The cryptocurrency market saw a notable decline during the US trading session on Thursday as major digital assets BTC and ETH recorded sharp declines. Bitcoin’s 4.2% pullback signals continued corrective sentiment among traders. While Ethereum price persistence below $3,500 hints at a continued downtrend, increased staking activity could fuel a rapid recovery.

Currently, ETH price is trading at $3,340 with an intraday loss of 4.4%. According to Coingeco, the global cryptocurrency market capitalization is $3.47 trillion, with a 24-hour trading volume of $1.2 billion.

Key points:

- The steady upward trend in ETH rates indicates growing adoption, increased network security, and long-term investor commitment.

- The $3,100 level acts as a key support for buyers to replenish depleted bullish momentum.

- Ethereum price stability is above the 200-day exponential moving average and 50% Fibonacci retracement level.

Ethereum rate reaches record level

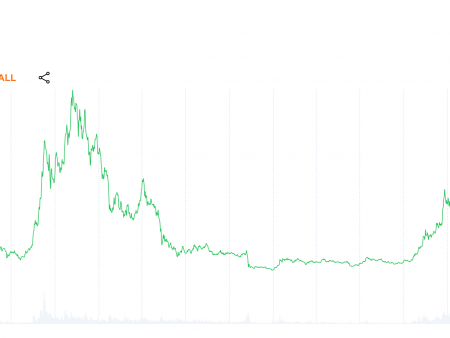

According to IntoTheBlock, Ethereum staking continues to show strong growth, with total ETH staking volume exceeding a staggering 54 million. This achievement underscores the continued confidence of investors and validators in the Ethereum proof-of-stake (PoS) ecosystem.

Currently, converted ETH represents approximately 10% of the total ETH staked, which is 5.22 million ETH. This reflects a growing trend among Ethereum validators to reinvest their rewards, further strengthening the network’s decentralized security.

The steady trend of Ethereum staking and re-staking underscores consistent adoption, increased network security, and a long-term commitment to future asset growth.

Key Support for Watching Ethereum Price Correction

Amid the broader market correction, the price of Ethereum fell from $4,108 to $3,342, recording a loss of 18.75%. The falling price breakout at $3,500 and the slope of the 50-day EMA indicate a bearish shift in the short-term trend.

With sustained selling, ETH coin could fall another 7% and test support at $3,100. The above level, backed by the 200-year EMA and 50% FIB, suggests a high area of interest (AOI) for buyers to take back control.

Thanks to broader market sentiment and sustained staking in ETH, the altcoin price is poised to regain bullish momentum in the near future. This potential could surpass the $4,000 resistance, followed by the $4,800 resistance.

Read also: $MOODENG Ethereum grew by 79% after Vitalik adopted MOODENG