In the recent OKX report, the state of decentralized exchanges (DEXS) was studied in 2025, revealing Solan as dominant power, while Ethereum is faced with problems to maintain its relevance.

The report emphasized as innovations between blockchains, technological achievements and developing user preferences in the aggregate changed the DEX sector.

Solan He heads the revolution DEX

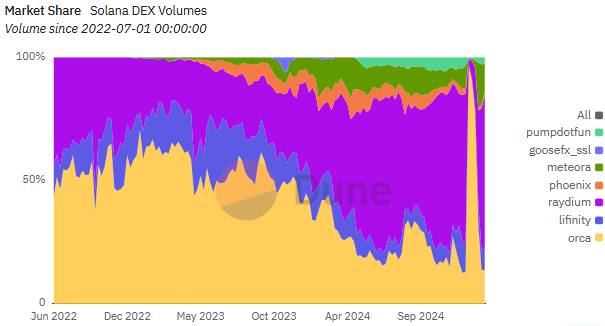

Solana Ecosystem It is a key point in the OKX Exchange report. This He became the dominant force in decentralized finance (Defi), commanding 48% of the total DEX. According to DEXS in 2025, this growth may be associated with its high -speed transactions, insignificant fees and infrastructure, friendly for developers.

“In almost all indicators of the acceptance of the Solan blockchain, it knocks out any other chain from the park. The generated fees for the transaction of network transactions, the number of transactions, active wallet addresses, Dex Active Users – Solana is really a retail network, ”read the excerpt in the report.

In addition, OKX quotes the architectural advantages of SOLANA, which also attracted merchants and developers, creating a strong ecosystem for decentralized trade. The main example of this success is Raydium, the flagship automated market manufacturer SOLANA (AMM). According to Beincrypto, Raydium recently dominated the volume of Solana dex.

Raydium has established itself as a key player in the Defi’s Solana ecosystem thanks to innovative innovative liquidity models. The OKX report notes that the effective combination of Raydium liquidity has become the standard for DEX platforms, creating a direct problem for Ethereum and its derivatives.

The report also emphasizes that users are increasingly gravitating towards Solan from lower transaction costs and higher speeds. This shift gave pressure on the Ethereum to accelerate the deployment of Ethereum 2.0 to remain competitive.

Since Solana continues to gain momentum, OKX emphasizes Ethereum’s efforts to remain relevant with the launch of Ethereum 2.0. The update is aimed at providing reduced fees, improving scalability and more smooth user experience. In addition, innovations, such as the V4 Uniswap, with modular “hooks” and gas architecture, strengthened the competitive advantage of Ethereum.

“Ethereum 2.0 influence on DEXS. Firstly, Ethereum itself is now more optimal for Defi applications. Secondly, L2S can now allow Ethereum cheaper using Blobs Data, allowing them to transfer significant costs to users and making existing DEX on L2S is much cheaper to use, ”added OKX.

Uniswap evolution illustrates Ethereum stability in adaptation to market requirements. The introduction of the middle market (twiri) and dynamic fees and dynamic fees improved liquidity management. These innovations, combined with a decrease in costs and performance improvements, position Ethereum as a critical player in the DEX ecosystem, despite the growing competition.

Decentralized derivatives and AI are holding attention

While point trade remains central to the activity of DEX, the OKX report considers decentralized derivatives as the expected next border in Defi. Despite their potential, derivatives are faced with fragmentation of liquidity and regulation problems. Platforms, such as Dydx and Synthetix, provide charging, optimization of throughput, fees and liquidity tools for creating the best trade environments.

The key innovation in this sector is a comparison of models with solid liquidity and synthetic approaches. The first relies on significant liquidity pools to support derivatives, while the latter use algorithmic mechanisms to simulate liquidity. Both models have their own compromises, but their further development will probably form the future of decentralized derivatives.

The integration of artificial intelligence (AI) in Kryptovin progressed in an unexpected way. AI agents in the course of the chain improve trading strategies, while the tools that contribute to AI translate operations on the DEX platforms. In addition, the growth of coins controlled by artificial intelligence demonstrated how these technologies can attract a new audience, potentially contributing to the adoption of Defi in the space.

“One of the biggest questions of the Crypto X AI intersection is why crypto is required … The answer to this question is the ability of cryptography to configure stimulation mechanisms and have a blockchain as a constant data recording,” OKX said.

Asia takes on leadership against the backdrop of a shift in the dynamics of the developer

A remarkable trend in Dexs OKX in 2025 is a shift in the centers of Crypto -development. According to the report, Asia overtook North America as an epicenter of innovation in the DEX ecosystem. Beincrypto recently reported that Singapore and Hong Kong lead the blockchain revolution Above the USA.

According to the OKX report, regulatory flexibility, an active community of developers and an increase Regional institutional interest lead to this change. The consequences of this shift are deep, since the leadership of Asia will probably affect the direction of development of DEX in the coming years.

Meanwhile, the report admits that liquidity remains the vital force of any DEX. Attraction of liquidity suppliers (LPS) and ensuring sufficient capital in liquidity pools are critical problems for new platforms. For example, Uniswap has set the standard to provide liquidity using its AMM design. Its model V3 introduced concentrated liquidity, significantly increasing capital efficiency, but added difficulty.

The incentives turned out to be decisive in overcoming the “initial loading problems”. For example, Sushiswap liquidity programs forced Uniswap to overestimate their approach. This competitive pressure emphasizes the importance of balancing incentives for attracting the LPP, while maintaining economic stability.

In the OKX report, it concludes that the future of DEXS depends on the achievement of the balance in which all interested parties are traders, liquidity suppliers (LPS), tokens and developers – profit. Large liquidity pools provide low gluing transactions, attracting more users, while well -thought -out stimulating structures provide long -term LPS participation. To succeed, the platforms must carefully navigate in compromises to create ecosystems, which stimulate both growth and innovation.