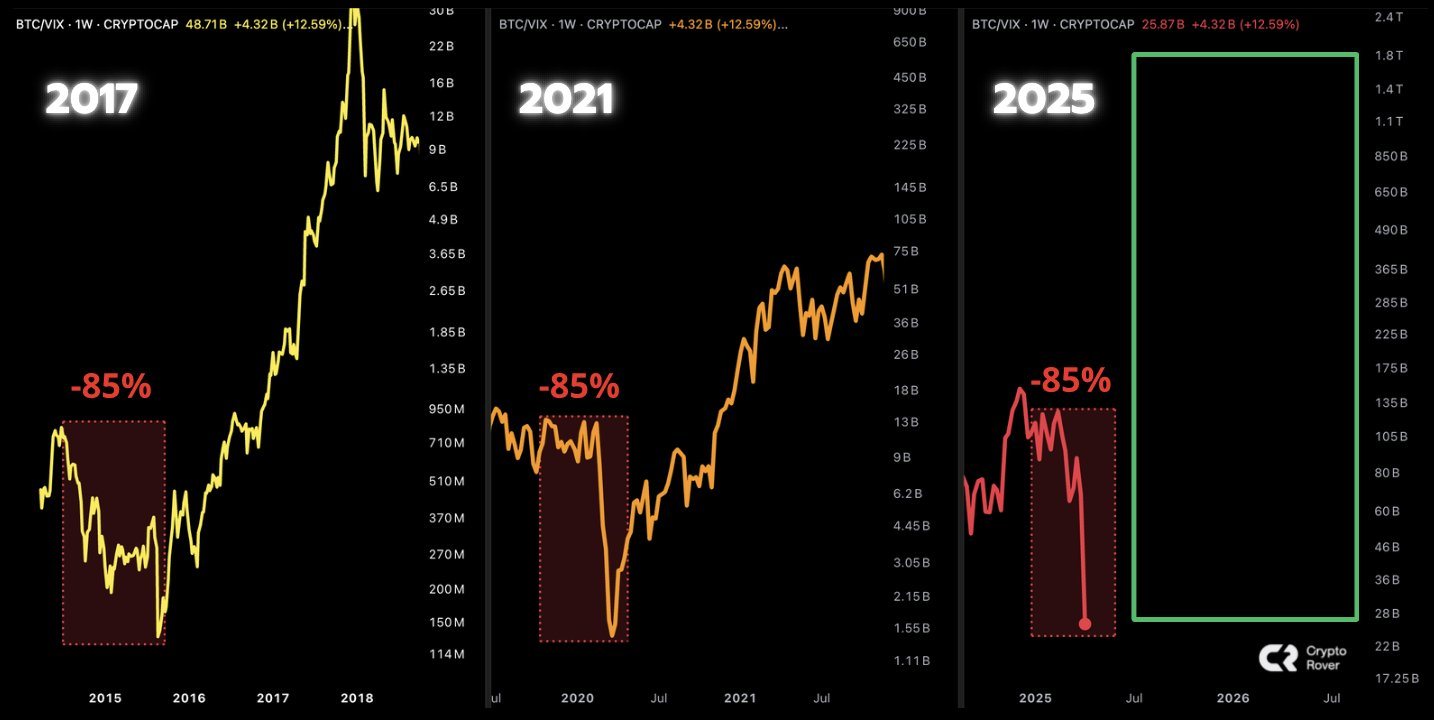

The current Bitcoin cycle shows a strong resemblance to structural discharges observed in 2017 and 2021.

Key market indicators, such as the relationship between bitcoins and market volatility (BTC/Vix ratio) and the overall market capitalization of cryptography in weekly diagrams, show equalization similar to those observed near previous important shifts on the market. These past basic price adjustments acted as not only recessions; They effectively reset the market until subsequent basic upward trends.

Bitcoin script: how the accident has passed historically new maximums

Looking at a wider picture, the story of the price of Bitcoin reveals a repeating long -term structure. As a rule, strong ascending legs caused by widespread excitement ultimately end with steep falls of prices (historically sometimes more than 80% -85% of the peak).

Following these basic falls, more quiet periods, when dedicated, long -term investors begin to constantly buy again, began historically, laying the foundation for the next significant rise. Examples include minimums reached about $ 200 after 2013, about $ 3,000 after 2017 and about $ 16,000 after the peak of 2021.

The structure of 2025 now shows a familiar rhythm: after it exceeded $ 100,000, Bitcoin dropped sharply to less than $ 80,000 caused by macroeconomic stress and increased geopolitical risks. It is important to note that this rollback brought prices to zones where a significant purchase arose in past cycles, which potentially prepared the ground for the next trend towards an increase.

Bitcoin prices checking: can BTC rethink the resistance to keys to confirm the template?

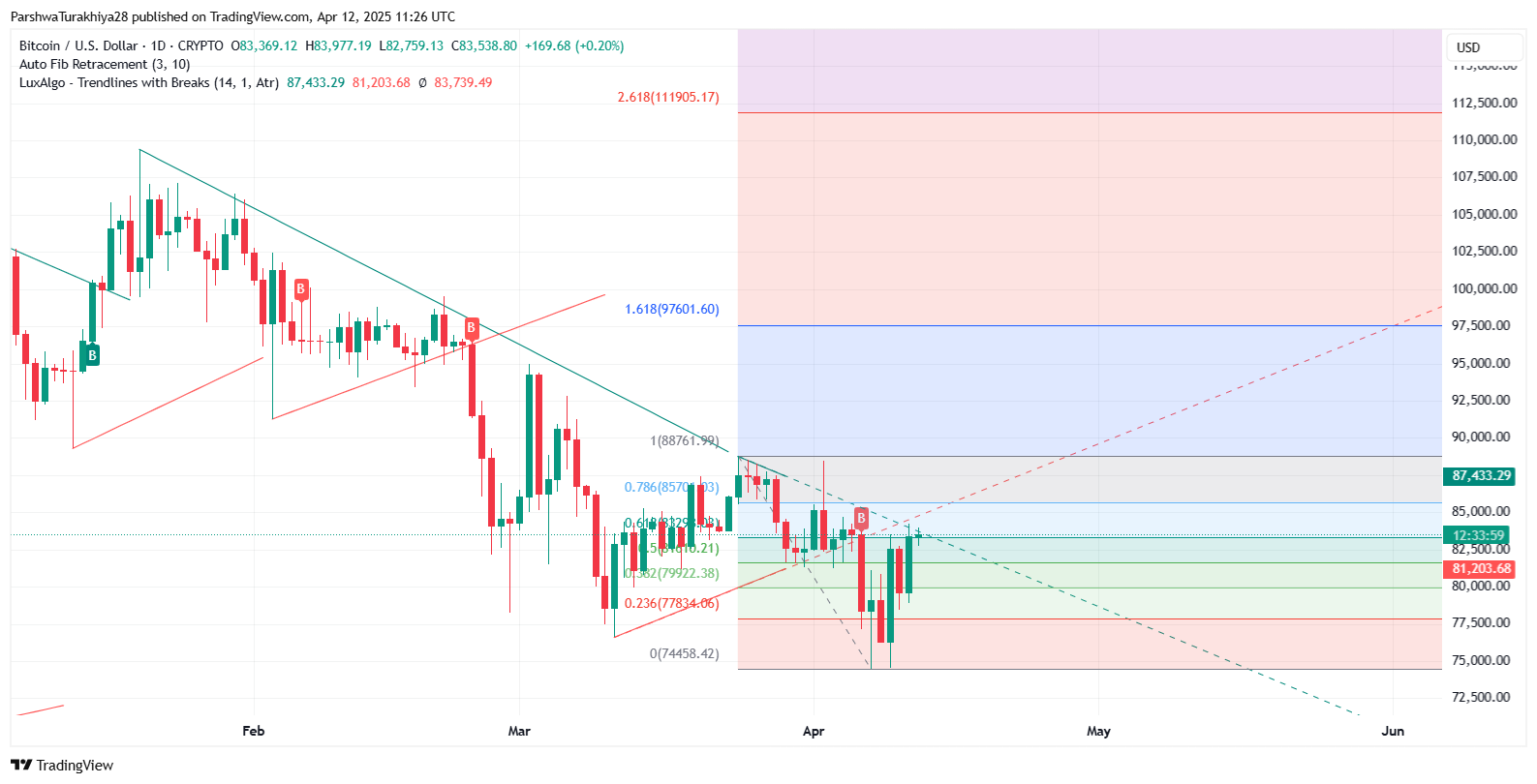

Bitcoin is currently trading about $ 85,050, recovering after the last minimums about $ 74,436. The exit back with recent minimums is about 74,436 dollars. On a 4-hour diagram, the price rose above the descending line of the trend, and at present, in the immediate extent of overhead costs, it concentrated from $ 84,200 to 85,700 US.

The relative force (RSI) index is located about 59.58, suggesting that the moderate energy of the purchase is present if the market does not exceed overheating. Fibonacci recovery levels offer clear goals: 85,700 US dollars (0.786), 88,700 US dollars (1.0) and $ 97,600 (1.618), with a potential growth of up to 111,900 US dollars (2.618), if the continuation of the trend was confirmed.

Every day it closes above $ 88,000 as a critical threshold for a bull check. On the other hand, the key support levels are 82,000 US dollars, followed by $ 79,900 and 77,800 US dollars.

If historical guidelines, can Bitcoin already be built for 150 thousand dollars?

The structure of the market, combined with indicators in chains and a historical cycle, suggests that Bitcoin can enter the phase of extension of pressure before another extension.

Nevertheless, confirmation will depend on the volume of breakthrough strength above 88,000 US dollars and the stable profitability of institutional purchases. If the story is repeated, Bitcoin’s path to $ 150,000 can already be started.

Refusal of responsibility: The information presented in this article is intended only for information and educational purposes. The article is not a financial advice or what -liba tips. Coin Edition is not responsible for any losses incurred as a result of the use of content, products or the services mentioned. Readers are recommended to be careful before taking any actions related to the company.