Over the past few weeks, the cost of the asset has fallen sharply, and Shiba Inu is in a free fall. The fears about the additional decrease were increased, since the bear impulse accelerated, which promotes the Shiber further into the negative territory. The market can still be in the midst of its tendency to decrease depending on the current price action.

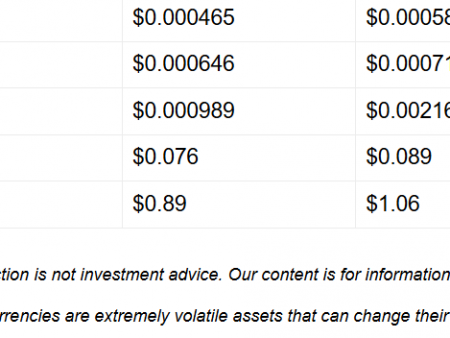

Since the Shiba fell below important support levels, sellers are clearly responding. Currently, about 0.00001740 is traded, further increasing the bear pressure after a recent break below psychological support of 0.00001900 US dollars. If there are no signs of recovery at once, price reduction can quickly quickly.

One of the important problems is that SHIB, which is currently trading for about 0.00002075 US dollars, could not restore its 200 EMA. A large trend towards a decrease indicates the loss of a sliding medium, which historically served the trend indicator. In addition, the bear structure intensifies 100 EMA at about 0.00002160 US dollars, which limits any possible attempts to restore. SHIB can continue to decline in accordance with the current structure from 0.00001500 US dollars, which serves as the following critical support.

The market may experience a more serious decrease to 0.00001200 US dollars, the area of historical accumulation, if this level breaks down. If the sale of the sale is still high, the conditions of reserves of the RSI indicator by about 33.5 will not be enough to cause a change. The Shib must cross above 200 EMA to restore its bull impulse, ideally restore $ 0.00002100 as support.

Meanwhile, rallies can not last long, because the daily diagram still shows lower maximums. With the speed of bear impulses, Shiba, the Inu currently sees one of the coolest falls in recent months. In the near future, the Shibe may experience even greater losses in the absence of a noticeable change scheme. Although traders should monitor the possible levels of support, the prospects are still gloomy if the asset remains below important sliding medium.