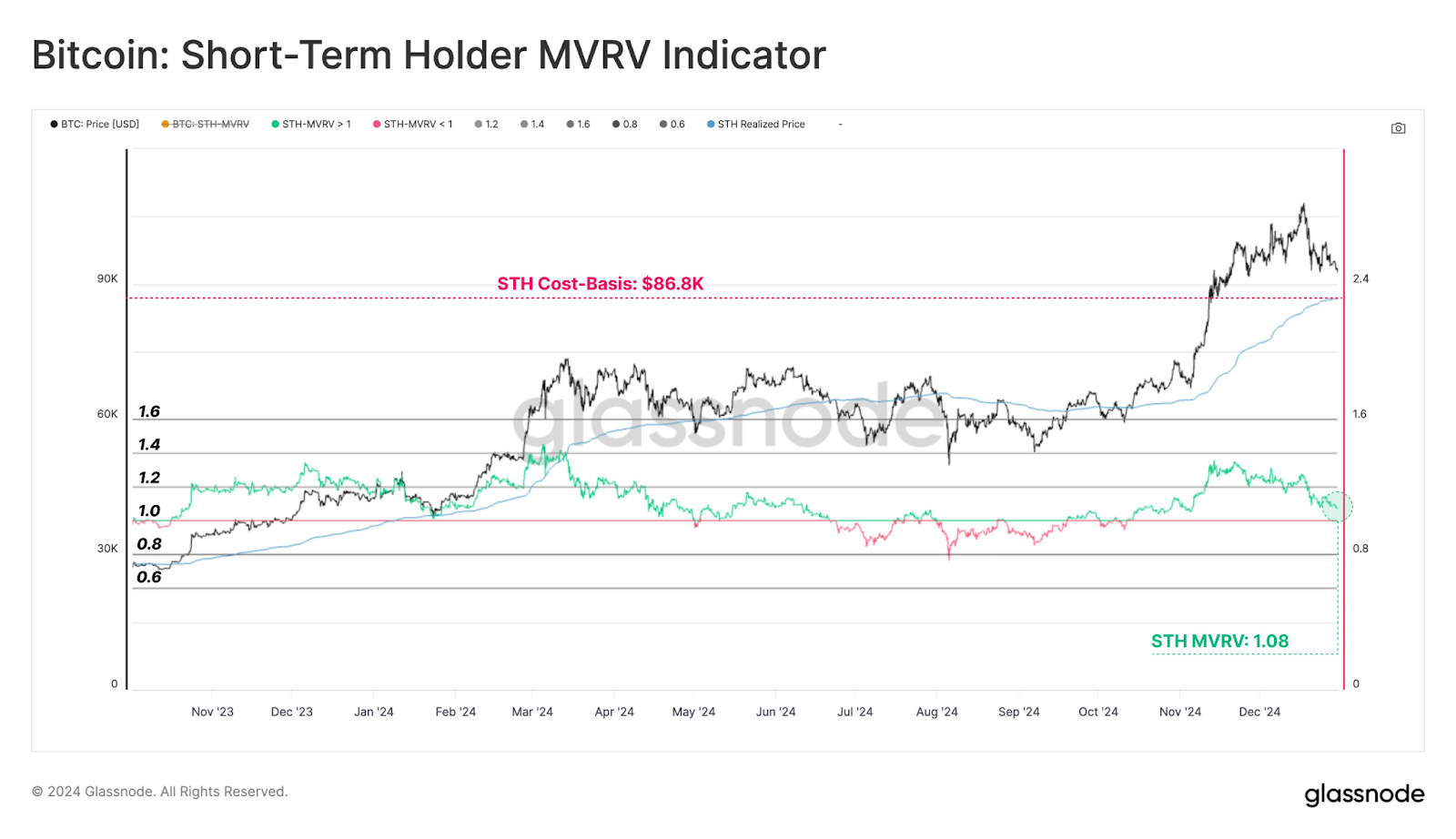

- Bitcoin’s $86.8K base price has become a critical level for market movements and investor confidence.

- Short-term holders remain profitable with an MVRV ratio of 1.08, indicating resilience in the face of price volatility.

- Analysts believe that a break above or below $86.8K will greatly influence the next direction of Bitcoin’s price.

According to Glassnode, short-term Bitcoin holders are enjoying an average unrealized gain of 7.9% despite the cryptocurrency’s recent price volatility. The ratio of market value of short-term holders to realized value is currently 1.08. Meanwhile, the average value for these investors is $86.8K, which has become a key level in building Bitcoin’s local momentum.

Source: Glassnod

Profitability of short-term holders and MVRV analytics

The STH-MVRV ratio of 1.08 reflects that most short-term holders remain in profit despite the market downturn. A ratio above 1.0 indicates unrealized gains, while a ratio below indicates potential losses for holders. This indicator at its current level shows that short-term holders remain confident in Bitcoin’s medium-term potential.

Bitcoin experienced wild price swings throughout the year, peaking at nearly $90,000. However, the recent correction has brought prices close to critical technical levels. The interaction between the STH-MVRV ratio and the selling price suggests that short-term investors are moving cautiously in the market but remain optimistic.

$86.8K: Key Underpinning of Bitcoin Price Momentum

The short-term holder’s cost basis of $86.8K has become a critical price level that influences traders’ decisions and market behavior. Historically, such thresholds act as strong areas of resistance or support during periods of increased volatility. Glassnode analysts highlight that prices falling below this level could lead to increased selling pressure, potentially leading to lower prices.

If prices remain above $86.8k, it could indicate increased buying interest and support a potential bullish recovery. This underlying value also reflects the collective market confidence of short-term bondholders, making it one of the most watched levels in the market currently.

Market context and short-term trends

The MVRV chart shows profitability ranges ranging from 0.6 to 1.6, which provides insight into the short-term trends of Bitcoin holders. A reading around 1.0 represents the break-even point for holders, and movement above this level signals sustained profitability. The current ratio of 1.08 shows cautious optimism, although traders remain vigilant about potential price movements.

Glassnode analysts emphasize the importance of closely monitoring these metrics, as the interaction between MVRV, cost basis and realized price provides important information. These metrics will continue to shape Bitcoin’s short-term market trends and investor confidence.