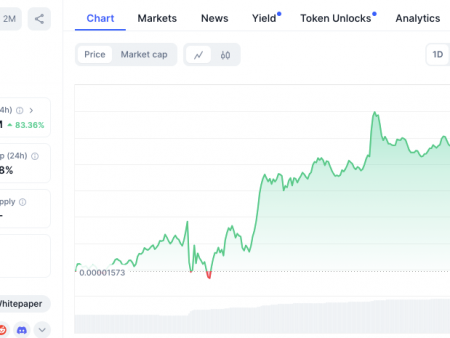

During a trading session on Wednesday, in the cryptocurrency market, a small panning after the consumer price index (CPI) showed. According to the latest data, the US CPI grew by 3.0% in annual calculus, which is slightly higher than the expected 2.9%. Thus, the price of Bitcoin teased a breakdown below the region for $ 95,000, and a flying memory, such as Dogecoin, is faced with a huge potential for reduction, but there is a catch.

Key basic points:

- Analyst Ali Martinez hints that the metrics on the chain, such as daily active addresses, volumes of transactions and whale movements, can project the early signs of the recovery of dogecin

- The inability to maintain an impulse down after Dogecoin has fallen below $ 0.26, signals the absence of strong sales pressure.

- The price of the coin currently ranges below the exponential sliding medium (20, 50, 100 and 200) indicates that wider market moods are still bearish.

Dogecoin low volatility phase: key indicators in the chain to see

For more than a week, the price of Dogain showed low volatility, as it ranged above 0.24 dollars. This consolidation with neutral candles and price deviations on both sides does not indicate a clear dedication from buyers or sellers.

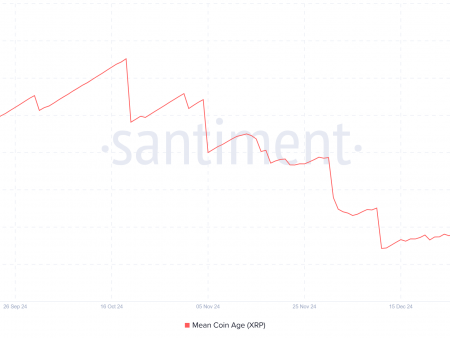

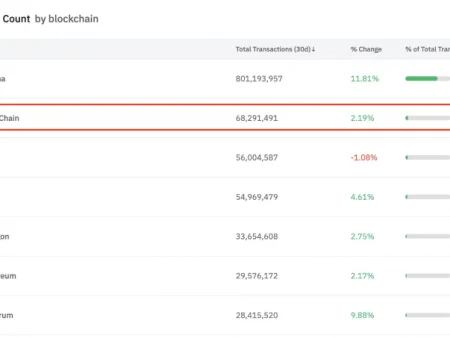

Along with the steady price of Dogecoin, onchain data, such as daily active addresses, volumes of transactions and whale movements, contain key levels. According to the crypto analyst Ali Martinez, the surge of these metrics on the chain may indicate the beginning of a new bull foot for a popular meme coin.

Daily active addresses and the volume of transactions reflect the participation of users who serve as fundamental indicators to evaluate the health of the network.

Meanwhile, whale activity is often associated with the accumulation of large investors, which historically coincided with the restoration of the market.

If these indicators come up, this signals the resumption of interest among investors and supports price rallies.

Bear traps sets resumes with customers of the Dog

Analysis of the prices for the Dogecoin of the daily diagram of the time period shows the formation of a key diagram of a change called Double. On February 5, the price of coins gave bear breakdown with the support of a pattern of a pattern of 0.26 US dollars, laying the path for prolonged correction.

Nevertheless, a memic on the topic of the dog showed stability above $ 0.24, which has shifted the price of the price to the side. The absence of subsequent hints of lack of faint convictions from sellers and potential bear trap.

Thus, the increase in doGeen prices above $ 0.26 would confirm a false gap and restore a bull impulse. After a break, a rally can strengthen buyers to regain higher.

Also read: Bitcoin reserves at the US state level to introduce $ 23 billion. USA in BTC: Report