XRP is trying to recover after a significant decrease by 25%, which led to a decrease in the price from $ 3.00 to $ 2.33. While investors in the near future hope for a rebound, the path to restoration can take some time.

This delay can also lead to potential losses for traders who fall into current market fluctuations.

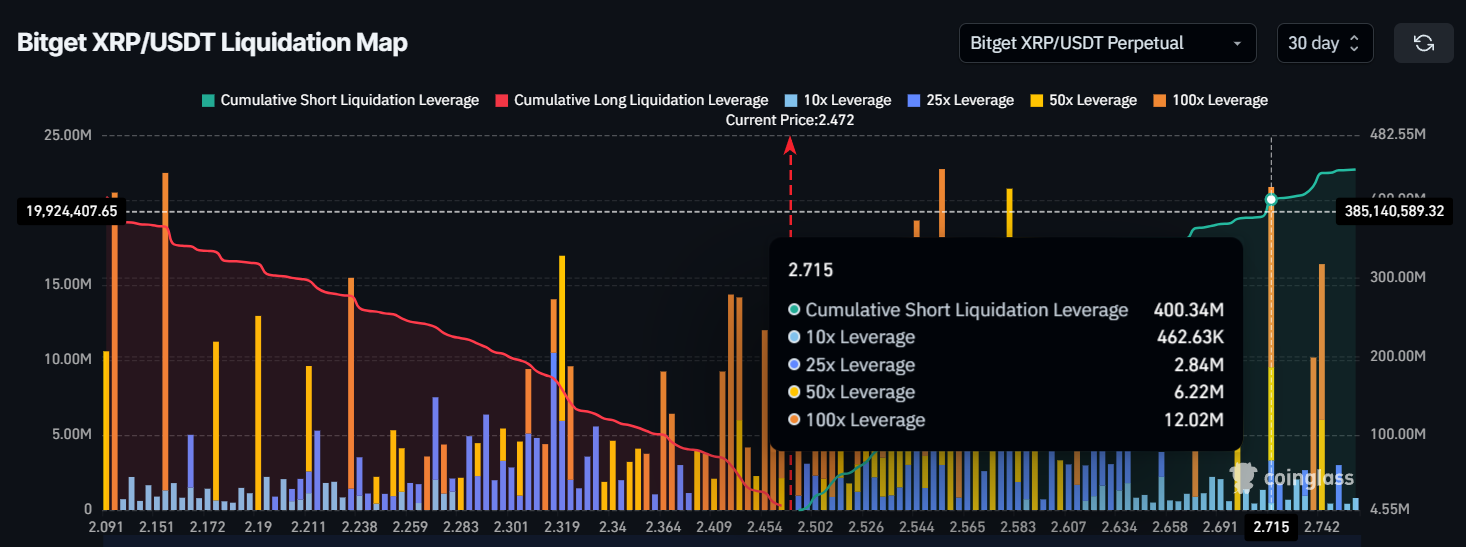

XRP traders may encounter potential liquidation

The liquidation map for the XRP reveals the script for short sellers. Approximately $ 400 million for short contracts is placed between the current price and a mark of $ 2.70. This significant amount of short positions shows that traders make rates of the XRP price, reflecting the dominant skepticism in the market.

Only a 10% increase in prices can lead to the elimination of these short positions, which can lead to a rapid movement of prices for an increase. Nevertheless, a large number of short contracts emphasizes the total cautious mood of the market, which can delay recovery or lead to further volatility if the price cannot violate the resistance resistance levels.

In the macrocarbon for XRP, bear signals are still predominant, and the average direction index (ADX) is at the level of 35.0, which is significantly higher than the threshold of 25.0. This suggests that the power of the descending trend remains untouched, even after a recent accident of 25%. ADX reflects a constant impulse in the market, indicating that the XRP is still under pressure, despite its attempts to restore.

If the ADX rises further, this will signal that the bear’s trend is still strong, potentially creates resistance in the efforts of the XRP to restore. While ADX remains high, it can limit the effectiveness of any movement at a price and lead to a delay in restoring previous levels.

X -ray forecast of prices: waiting for a violation

Currently, the price of XRP is $ 2.47, only 10% of the next major resistance of $ 2.70. Altcoin moves within the framework of the ascending wedge scheme, assuming that the next movement probably can be a rise. If the XRP manages to break through the resistance of $ 2.70, it can see further profits.

However, the factors mentioned above indicate that this growth may encounter significant resistance. XRP can try to violate a barrier in the amount of $ 2.70, or it can remain closer to the support level of $ 2.33, if pressure prevails on sale. In this case, the price can be consolidated within the strict range or experience of further subsidence.

If bull -market market signals begin to overcome the predominant bearish, XRP can successfully disrupt the resistance of $ 2.70. A break above this level will turn it into support, potentially canceling the bear’s views and prepared the ground for a more sustainable recovery in the coming days.