Disclosure: This article does not submit investment tips. The content and materials presented on this page are intended only for educational purposes.

The mantra of the eye is $ 10, since analysts predict mass growth, contributing to strong acceptance, key partnerships and an accent on RWA adjustable tokenization.

Mantra (OM) currently ranges from $ 3.91, which is slightly lower than at the highest point this week. This movement brought the market capitalization of token more than 3.74 billion dollars. Despite the fall, Mantra attracts considerable attention in the blockchain space, and analysts predict significant growth in 2025.

At the moment, Mantra leads the adjustable RWA tokenization space as the first Layer-1 blockchain, specially created for this purpose. According to forecasts, the project is positioned to obtain a significant share in the tokenization market for 16 trillion dollars+ RWA by 2030.

In addition, Mantra partnerships with Google Cloud, Mag, Zand Bank and Pyse provided the project that it requires. In addition, the growing acceptance of the mantra, especially in the UAE, signals the trust of investors.

Compared to other Layer-1 blockchains, such as SOLANA and SUI, Mantra stands out with an accent for RWA-compensation tokenization corresponding to the regulatory service. Analysts believe that this approach gives OM an advantage in the blockchain ecosystem.

The long -term vision of Mantra includes the total cost of $ 100 billion (TVL) on the chain by 2026. With the current market capitalization of $ 3.74 billion, this means that there is a significant place for growth. Experts say that OM can easily see a 10 -fold increase in the long term, with a more realistic target price 3 times to $ 10 in the short term.

Mantra is preparing for a breakthrough

The OM diagram forms a sample of the Bull Flag textbook in the accumulation zone, which indicates the strong potential of the breakthrough. The pattern shows consistent higher minimums with a decrease in sales pressure, which indicates the accumulation of solid composition with institutional investors. This technical installation, combined with an increase in the volume of profiles, reflects patterns observed in other successful Layer-1 blockchains before their parabolic movements.

With a strong support of $ 3.60 and a resistance of $ 4.10, a coin can prepare for a potential surge. If OM can break through with a mark of $ 4.60, analysts believe that there may be a sharp rally, and price goals have reached $ 10. The growing institutional acceptance and growth of the ecosystem fuele these optimistic projections.

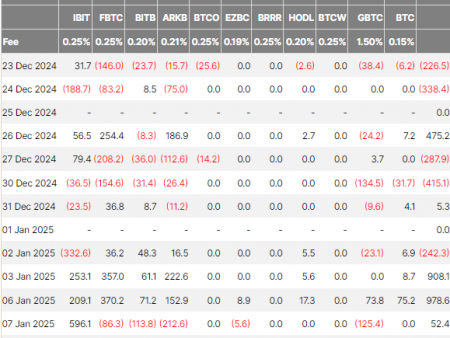

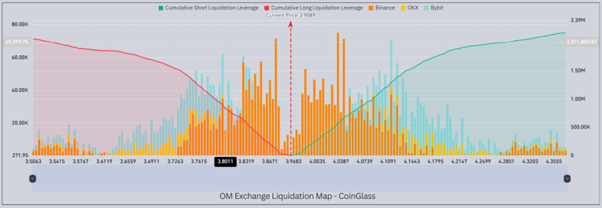

Over the past 30 days, OM shorts have been eliminated in significant quantities, which may indicate the potential for price compression. Over the previous 24 hours, more than $ 2 million in shorts were liquidated. Over the past 7 days, more than $ 9 million, and over the past 30 days, more than $ 20 million have been liquidated.

This growing trend in short liquidations, compared with long positions, involves strong purchase pressure and potential for explosive movement upward, similarly to models observed in previous crypto -bites.

Disclosure: This content is provided to the third party. Crypto.news does not support any product mentioned on this page. Users must conduct their own research before taking any actions related to the company.