The price of ONDO Finance (ONDO) has shown little movement over the past 24 hours. Nevertheless, its long -term growth remains impressive, with an increase of 519% over the past year. Being one of the largest assets players in the real world (RWA) in the market, Ondo caused great interest to both retail and institutional investors.

While RSI recovered from resold levels, and whale assets reached a record high maximums, the ONDO remains in the consolidation phase from its EMA line, closely located. Whether it is a golden cross for a bull breakthrough or persons of further pressure lack, will depend on the upcoming market impulse and the activity of investors.

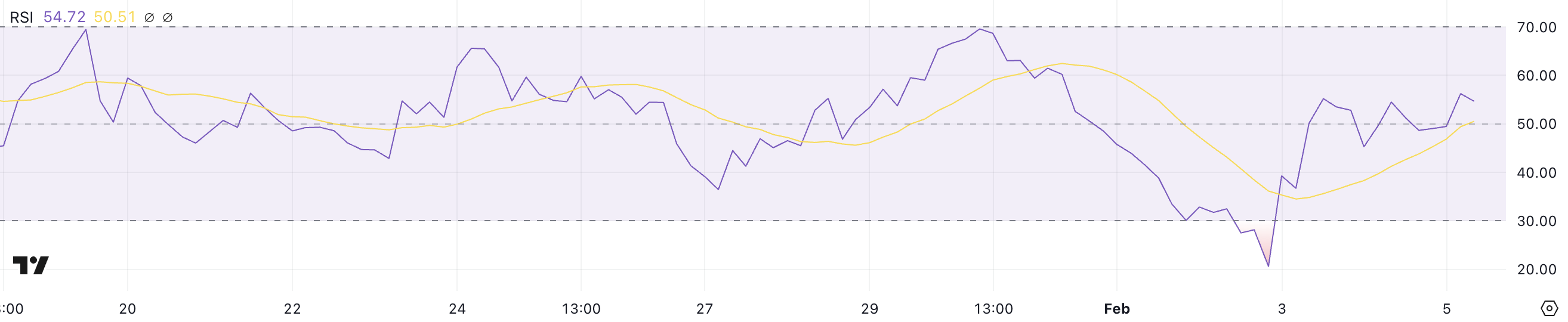

ONDO RSI is currently neutral, recovering after resold levels

The relative force of the ONDO (RSI) is currently 54.7, which is a sharp recovery from 20.6 just two days ago. This significant rebound indicates that the purchase pressure has returned after the ONDO was previously in deeply resold conditions.

RSI below 30 usually assumes that the asset is resold and can be associated with the rebound, which is consistent with recent surgery of ANDO.

Now that the RSI has crossed above 50, the impulse, in the visible one, is changing in favor of customers, although it remains in the neutral zone, and not very optimistic.

RSI is an indicator of the pulse, which measures the speed and value of prices in a scale from 0 to 100. The indications above 70 suggest that the conditions of bite and potential for the rollback, while the indications below 30 indicate the conditions of resellibility and possible recovery of price.

The RSI ONDO is now 54.7, the assets are in a neutral and radiated zone, which suggests that it still has a place to rise if the purchase of an impulse continues.

If the RSI advances above 60, this may indicate a stronger bull impulse, but if it delays or decreases, the price of the ONDO can be consolidated before making the next move.

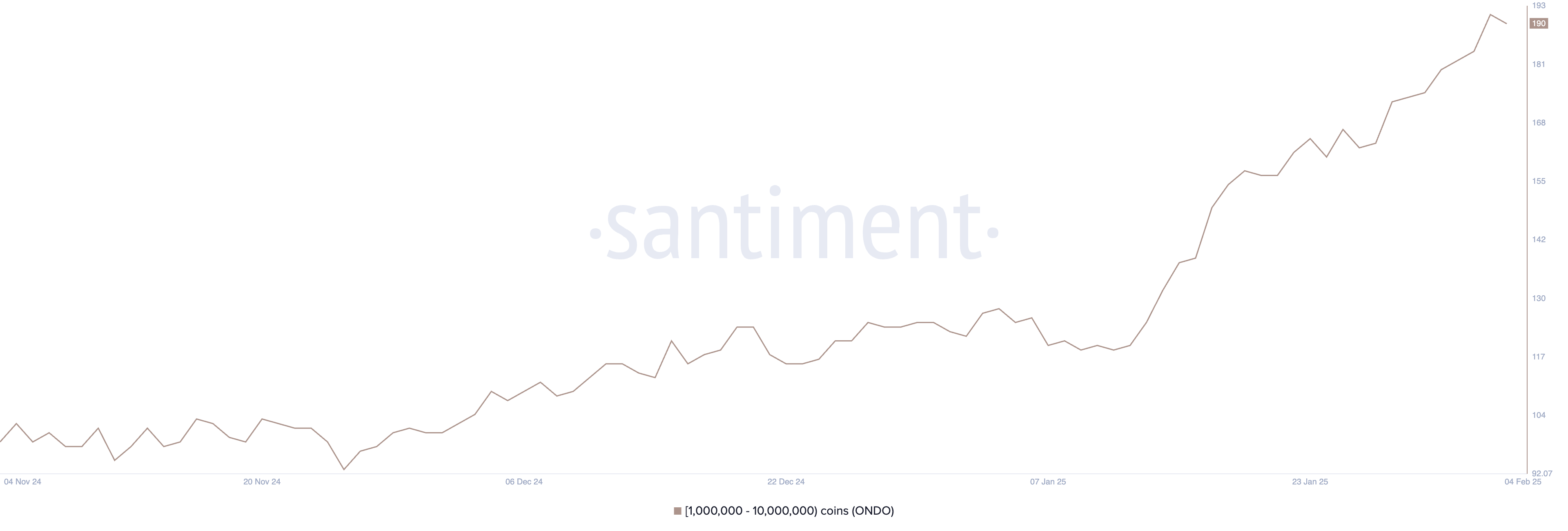

ONDO-Kits reach all time

The number of whales passing from 1,000,000 to 10,000,000 years fell slightly from 193 to 190 on the last day. However, despite this, a slight decrease, the total number of ANDO whales is growing steadily from January 12, when there were only 120.

This long -term growth assumes that whales accumulate ONDO, reflecting the growing confidence in the asset. Even with a recent fall, these whale possessions remain at the highest levels, which indicates a strong interest in RWA from large investors.

The monitoring of the activity of the whale is crucial, because large holders can affect the movements of prices through accumulation or distribution. The growing number of whales, as a rule, signals the strong institutional or high attractions of investors, which can ensure the stability of prices or fuel of the fuel-defense pulse.

While a small fall from 193 to 190 implies a certain short -term distribution, the general trend remains positive. If the numbers of whales continue to grow, the price of ONDO can see further growth, but if more whales begin to sell, this can lead to an increase in volatility or price correction.

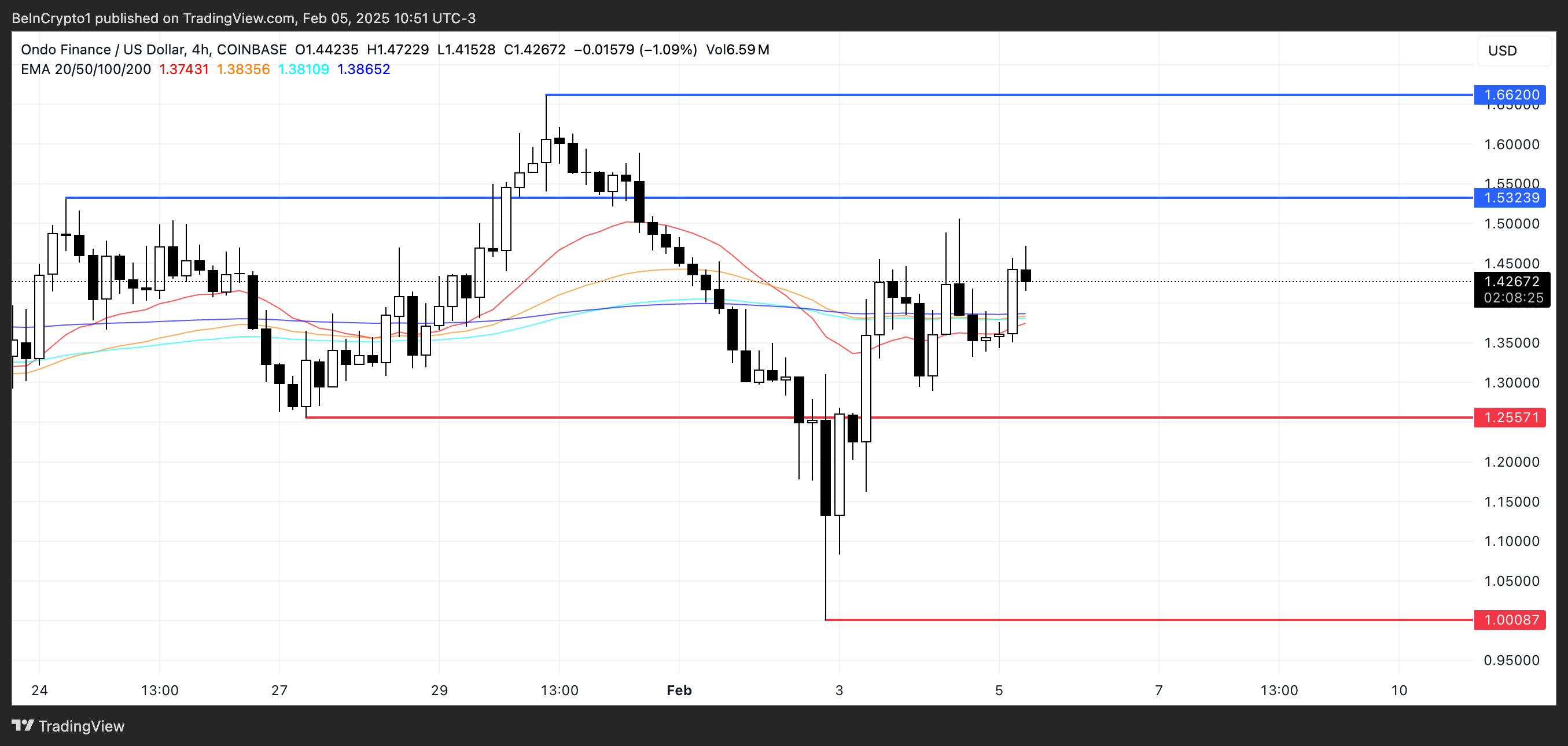

ANDO price forecast: will the golden cross will be formed soon?

Currently, ONDO is one of the largest RWA coins in a market with a market capitalization of about $ 4.5 billion. Its EMA lines are very close to each other, which indicates a period of consolidation since yesterday.

If the short -term EMA intersect over long -term, this forms a golden cross, a bull signal that could push to a resistance of $ 1.53. A breakthrough above this level can fuel a further impulse for the following purpose by $ 1.66.

On the other hand, if the ONDO cannot set the ascending trend, it can be down reduced pressure. The decline in support for $ 1.25 may be the first sign of weakness, and if this level breaks down, ANDO can decrease further to $ 1.00.

Given the current consolidation, the market is on a critical point, and the next major step will determine whether the ONDO will resume its bull tendency or is included in a deeper correction.