Когда солнце поднимается в воскресенье, 2 марта 2025 года, Биткойн задержался под порогом в 90 000 долларов США на уровне 85 803 долл. США в мире, но рынки Южной Кореи бросили вызов этой тенденции, причем BTC командовал премией 2,18% до 87 673 долл. США – а -э -э -э -э -э -э -э -э -э -э -э -э -э -E -e.

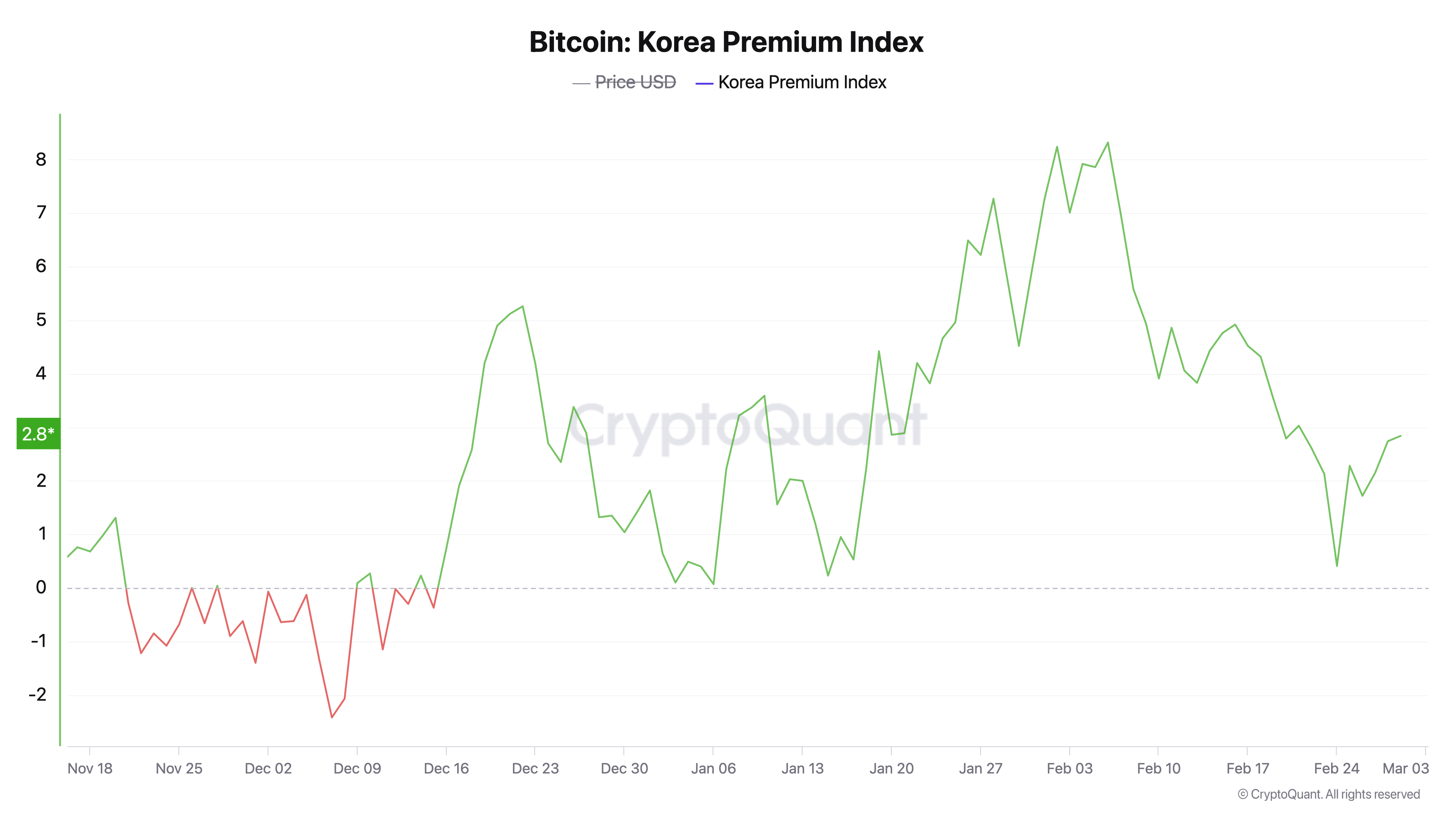

Three months, one trend: Evaluation of Bitcoins of South Korea to get ahead of global markets

Bitcoin spent an implacable week, making up a 30-day descent of 18.1%, since the geopolitical tremor tied to Trump’s tariffs made volatility to financial markets. Against this background, the BTC estimates of South Korea consistently ahead of global average values during February, creating a narrative about localized disobedience.

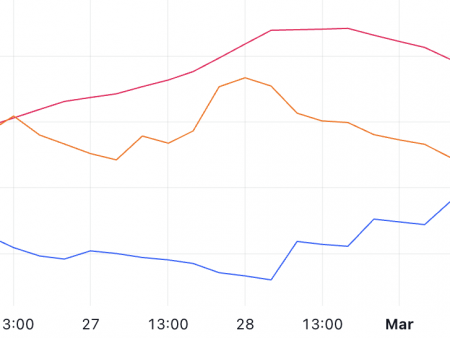

Historical data Cryptoquant.com show that this premium phenomenon has been preserved since December 16, 2024, which leads to the fact that the story of the contrast between regional enthusiasm and a wider trepidation in the market. By the end of December, the Bitcoin Prize in South Korea reached 5.26%, and by the end of January 2025 it increased to 7.27%. This did not stop there; On February 8, the prize reached 8.32% compared to a balanced average world average.

Bitcoin, a car in South Korea, decreased at the end of February and until the beginning of March, at 2.84% on March 1, and as of 2.18% as of Sunday, March 2, according to current indicators. By 8 am to eastern time (ET) on that day, the BTC rating in the country overshadowed global average values for $ 1870 – a constant and current price anomaly.

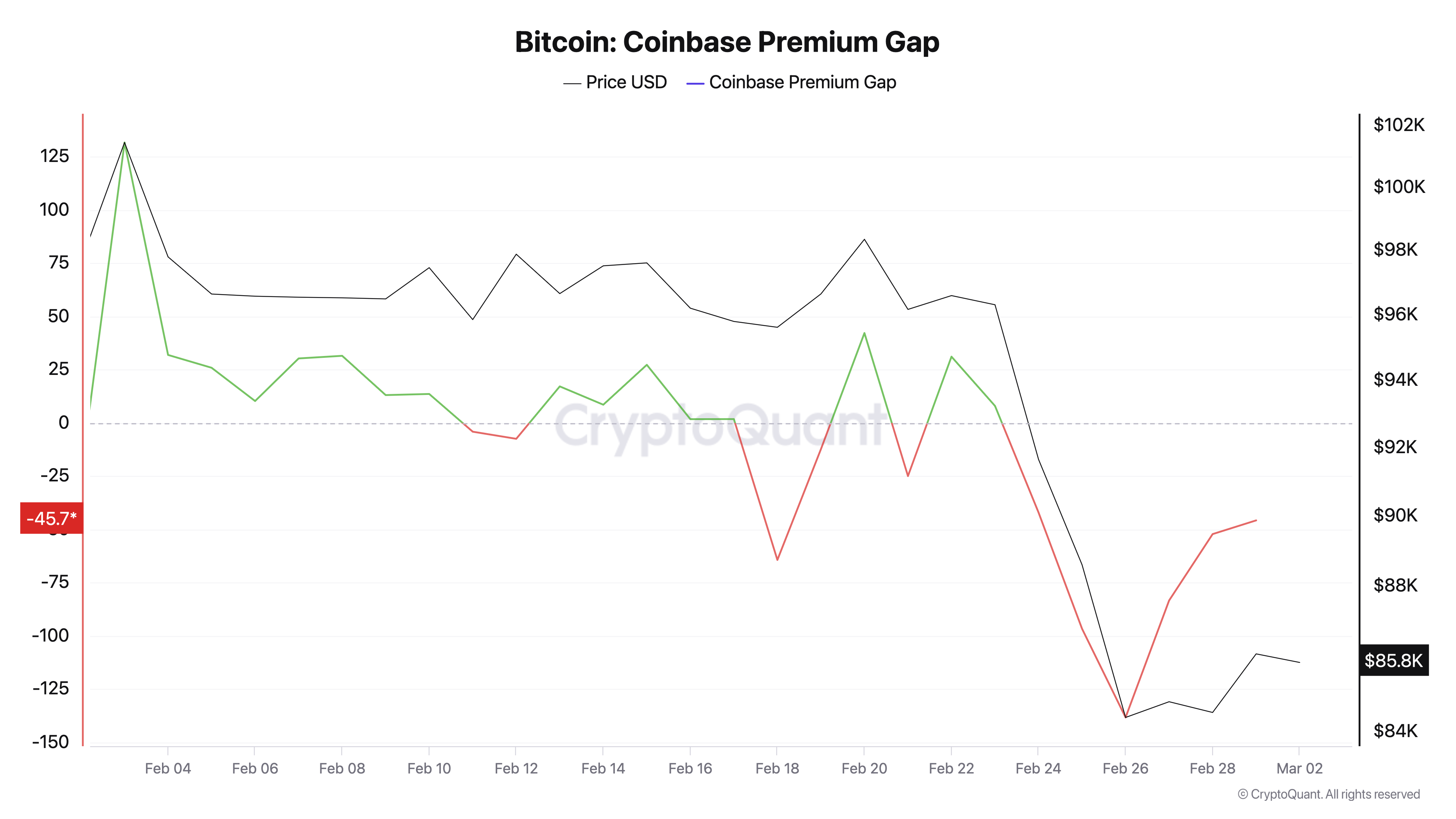

In parallel with this, the Coinbase Premium index and the space placed on Cryptoquant.com fluctuates until February, its unstable waves hint at the careful inertia of US investors. It is noteworthy that from February 24 the index languished in a negative territory, creating a sharp trans-Tikhoocaan contrast: South Korean merchants put forward the demand with energy, while their American colleagues used restraint.

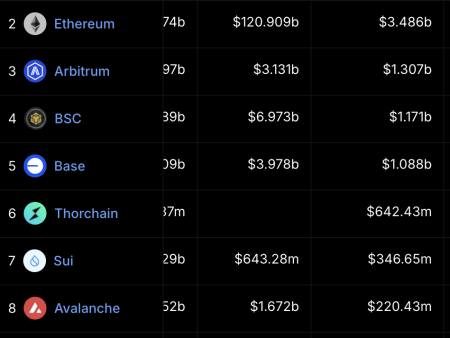

In addition to the dominance of Stablecoins, the US dollar remains the main trading partner of BTC, although the South Korean won the paths, it accounts for 3.20% to 5.6% of global transactions last week. Daily trading volumes for the euro, Canadian dollar and the British pound are pale next to the lively activities of Won. Stablecoins commands the lion’s share in the BTC volume related to Greenback and Won – the trio that formed the Crypto liquidity hierarchy over the past year.