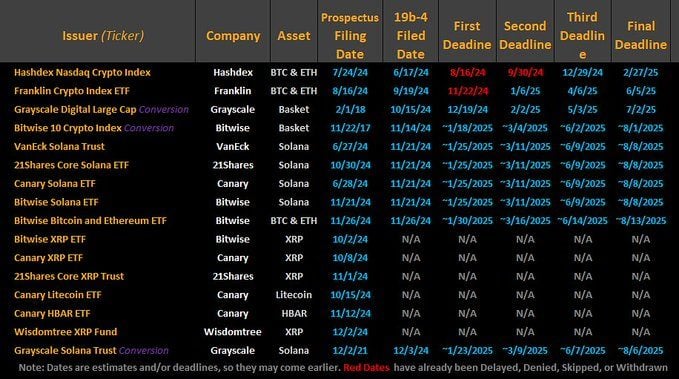

US SEC is faced with the first term today to decide on the statement of Greyskal in order to convert its Trust (GSOL) solar into ETF. The proposed ETF Solar from Vaneck, 21Shares, Canary Capital and Bitwise await the regulator’s solution on January 25.

On December 4, Nyse Arca proposed listing GSOL shares as a SOLANA ETP spot. The trust, which was launched in April 2023, had 7,221,835 shares in the appeal as of January 21.

The deadline occurs after the departure of Gary Gensler as the chairman of the SEC. Under Henser, the SEC law enforcement unit initiated numerous trials against crypto companies, including those that are aimed at Binance and Coinbase, where the regulator classified SOLANA and a number of other digital assets as securities.

According to the analyst Bloomberg ETF James Seyffont, the position of the law enforcement unit forces other SEC divisions for consideration of ETF for commodity goods for SOLANA.

“The terms can be extended to 2026 from the SEC precedent,” Saiffart said in a recent interview with BlockWorks Macro. “SEC law enforcement unit calls SOLANA Security, which does not allow other seC divisions to analyze it for the ETF Commerities wrapper.”

To approve Solana ETF, it is necessary to resolve regulatory obstacles. ETF analysts suggest that the purpose of the crypto -adovocate of Paul Atkins for the SEC can facilitate this change.

However, as expected, the process of confirming Atkins will take several months. Currently, the SEC is working with three commissars, including Mark Uyed, who was appointed acting chairman after the recent transition of the leadership under President Trump, Hester Pierce and Caroline Krentshaw.

According to the CEO of SOL Strategies, LII WALD, while a change in the SEC leadership can potentially change the normative landscape – with some assumptions that Paul Atkins (if confirmed) can positively affect the applications of Solana ETF – direct green light is unlikely .

“I think there is quite a lot of time until SOL ETF is approved,” she said in an earlier statement, adding that regulators may take a year or more than a year to understand the unique attributes of Solan.

In July last year, Vaneck and 21Shares submitted 19B-4 forms in SEC for their relevant ETF Solana, starting the process of checking the regulation. Canary Capital and BitWise joined the race later in the same year.

According to Matthew Siegel, the head of Digital Assets Research in Vaneck, Solana functions similarly to other digital goods, such as Bitcoin and Ethereum.

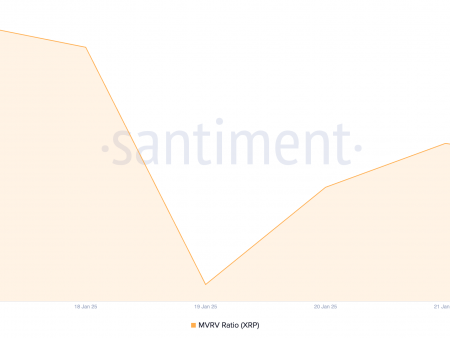

SOLANA and XRP are considered leading candidates for the next wave of Spot Crypto ETF, but from the continuing legal problems, ETF analysts suggest that the ETF, attached to Litecoin, is the “most likely” first to launch Trump.

CFTC considers Litecoin as a product in his case against Kucoin.