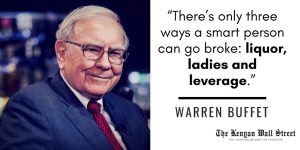

Let’s embark on a journey through the intricate world of margin and leverage in futures trading, unearthing the nuances that often elude the uninitiated.Of course, one quote from an investment guru before we begin

and first 2 was a “joke”

Margin and Leverage

Margin, dear trader, is the financial bedrock upon which your open trades rest. To distill it into simplicity, it represents the sum required to keep your trade unfurled in the turbulent seas of the market.

Now, allow me to unveil the stark contrast between trading futures contracts and engaging in the tempestuous spot market:

- – In the realm of the spot market, your prowess is limited to the funds neatly nestled in your trading account.

- – However, futures contracts usher in the tantalizing concept of leverage, allowing you to wield borrowed capital, akin to wielding a financial Excalibur.

This power of leverage bestows upon you the ability to, for instance, deploy a mere $1,000 deposit to unlock multiple trades, each endowed with the same princely sum. As long as the mystical margin requirement is met, the possibilities are vast.

In the spot market, a $1,000 trade might languish for days, longing for the stars to align while other opportunities gallop past. Frustration sets in, fees accumulate, and your entry into the market becomes a lamentable odyssey.

But, and here’s the paradox, for every blessing, there’s a curse. Leverage’s dark side emerges when your margin, like a dwindling candle, can no longer sustain your open positions. In such a dire juncture, the executioner’s axe falls, and your exchange account dwindles to the grim countenance of zero.

Thus, when wading into the futures contract waters, an unwavering commitment to risk management is your compass and anchor.

Yet, as we traverse this financial landscape, we encounter the vagaries of human psychology, which can distort our perception of leverage and futures trading:

- – Laziness often conspires with hubris, leading us to believe that we possess an infallible intellect superior to others.

- – The siren call of effortless riches lures us astray, blurring the line between ambition and folly.

- – High-profit prospects dangled before us on social media platforms become irresistible bait, steering us into turbulent waters.

Let me share a nugget of wisdom: When you apply leverage, a factor of 1 can magically transform a 10% profit into a tantalizing 100%, and a 1000% profit at a factor of 100. Yet, the size of your trade remains constant; only the margin dances to a different tune.

Now, onto the cornerstone of prudent trading – risk management:

Before you unfurl your financial sails in the market’s tempest, heed these principles:

- – Never bet the entire kingdom; never stake 100% of your treasure in a single trade.

- – Divide your fortune into five hypothetical parcels, and let no single trade lay claim to more than 20% (1/5) of your hoard.

- – Calculate your risk size – the sum you’re willing to bid farewell to if the market’s tide turns against you. For instance, it might be a mere 1% of your wealth.

In the realm of dollar and cents, with a mythical treasure of $1,000, each trade’s maximum magnitude stands at $200 (20%), with a perilous risk size of just $10 (1%).

- – The guardian angels of trading, protective orders or “stops,” must never be forsaken. Set your stop size equal to your acceptable risk size. In our example, it’s $10 for a $200 venture, a vigilant 5%.

- – Lastly, before you unfurl your financial colors, embark on a Risk/Reward odyssey. The ratio of expected profit to potential loss should, in plain terms, favor the former. Let this ratio not dip below 1:2, and better yet, aspire to 1:3. Such a balance ensures that even missteps, ending in stop-triggered losses, can be offset by victorious trades. It’s the lifeboat in this treacherous sea.

Drawing from the collective wisdom of seasoned mariners, the perilous shoals of losses are most often navigated through the art of embracing risk management, not defying it.

The depths of the human psyche often lead us astray:

- – The hubris of challenging the market’s might.

- – The futile quest for quick redemption, often spiraling into deeper financial abysses.

- – Trading seen not as a craft but as a gambler’s dice roll.

- – The sirens of tantalizing profit percentages on social media.

- – The tempests of personal life unsettling the waters of trading.

This missive is a beacon, a guiding light for those who have weathered the market’s tempests for a month or a year. It beckons you to navigate the waters with prudence, steering clear of the sirens of financial ruin.