- On Tuesday, Litecoin was trading below $88, down 17% from its Nov. 23 high of $106.

- Litecoin Whales has recorded positive net inflows for 73 consecutive days.

- During this 73-day buying spree, whale wallets purchased 13.2 million LTC worth $946.6 million.

Litecoin price reached $87.90 on Tuesday, down 17% from its recent high of $106 on November 23. Despite the steep correction phase, on-chain data shows that crypto whales have entered a 73-day buying spree.

Litecoin price loses support at $90 amid cascading liquidations

Following the announcement of the resignation of US Securities and Exchange Commission (SEC) Chairman Gary Gensler, the major altcoin markets have received a boost.

Notably, crypto assets under litigation and those with ongoing ETF filings, including Solana, LTC and XRP, recorded significant gains last week.

However, when the price of Bitcoin fell below $100,000, the ensuing sell-off caused bearish headwinds in the altcoin market.

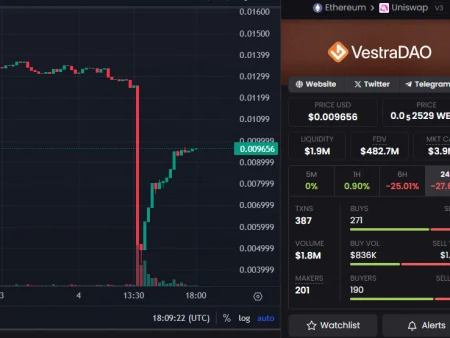

Litecoin price | LTCUSD

The chart above shows how the price of Litecoin rose 31% within 48 hours of Gensler’s withdrawal announcement, rising from $81.50 on November 21st to a five-month high of $106 on November 23rd.

However, when the BTC price dropped below $92,000 on Tuesday, Litecoin mirrored the market’s downward trend, reversing 17% of last week’s gains.

Whales invest $950 million in 73-day buying spree

On the surface, Litecoin’s 31% rise last week is largely driven by speculative demand from traders betting that Gensler’s exit will boost the chances of the LTC ETF being approved.

However, a closer look at online data trends reveals that a protracted whale accumulation trend is behind the recent Litecoin price breakout.

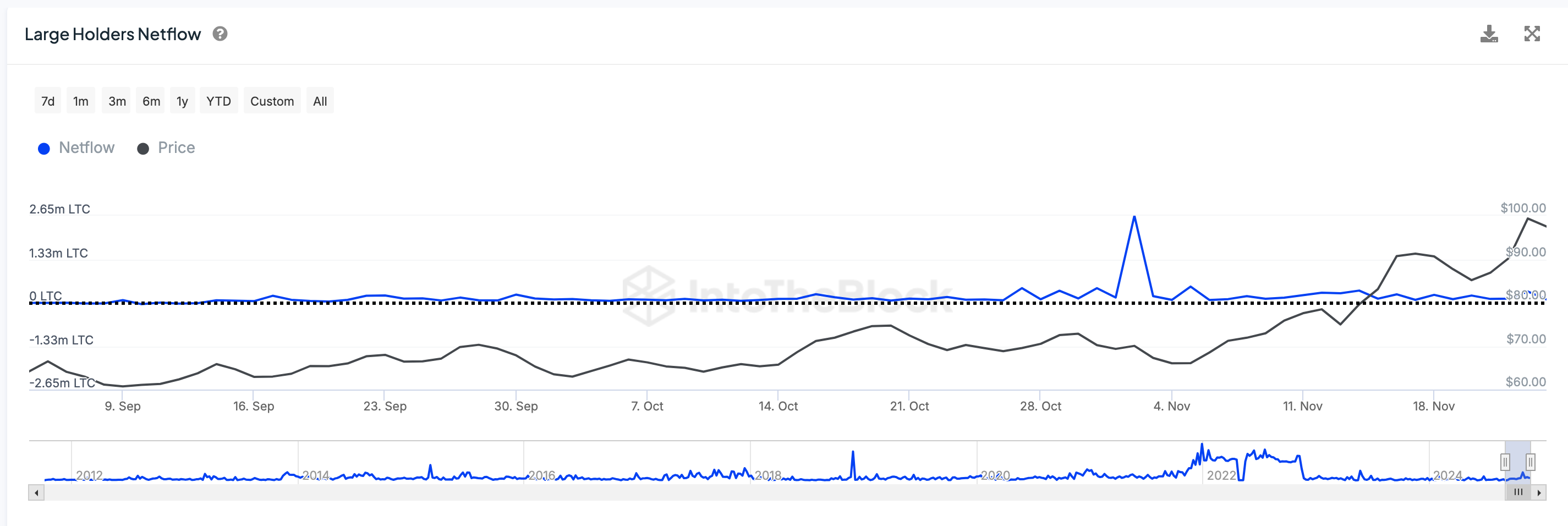

IntoTheBlock’s net large holder flow data tracks daily deposits and withdrawals from wallets holding at least 0.1% of the total supply of Litecoin.

Net flow of large Litecoin holders | LTCUSD

Net flow of large Litecoin holders | LTCUSD

As shown above, Litecoin whales recorded positive net flows for 73 consecutive days starting September 14, purchasing 13.2 million LTC at an average price of $946.6 million.

When whales acquire such large quantities of coins, it creates positive sentiment for two key reasons.

First, it signals that Litecoin’s largest shareholders remain bullish on LTC’s long-term potential.

With LTC ETF approval set to be approved in the near future, this trend could continue, potentially pushing the Litecoin price above $100 when market demand returns.

Additionally, large-scale whale purchases reduce the amount of Litecoin in circulation on exchanges, creating a potential shortage.

This imbalance in supply and demand could increase the likelihood of price movements upward, making Litecoin more attractive to new market participants.

LTC Price Forecast: All Eyes on $85 Support

Litecoin (LTC) is showing signs of cautious consolidation after plummeting 15% from its recent peak of $106.

LTC price returned to the $90 level, with immediate support found near the lower Bollinger Band at $85. This level is critical because it coincides with the confluence of previous demand zones and the 20-day simple moving average (SMA).

Litecoin price forecast | LTCUSD

On the other hand, resistance lies at $101, the upper Bollinger Band that LTC failed to hold during the recent rally.

The average daily range (ADR) suggests lower volatility, which could signal consolidation ahead of the next big move.

A break below $85 could see LTC fall further towards $68, while a bounce could target $96 and $101 as potential recovery zones.