MARKET OVERVIEW by Resonance

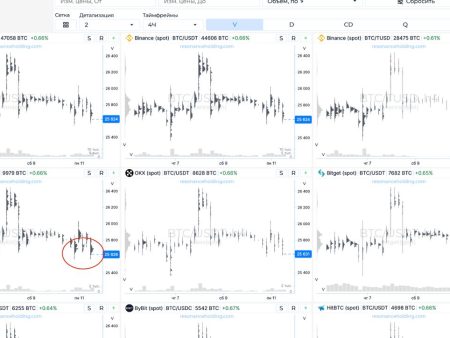

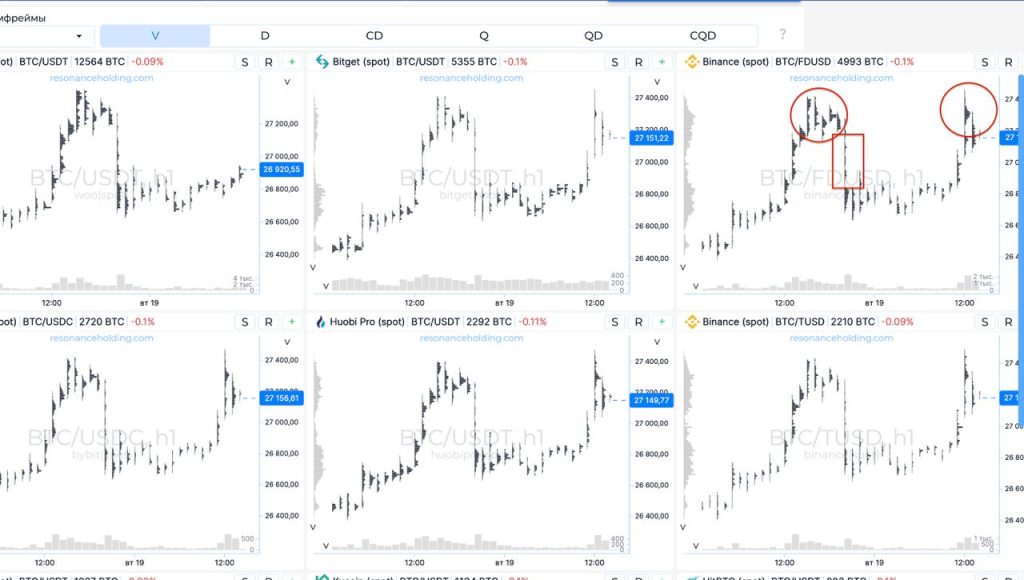

It is disconcerting to see the emptiness in the glass when there was selling overnight. This can be seen as price fell into the empty glass. Also the limit sellers rebound at the top. You can see by the clusters well, where sellers stopped the price and then discounted it with market orders.

So the lack of good limit support of buyers is confusing. How are they going to drive the price up? They have to work in combination. So far these factors are confusing.

In the delta market stat we can see the activity of buyers, which is bumping into the wall of limits. Will they be able to pass it now? If yes, I may even be longing. If not and they will give weakness here, then the short is more reliable for me.

I like the picture of alts better. By the way, they went up and there are traces of good support and demand on many of them. They are no longer reacting so actively to bitcoin drops. More often they are recovering prices and more of them are moving sideways.

I think that many of them can be considered for medium-term trading.

You can check resonance web page by making a click here

Liquidity is capital. And any capital affects the market. The analyst’s task is to determine the balance of the asset (the state of balance between supply and demand). The trader’s task is to calculate the liquidity of the asset, assess the amount of capital under management and evaluate the permissible position size for the given liquidity of the asset, calculate the risk per trade and gain a position. If necessary, to exit a position without upsetting the balance of the market.

Each asset has its own balance. Each trader has its own volume of capital. Decision-making on prices and volumes of entry and exit is a matter for each trader. What is acceptable for one is unacceptable for another. One looks at the scale of the last hour, someone looks at the scale of the last year. One has $100 capital, the other has $100,000.

The market is liquidity.

Liquidity is money.

When we trade, we make a lot of transactions.

A lot of trading is liquidity for those who trade intraday and execution of orders of large investors who gain a position over the long term.

A lot of trades means commissions for exchanges and brokers.

The earnings of exchanges and brokers contribute to the development of infrastructure and increase the number of people in the market. Accordingly, liquidity will increase.

The better the infrastructure is developed, the more arbitrage algorithms and the less price manipulation. Less manipulation makes the market more secure, which attracts traders and investors.

We share working strategies so that more people will come to the market. Because everyone will get what they want, traders get volatility and liquidity, funds get liquidity and perspective, exchanges get liquidity and commissions, product companies get clients and infrastructure to develop further.

Resonance will get a professional community, changing the usual ways of doing things.

The price change is a consequence of the volume change.

No indicator reflects the real state of the market, because it is impossible to analyze the price to understand how much money is waiting in the bids and how much money has already been involved in the transactions.

Not a single candlestick configuration does not predict further arbitrage action.

Not a single “support” line shows the real state of demand for an asset. Moreover, it does not predict even the potential appearance of money in the order books.

Not a single technical analysis figure shows the balance between supply and demand.

No “wave” predicts people’s future behavior. It can’t know if people will still buy, it doesn’t know motives which push participants to make transactions.

No Fibonacci zone guarantees the appearance of money in the order books, much less guarantees that even when the prices, buyers will buy creating a “correction.”

No. It never did.

A change in price is a consequence of volume behavior. And volume behavior is a consequence of the actions of market participants (see Market Participants).

Proponents of technical analysis say that when the price reaches a certain level the participants will start buying. Technically they’re right: they will buy as well as sell. Because the market is all buying and selling. You can’t buy if you won’t be sold.

It’s presumptuous to claim in advance that when a certain price point is reached, the amount of money in buyers will exceed the amount of assets in sellers, and that after all the purchases have been made, they will have capital to continue trading (see Arbitrage).

The false Monte Carlo deduction and the Texas sharpshooter fallacy vividly describe this fallacy.

You might think that if the word volume appears here, then it is effective. But no. In this method, price analysis is the key.

For example:

Shorting of Thrust (SOT) – selling attempt – a signal when a sale is moving up and trying to get past some level that someone is selling (Wikipedia).

Up-Thrust – a manipulative signal where price makes an attempt to go up (Wikipedia).

VSA uses candlestick charts (see Candlestick chart, section TA). This method discards the presence of arbitrage algorithms and the concept of market balance. VSA rejects the presence of volume manipulation and spoofing.

All VSA analysts without exception claim that any price movement is market maker’s manipulation. If a person put a stop loss under a level and the price went down there so that their stop loss triggered, they claim that the MM took their money. Listening to such analysts, you get the impression that there are only two people in the market: the market maker and he. That the price was lowered not by active sales on the spot market, but by MM’s desire to take the trader’s money (see Arbitrage).

Definitely not. Because there is no proven, objective reason to search among the noise of the futures trades for reasons to move the spot market. The futures market does not move the price of spot assets. It always follows the price of spot assets.

A promise to pay the difference (a bid reward) can’t move the price of the real commodity. No matter what financial services salespeople tell you, it is physically impossible.

It is possible to trade futures and options, they are liquidity for us, but to analyze them is to engage in self-deception.

But if a market maker does decide to start manipulating the market, he will start pouring money into the spot market and shifting the balance of supply and demand, he will definitely leave a lot of traces and create a sustained deficit. And this we will notice (identify) fairly quickly. If he did not leave traces, it means that he did not affect the balance, and therefore he will not move the price.