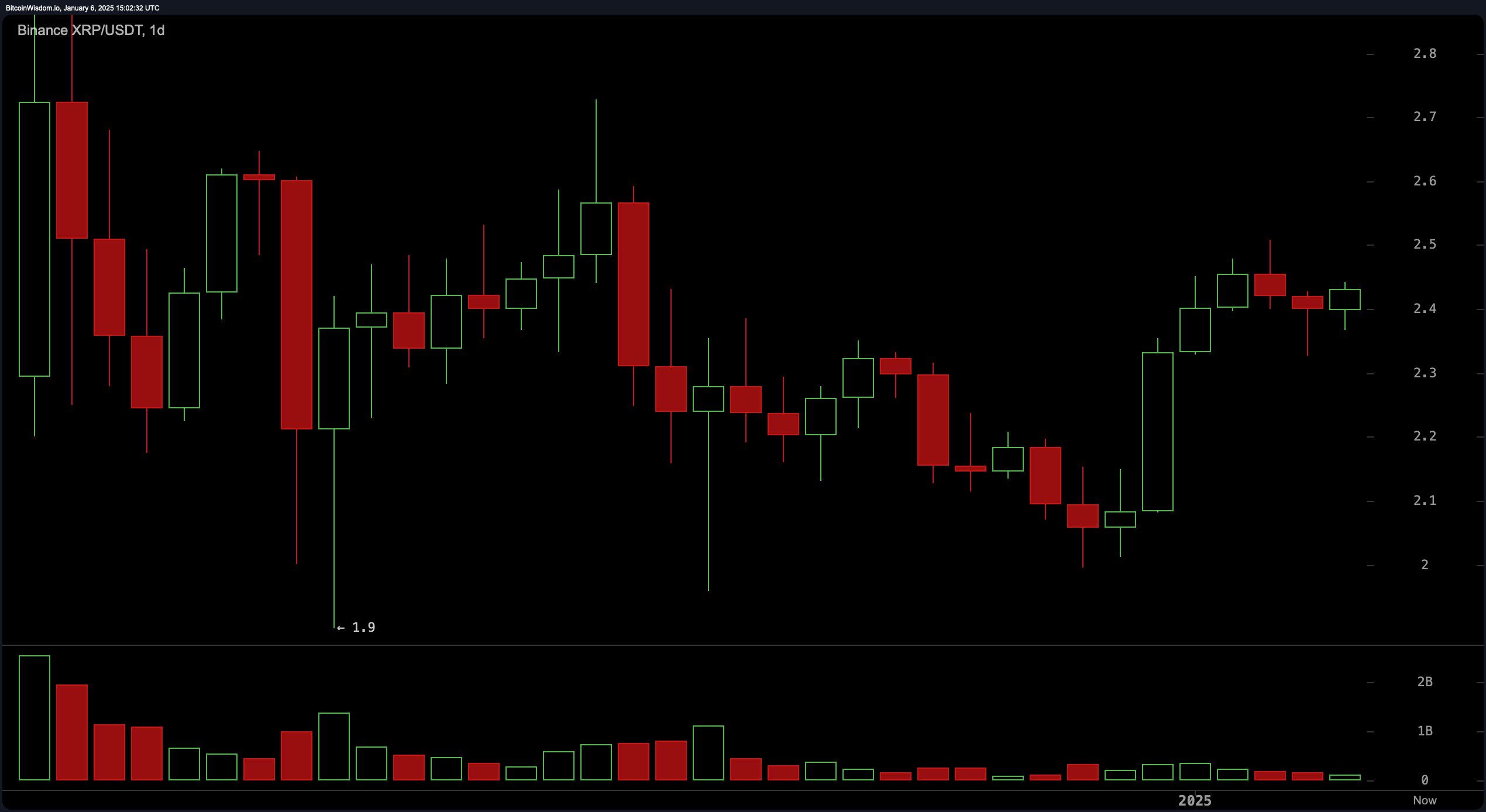

XRP Ripple is currently trading at $ 2.43, which can boast of a market capitalization of $ 136 billion, a 24-hour trade volume of $ 3.8 and intra-day vibrations from $ 2.46 to $ 2.46 .

XRP

On the daily diagram, the XRP continues to show a bull revival after an extended phase of lateral consolidation. Resistance at the level of $ 2.50 remains a critical level, since previous attempts to surpass it failed. Nevertheless, today’s sharp surplus price indicates an updated percentage of purchase. A decisive breakthrough above $ 2.50 will be alarm with a large volume, aiming at levels, such as $ 2.75. The inability to cleanse this threshold can see how XRP retreats to $ 2.20, although today’s impulse suggests that the bulls are gaining momentum.

The 4-hour diagram shows the strengthening of a bull impulse, since the recent surge violated the scheme of the lower maximums observed earlier. Support remains solid at $ 2.38, while today’s upward step implies the potential for re -testing of $ 2.50. It is noteworthy that the volume of bidding increased during this surge, encouraging a sign for buyers. A successful test and retention of $ 2.44 can open the door at higher prices, while the inability to maintain this level will bring $ 2.38 in focus as key support.

On the 1-hour diagram, XRP burst out of its insignificant descending trend, resolutely rising above $ 2.42 with a sharp increase in volume. The recent surge is strengthening $ 2.38 as a solid support zone, and also represents $ 2.46 as the next short -term resistance. Internal traders must control the consolidation or continuation of this impulse, since a break above $ 2.46 can cause a quick rally to $ 2.50.

The oscillators reflect the mixed feelings observed in terms. The relative force index (RSI) is neutral at 57, while the sliding divergence (MACD) continues to give a positive signal, which is consistent with the newly acquired bull impulse. Meanwhile, the oscillators of the pulse, including the Stochastic index of commodity channels (CCI), remain neutral, signaling that further confirmation is required before a strong directional movement.

The average movements are decisively optimistic, with a 10-day exponential sliding average (EMA) of $ 2.33 and 20-day EMA in $ 2.28, both indicate purchase signals. The leveling of these average values with the current price action adds weight in a bull case if the resistance levels can be overcome.

Bull’s verdict:

If the XRP can withstand this impulse and tear off the $ 2.50 resistance level with a strong volume, it can prepare the ground for rally for $ 2.75 or higher in the near future. The leveling of sliding medium and growing bull tendency for several terms strengthens this look.

Bear Verdict:

If the XRP cannot hold $ 2.38 as support, it can repeatedly introduce a consolidation period or decrease to $ 2.20. Traiders should remain careful with respect to sales pressure at key levels of resistance, especially if the volume cannot maintain today’s surge up.