Enjoy the On the Margin newsletter on Blockworks.co today. Get news delivered straight to your inbox tomorrow. Subscribe to the On the Margin newsletter.

Welcome to On the Margin, a newsletter presented by Casey Wagner and Felix Jovin. Here’s what you’ll find in today’s edition:

- Rate markets say the Fed is heading for an emergency rate cut, we say otherwise.

- Crypto Stocks Are Back in the Green. Here’s What’s Fueling the Bounce

- Vice President Harris has a vice presidential pick. We break down his crypto credentials.

We’re looking for feedback from our On the Margin listeners and readers. Share your thoughts Here.

Surprise! No unexpected rate cut yet

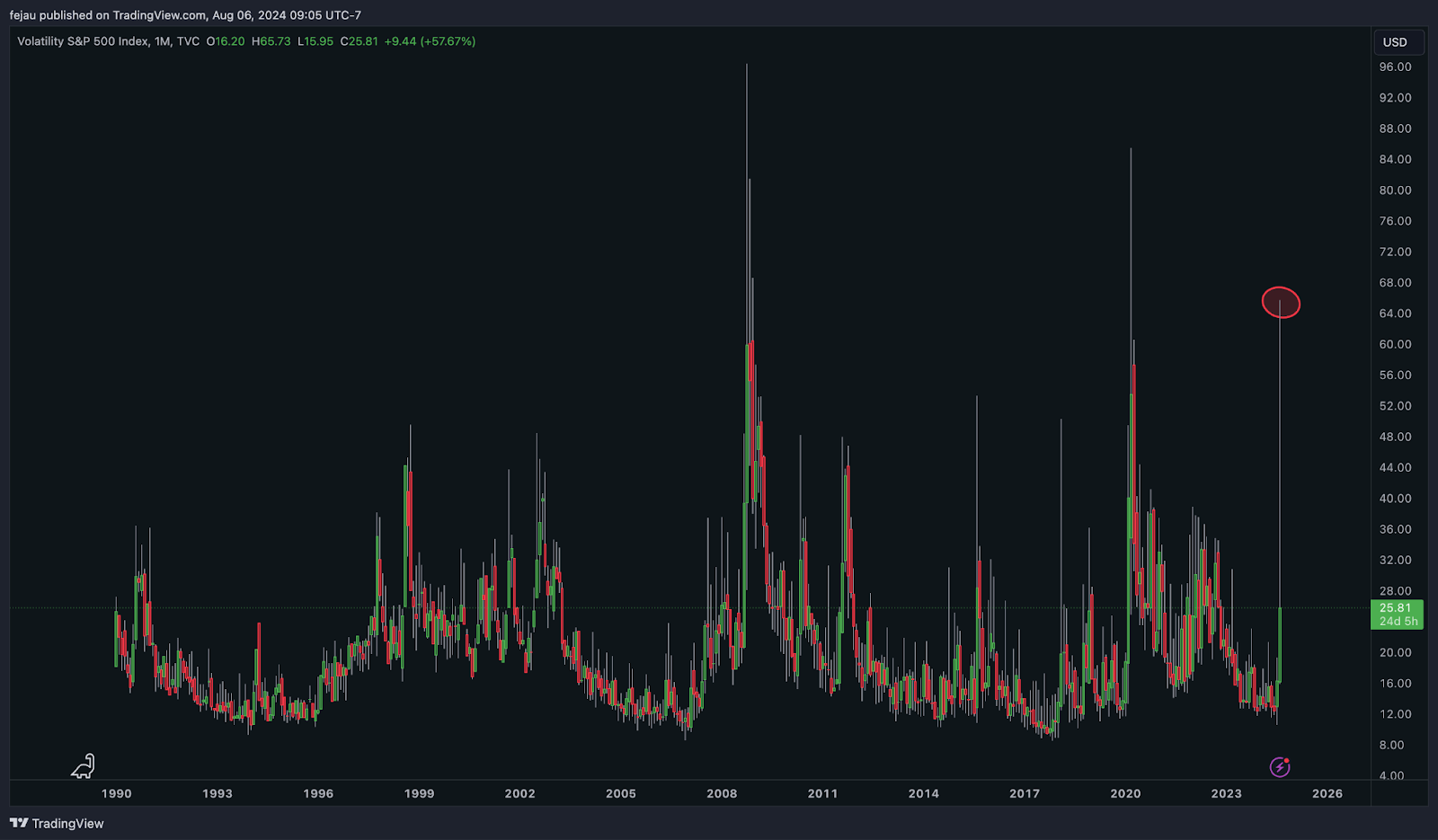

This week, panic gripped markets to such an extent that we saw the third highest VIX reading ever:

While the odds have fallen, traders have begun pricing in a 60% chance of a rate cut between FOMC meetings over the next week.

Much of the discussion has focused on whether this market downturn was caused by market structure dynamics (such as positions being closed) or by a fundamental change in the macroeconomic environment.

Understanding what dynamics are driving the markets is key to understanding whether the Fed is worried about this market downturn or not — it doesn’t care if your 401k is down 20%; it cares if funding markets seize up and credit spreads blow up. Here are a few charts I like to look at to get a better sense of the underlying market components that the Fed is really worried about:

The chart below compares VIX, a measure of stock volatility, and MOVE, a measure of credit market volatility.

There was a huge rally in the VIX, but the MOVE index remained range bound and untroubled. This is partly due to the flight to the safety of long-term Treasuries during the market crashes. If Treasury markets had stalled, we would still have seen excessive volatility in the MOVE index.

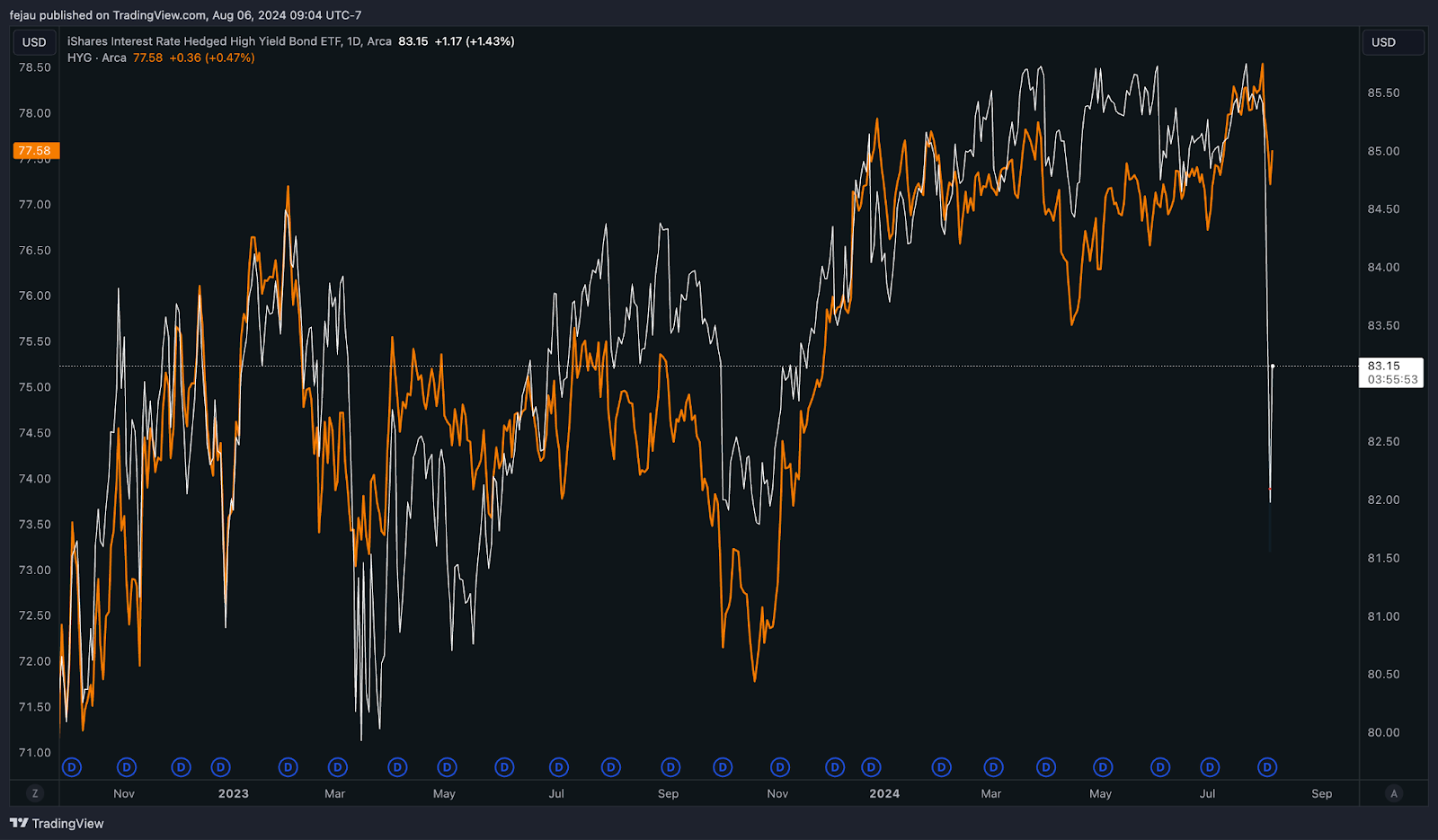

HYG is an ETF that tracks high-yield corporate bonds, while HYGH is a bet-hedged version that specifically isolates credit stress. As a quick reminder, bonds can lose value in two ways: rising interest rates or rising default rates.

In the chart below, we see that the decline was isolated from credit risk issues as HYGH fell well below HYG. Although it is bouncing around today, it means that the stock pullback we have seen has begun to trickle down into credit markets.

While this figure is still far from a meaningful level requiring Fed intervention, it is worth keeping an eye on.

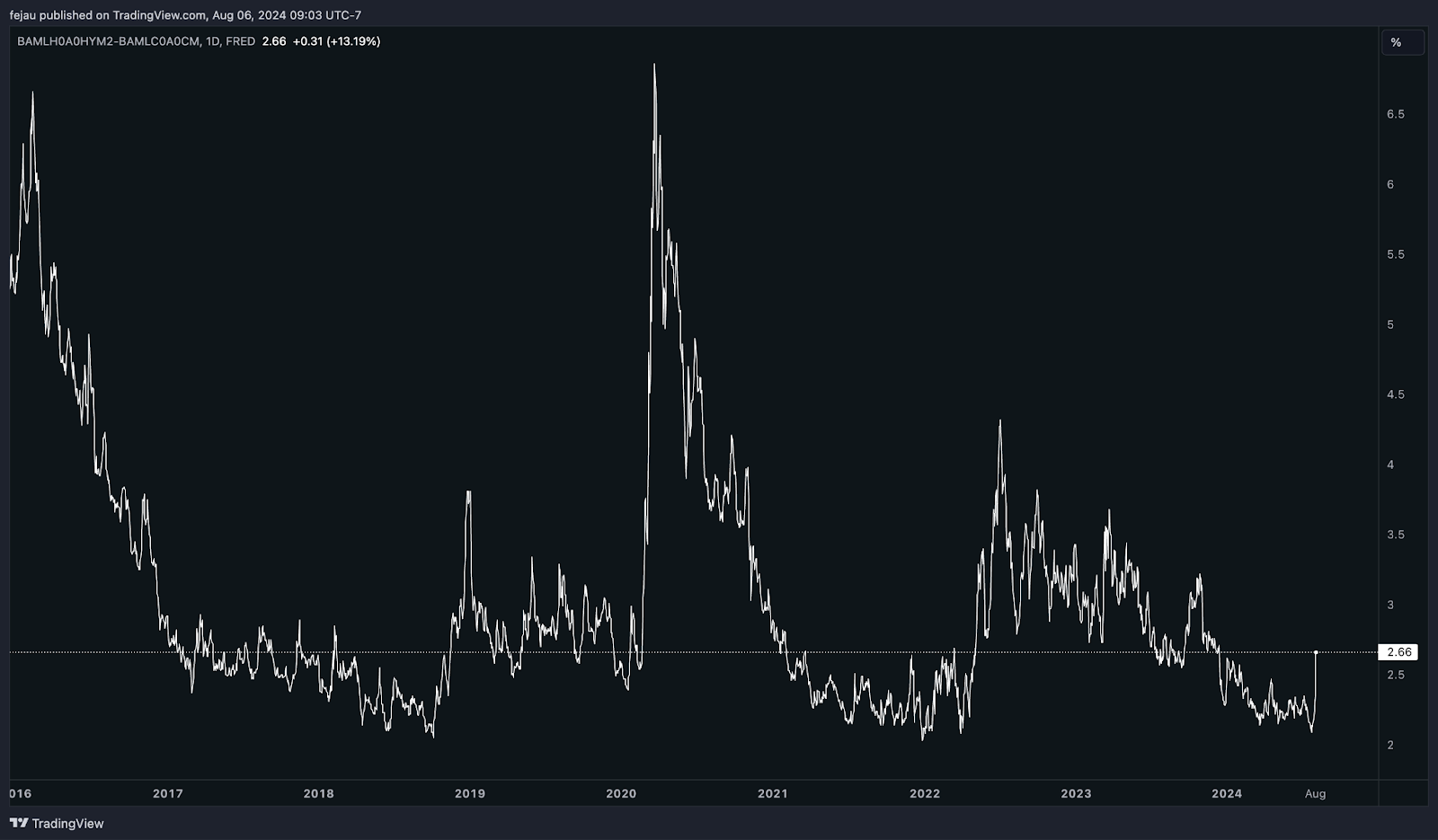

Let’s look at the spread between high-yield (HY) and investment grade (IG) debt. Typically, this spread widens when credit spreads widen due to rising fears of default. Since HY has a larger credit spread structure to its yield than IG, it widens during recessions. As noted in the table below, spreads have widened, but not to a significant level of concern yet. We will need to monitor this spread for further widening.

Overall, there’s been a lot of turbulence in the markets this week, which has rightly raised the odds of a Fed rate cut over the next few meetings. However, when we look at the core markets that the Fed cares about most (like credit), something like a rate cut between meetings is a bit dramatic for my taste.

— Felix Joven

49 million dollars

The volume of new investment that entered US spot Ether ETFs on Monday came even as Ether itself lost as much as 20%.

The figure comes as spot bitcoin ETFs lost $168 million amid yesterday’s broader market turmoil. Spot prices for bitcoin and ether rebounded on Tuesday, up about 4% and 1%, respectively, in the 24 hours as of 2 p.m. ET.

The actions that cried “Wolf!”

After just 21 S&P 500 stocks closed higher yesterday, things are looking up.

The S&P 500 rose 1.6% in two hours of trading, while the tech-heavy Nasdaq rose 1%.

Cryptocurrency-related stocks also rode the recovery wave on Tuesday. Coinbase, which lost 20% on Monday, was trading 3% higher at 2 p.m. ET today.

MicroStrategy shares, which fell 25% on Monday, are also back in the green today, up 5% as of 2 p.m. ET.

Core Scientific surged a whopping 16% on Tuesday. While not hurt by the overall stock market rebound, the move was likely prompted by the announcement that the Bitcoin miner would provide additional hashpower to host NVIDIA CoreWeave GPUs.

The Japanese yen and VIX fell this morning, helping ease recession fears and calm markets after Monday’s global sell-off.

As Felix mentioned above, the VIX jumped to 55 yesterday, its highest since March 2020. The volatility index is down about 30% to 27 on Tuesday morning, but is still up 66% over the past five trading days.

The yen weakened against the U.S. dollar for the first time since early August. The U.S. dollar has fallen about 6% against the yen over the past five trading days.

Markets are still calling for a rate cut in September, although traders are less confident than they were yesterday. Fed funds futures showed a 67% chance of a 25 basis point cut next month on Tuesday, down from 85% on Monday but up from 11% a week ago.

The bad news for most investors is that while they may think the sky is falling, the Fed isn’t. It will take more than one weak employment report to convince them to cut rates.

— Casey Wagner

Vice President Gets Vice President

Vice President and presumptive Democratic nominee Kamala Harris has chosen Minnesota Governor Tim Walz as her running mate.

Walz’s cryptocurrency policies are… not very well documented. He hasn’t made any public policy statements regarding the industry, but he recently signed a new bill aimed at protecting crypto ATM customers.

The law, signed in May, went into effect this month and requires cryptocurrency kiosks and ATM operators to display warnings to customers. New customers are also limited to transactions of less than $2,000 per day and have 14 days to file a report in the event of fraud, which could result in reimbursement for losses.

The Minnesota bill received strong support from AARP, which also advocated for similar legislation in Vermont and Rhode Island.

The effort is another example of states taking cryptocurrency regulation into their own hands while federal lawmakers struggle to come to a consensus.

I heard that Harris’ camp has been bypassing crypto lobbyists and advocacy groups. I also heard that her people weren’t too happy with Bitcoin Magazine CEO David Bailey after he claimed that Harris declined an invitation to speak at Bitcoin 2024 after “negotiating” with the event’s organizers.

(Blockworks reached out to Harris’ team to confirm these claims but did not receive a response.)

However, I think we are still a long way from a comprehensive crypto policy plan from Harris/Waltz (remember, Trump hasn’t released a written platform yet either), if we get one at all.

— Casey Wagner

Bulletin board

- Former Phoenix Vice Mayor Yassamin Ansari appears set to win the Democratic nomination for Arizona’s 3rd Congressional District after a tight race prompted a recount Monday night. Last month, Ansari signed a letter to the DNC demanding the party adopt more favorable policies toward cryptocurrencies.

- Nasdaq Stockholm-listed CoinShares announced its second-quarter earnings today. The company said it doubled its revenue year-over-year and sold its FTX claim for a 116% recovery rate.

- Household debt is on the rise, according to a new report from the Federal Reserve Bank of New York. Total household debt rose by $109 billion in the second quarter, bringing the national debt total to $17.8 trillion. The biggest contributor was mortgage balances, which grew by $77 billion.