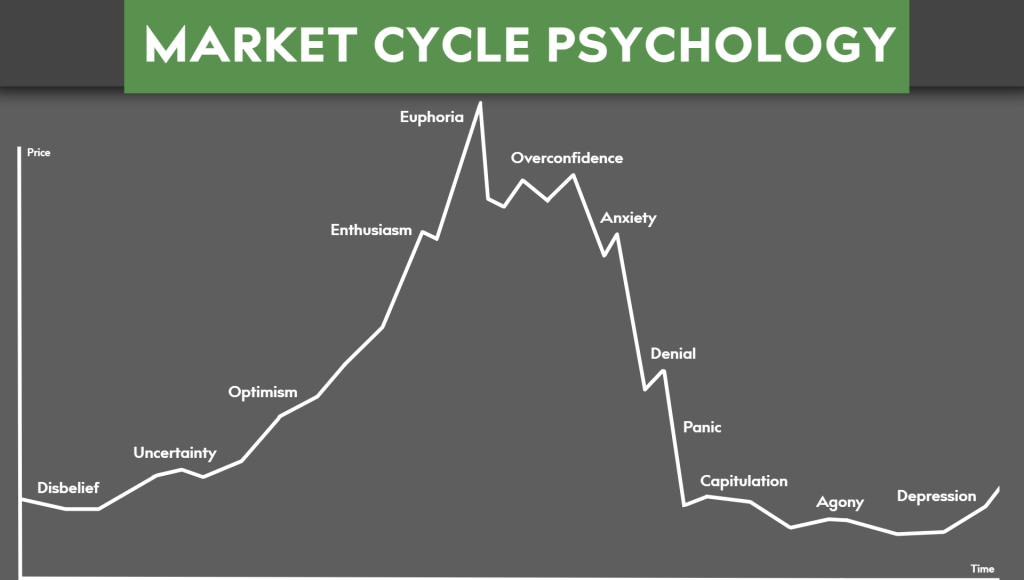

Introduction in market cycle psychology

In this discussion, we’ll explore the various phases of a product’s life cycle within the context of market dynamics, using the popular SXP as our case study.

Table of Contents

Product Introduction Phase

In this initial stage, a product makes its debut in the market. This phase is marked by a modest uptick in sales, as indicated by the purple arrow on the graph. Observing the graph, one can discern consolidation, followed by a price surge aimed at capturing market attention. During this time, rumors about potential listings, such as on Binance, tend to circulate.

Growth Phase

The product gains acceptance in the market, leading to an increase in demand. In our SXP example, it was listed on Binance, and market makers came into play, charting price movements while providing liquidity. News about the product spreads, generating excitement among market participants.

Maturity Phase

Sales volumes reach significant levels, but further growth plateaus. Despite the rapid 5x growth since its Binance listing, enthusiasm among market participants continues to grow. Conversations shift towards medium and long-term investments, often without realizing that the market is nearing its peak. This phase witnesses the highest trading volumes for the coin.

Decline Phase

This final phase experiences a significant decline in sales volumes, potentially leading to a complete loss of demand. Latecomers enter the market, hoping for a favorable price point. People anticipate further growth due to the project’s fundamentals and news of new partnerships. It’s important to note that strong news has a rapid effect in the growth phase, while the market reacts less actively in the decline phase, leading to a swift end to growth.

Real-World Analogy

Imagine you own a large warehouse filled with televisions. Initially, you had 100,000 units, initiated an advertising campaign, hired sales staff, and sold 80,000 TVs. Subsequently, a small news campaign reduced your stock to 5,000 units. In this real-life scenario, most people would sell the remaining units at a discounted rate with minimal profit to cover current expenses.

Strategic Question

Given that you have 5,000 televisions left, why would you launch a new advertising campaign?

Market Expectations

Many sources, including Telegram channels, suggest an anticipated price increase up to $10. This hints at the possibility of a new market cycle emerging after some time, potentially resulting in a lesser price increase. However, such a transformation requires time and preparation. A significant portion of market participants may have purchased coins at the market’s peak, evident in the high trading volumes during the third phase.

Investment vs. Speculation

Rather than exiting with minimal losses through a stop strategy, many individuals make the common mistake of turning speculation into long-term investments. They lock their capital for an extended period, hoping for a new cycle. However, the essence of investments is entering a project at its inception, not at the market’s peak. This fundamental principle elucidates how market cycles operate, with the SXP/USDT instrument serving as a prime example.