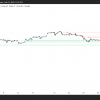

Trump’s market turmoil reduced Microstrategy MSTR shares by 5.85%. The question is whether the promotion of the bitcoins will remain or fall, like most prices for shares.

Microstrategy, the largest corporate holder of Bitcoin (BTC), decreased by 5.85% in preliminary trading on the heels of a large crypto spade. Previously, market trade offers information about market moods on the eve of the official hours.

Crypto -market chaos

On Saturday, February 1, the White House staged tariffs of 25% on Mexico and Canada and 10% tariff for China. As a refutation of the introduced tariffs, Canada applied a 25% tariff for US products. This trade war led to short-term inflation, according to analysts in the Singapore crypto-trading company QCP Capital.

Nevertheless, on February 3, Coinshares reported that the products for investment in digital assets had an influx of $ 527 million, although this mainly fluctuated in the news headlines and general market problems, including the news about Deepseek.

MSTR ASTION

New applications show that Microstrategy owns more than 471 107 BTC, regularly buying more BTC. This technique connects the results of the company’s shares with the price of BTC. “Microstrategy is unique in its double focus: traditional software for business analytics (BI) and investment in bitcoins,” says Oliver Rodzianko, an alpha search analyst.

In well -regulated markets, such as stock exchanges, MSTR provides traditional investors with the opportunity to get the BTC price without owning an asset.

According to the Tipranks, MSTR market research platform, is located on the territory of Buy Now. The average 12-month target price is $ 557.50, which is 66.52% compared to the current price.

The amount of a bear with bitcoins of 100,000 dollars absurd

Think about how far we advanced a year ago.

We are still in the incredible mode of the bull price.

– Dan Hold (@danheld) February 2, 2025

The last time, bull optimism was observed on January 29, when MSTR surpassed large technological giants such as Meta, Netflix and NVIDIA in the NASDAQ 100 YTD list.