On Monday, November 25th, Safemoon’s price increased by 76%, making it one of the best performing coins in the industry.

Safemoon token (SFM) rose for the second day in a row, hitting a high of $0.00002890, its highest level since November 1, and about 77% above its one-month low.

However, the recovery was not supported by significant trading volume, which could have been a warning sign. Safemoon’s 24-hour trading volume was only $90,000, which is a modest figure for a coin with a market cap of over $31 million. This low volume may be due to the limited number of exchanges such as MEXC, Gate and BitMart that have listed the token.

The rally may have been fueled by the recent announcement of the Safemoon wallet, which is currently in open beta. The wallet, acquired by the VGX Foundation during bankruptcy proceedings, has an NFT data collection page, a feature-rich calculator, a wallet tracker, and a dApp browser.

Safemoon’s price also rose as investors bought the dip, noting its underperformance during a broader cryptocurrency rally. The price of Bitcoin is just below $100,000, and the Crypto Fear and Greed Index has reached an “extreme greed” level of 88.

Historically, fallen angel cryptocurrency tokens such as Terra Luna Classic, Celsius and Voyager Digital tend to rise in price during periods of increased risk appetite in the industry.

Safemoon Price Analysis: How High Can SFM Go?

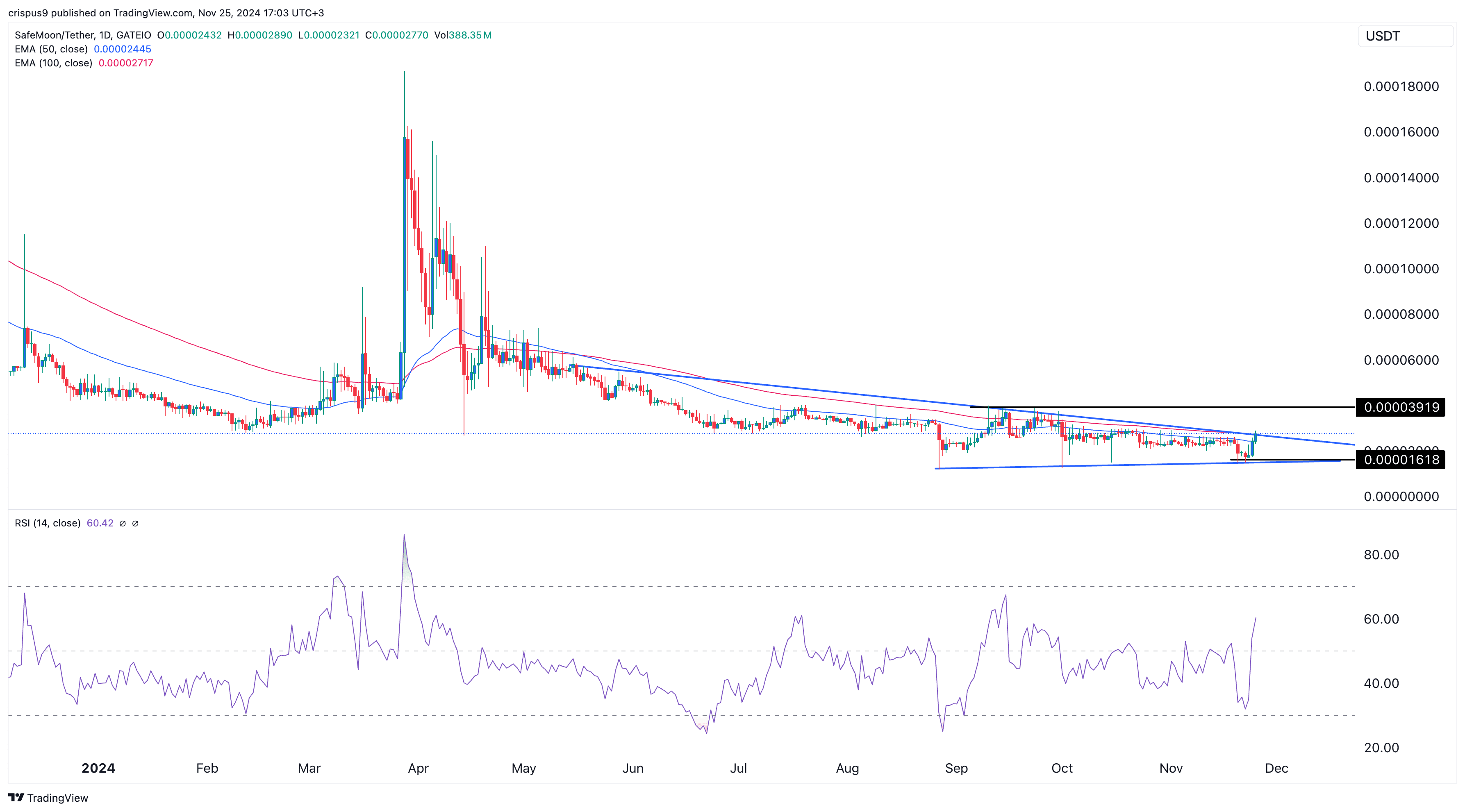

The SFM token has recovered as it approaches the top of the symmetrical triangle chart that has formed over the past few months. Typically, assets experience a bullish or bearish breakout as the triangle approaches a confluence point.

Safemoon is currently trying to break above the 50-day and 100-day exponential moving average. The RSI’s upward trajectory suggests the token is gaining momentum.

Safemoon’s price is likely to remain within its current range as investors await further catalysts. The continued bounce could trigger fear of missing out, potentially pushing the price towards the psychological $0.0050 level. Conversely, a fall below the $0.00001618 support would invalidate the bullish outlook.