Against the backdrop of a recent decline, the analyst noted that Shiba Inu is currently in a macro -wave 3, with support levels from 0.000015 to 0.000016 US dollars.

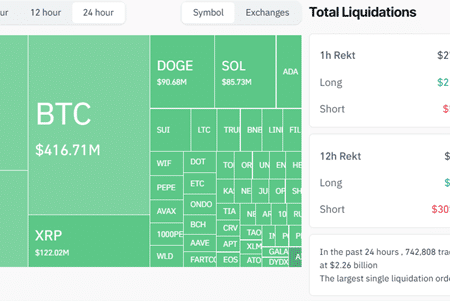

Shiba inu (Shib) experienced a sharp decrease at the beginning of the week, reflecting wider market trends. The price fell to an intraday minimum of $ 0.000014, which marked a significant rollback. Starting with writing, over the past 24 hours, the schub has fallen by 19.18% over the past 24 hours and 21.16%.

Despite the decline, technical analysis suggests that key support zones should be maintained before any potential recovery to their previous record maximum.

Macro Wave 3 in the game for Shiba Inu

The observation divided by a guy in a diagram on X suggests that the Shiba remains in a wider bull structure, according to the theory of Ellitt waves. The analysis describes the five-wave impulse scheme, where the price is currently located in a macro wave 3.

As a rule, this wave is the strongest and long in the cycle. Although the wave 2 in the macro -wave 3 revised deeper than originally expected, the price still supports optimistic within the framework of the wave structure.

According to the analytics, the key zones for Shiba Inu are from 0.000015 to 0.000016 US dollars, which corresponds to the Fibonacci recovery range 0.618-0.786. During the seal, Shiba has already violated these levels, but tries to return them.

Meanwhile, the analyst expects the Shibe will be very pumped out of these points. Accordingly, he noted The fact that once a schube reaches his record high level, he plans to sell his entire position before the start of the wave 4.

Nevertheless, the current SHIB price remains 83.50% below its record high level, which indicates a significant basis for recovery before reviewing previous peaks.

Reducing interaction for Shiba Inu

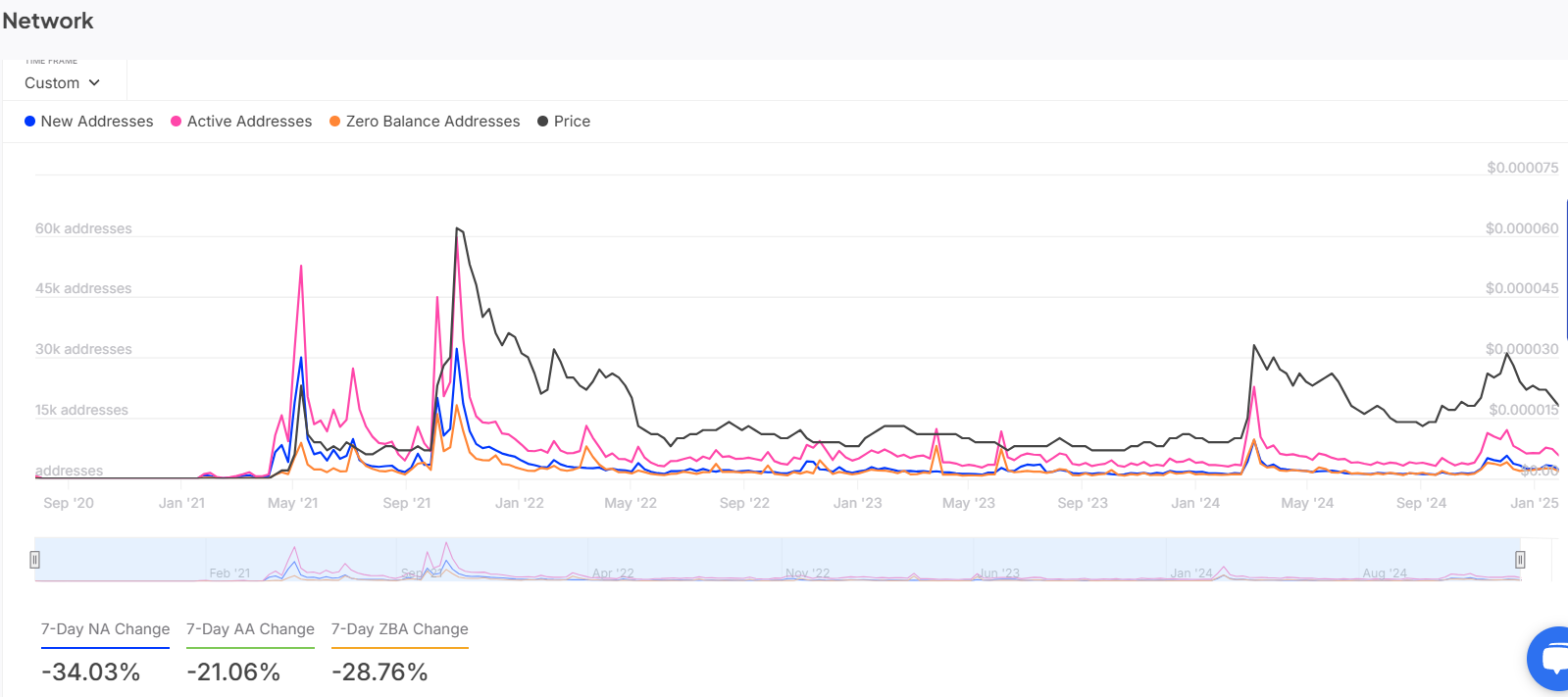

In another place, Metriki on the chain Intoleblock indicates a decrease in network activity, which often correlates with the movement of prices.

Over the past seven days, data show a decrease in new addresses by 34.03%, a drop in active addresses by 21.06%and a decrease in the addresses of the zero balance by 28.76%.

These reductions involve lower levels of participation in the SHIB ecosystem, consistent with the current retrospective of the price in the direction of the identified Fibonacci support zone.

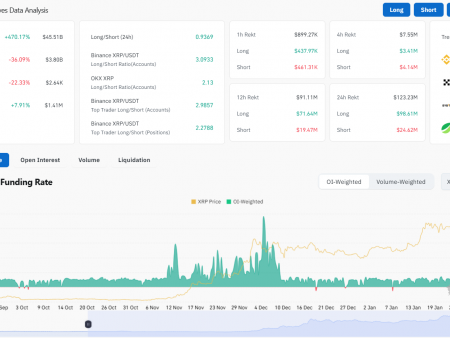

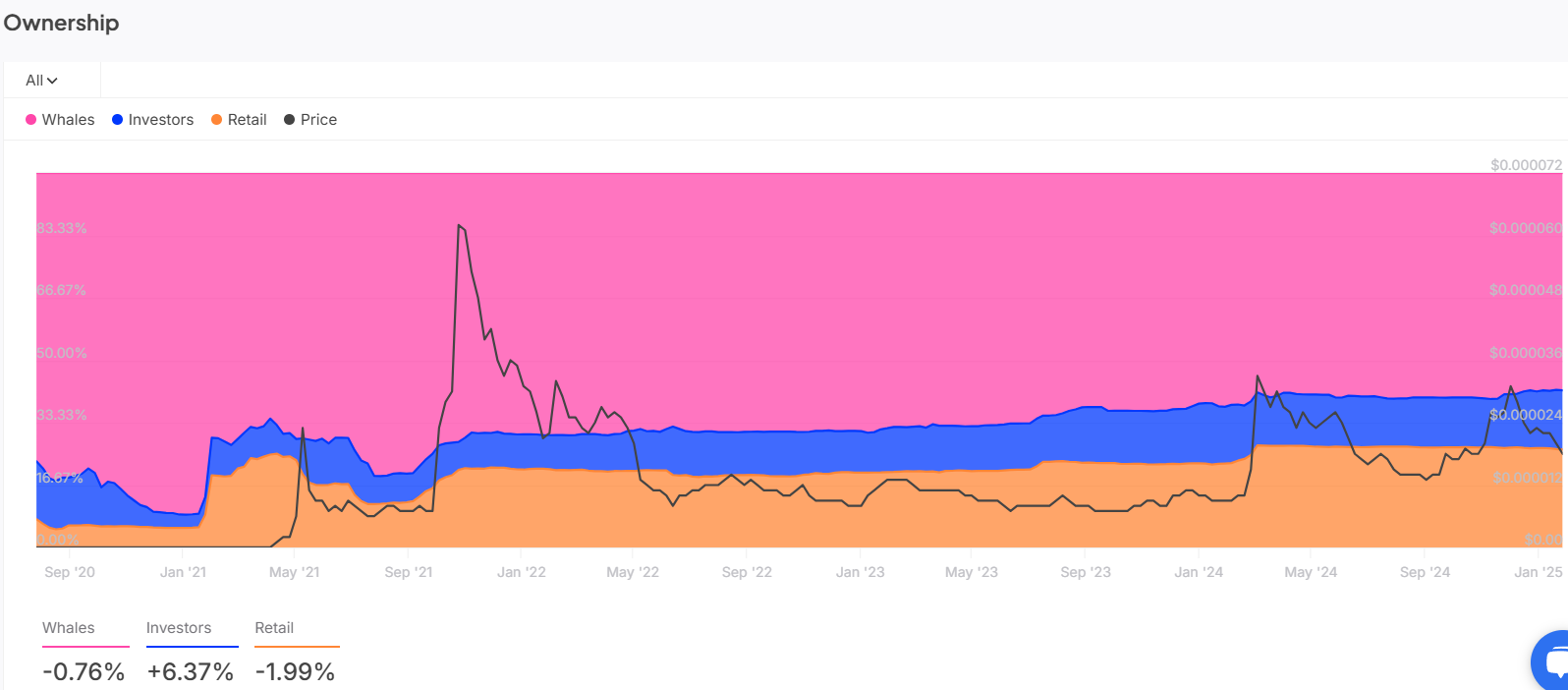

Meanwhile, shifts in the dynamics of property are a mixed picture. There are fangs reduced 0.76%signal a slight decrease in large -scale positions of investors.

Conversely, the activity of investors increased by 6.37%, which involves increased interaction from medium -sized holders. However, participation in retail trade fell by 1.99%, which indicates a potential percentage of cooling among small investors.