Following XRP’s recent rally on news of Donald Trump’s re-election and Chairman Gary Gensler’s upcoming resignation on January 20, POL (ex-MATIC) – formerly Polygon (MATIC) – is one of the last major cryptocurrencies with 40.8% in the red. 2024.

However, one digital asset expert believes that POL is simply late to the rally and is well positioned for significant – perhaps 6,000% – growth.

In particular, cryptocurrency analyst Ali Martinez shared his bullish forecast – or as he puts it, a “wild price forecast” – for the token in several X posts, outlining the asset’s path to a price of $15.27 to $36.17.

Crypto Analyst Outlines Polygon’s Path to $36

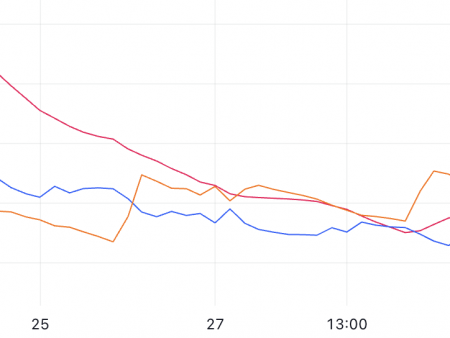

According to Martinez, the situation is positive due to the simple fact that approximately 75% of Polygon holders are “out of money” – they bought the token at a higher price than the $0.5845 it was valued at at the time of publication on November 25.

This fact alone means that investors are unlikely to try to “take profits in the near term”, which would sharply reduce potential selling pressure.

Many investors are holding POL from the previous cycle, and almost all of them are in the red.

In fact, only 15.11% of Polygon owners are in the black. This is a positive sign for price action as many will not be looking to take profits any time soon.

The expert also explained that recent on-chain indicators such as the growth of new active addresses, whale activity and volumes indicate that numerous new traders are increasing their positions in POL.

Whales are considered particularly bullish as they are estimated to have bought, for example, 140 million POL between November 14 and 18.

#Polygon whales have bought nearly $140 million worth of POL over $56 million in the last 96 hours! pic.twitter.com/Zn6Gd9qvDg

— Ali (@ali_charts) November 18, 2024

Ultimately, Martinez concluded that between the low risk of significant selling pressure and bullish indicators emerging from the utility token’s multi-year descending triangle, there was a high probability of a rally to $36.17, nearly 6,000% higher than the price quoted in the press.

The final precondition that Polygon must meet is a sustained close at $0.7973, a level not seen since April 2024, according to the analyst. However, POL seems poised to regain its price level as it has already risen by over 80% over the past year. 30 days.

I believe Polygon is consolidating into a multi-year descending triangle, and a weekly close above $0.7973 could trigger a rally to $15.27 or $36.17!

Elsewhere, a technical on-chain expert warned that despite their confidence in the bullish scenario, maintaining stop losses remains important. They added that if POL falls below the critical “support wall” between $0.375 and $0.386, they will exit the trade themselves.

When did MATIC become POL?

It is worth noting that Polygon made the transition from MATIC to POL in mid-September and that all holders of the old version of the token have a two-year grace period to exchange their cryptocurrency at a 1:1 ratio.

At the time, Polygon explained that the move was a simple upgrade meant to move the asset closer to its eventual vision of becoming “a valuable layer of the internet.”

At the time of publication, POL and MATIC are trading at almost the same price, as would be expected given the guaranteed 1:1 exchange ratio.

Featured image via Shutterstock