The recent price struggle Ethereum (ETH) did not prevent the institutions from accumulating coins, while large organizations encourage significant ownerships from exchanges. The second largest cryptocurrency in market capitalization has increased by 0.3% from the moment of recovery with recent minimums and restoration of the level of $ 2650.

Data on the chain of Loutonchain has shown that in the last two days of Cuberland, the Cumberland asset management company has removed 62,381 ETH (cost approximately $ 174) from exchanges and transferred it to Coinbase Prime.

It seems that the institutions accumulate $ eth.

Over the past 2 days, #Cumberland has removed $ 62,381 ($ 174 million) from exchanges and handed it over to #Coinbaseprime.https: //t.co/at53haha36m pic.twitter.com/6NJXNKXJZH

– lookonchain (@lookonchain) February 6, 2025

This news appeared only two days after BlackRock, the largest asset manager in the world, acquired 100,535 ETH, estimated at $ 276 million. The USA, which amounted to their total amount up to 1,352,934 ETH, in the amount of about 3.71 billion dollars.

The Arkham Intelligence data show that after its latest transaction, Eth Cumberland controls the crypto -acuits of more than $ 31 million, which include AAVE, USDC, AVAX, USDT and.

Ethereum outflow from exchanges

The recent price action of Ethereum will follow the period of intensive market volatility, which led to a decrease in its price to $ 2120. Buyers actively intervened at this level, which led to a strong recovery. The rally gained impulse after ETH struck the key levels of resistance in the amount of $ 2550 and $ 2650, and at the time of publication, the coin passes above $ 2800.

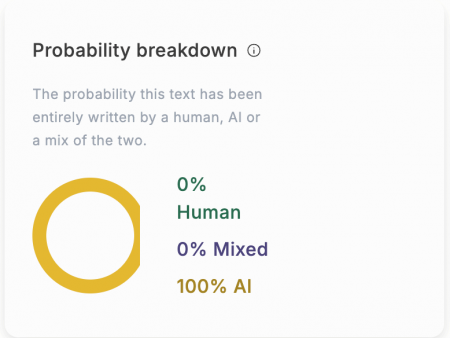

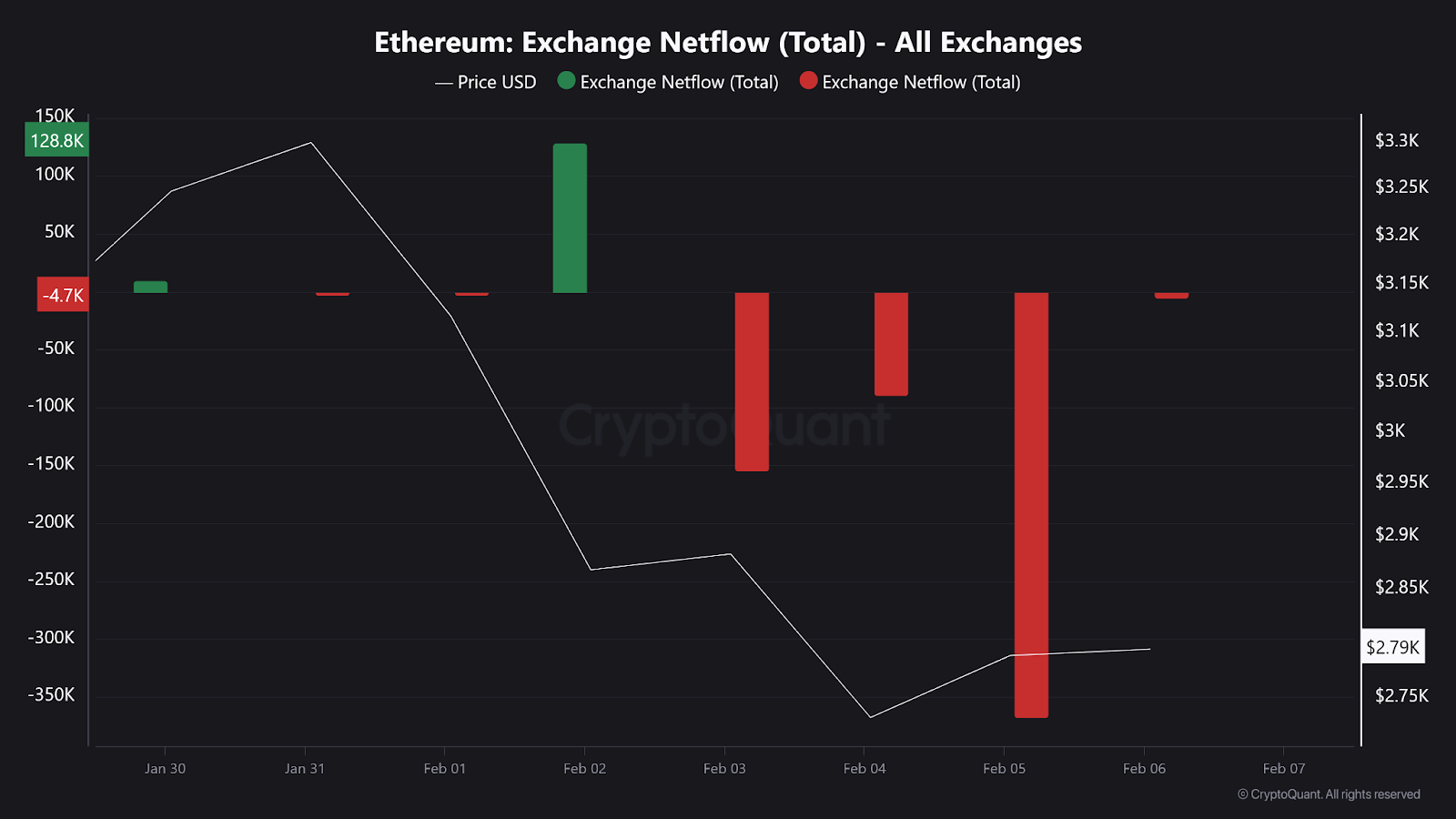

Cryptoquant records show that Netflow’s Ethe, which monitors the general influx and outflow from trading platforms, saw 367.6 ETH (approximately $ 992,000) on Wednesday.

Three consistent days of the total negative records of Netflow, which signals a growing confidence among investors in an incoming price.

Kraken Exchange was the largest depositor of outflows, collecting about 299 ETH, which is more than 80% of the total.

On Wednesday, the participant of Cryptoquant Amr Taha noted that Ethereum Exchange Netflow on the derivatives of exchanges fell below -300 000 ETH for the first time since August 2023. This suggests that traders move large amounts of ETH exchange, reducing the pressure on the sale.

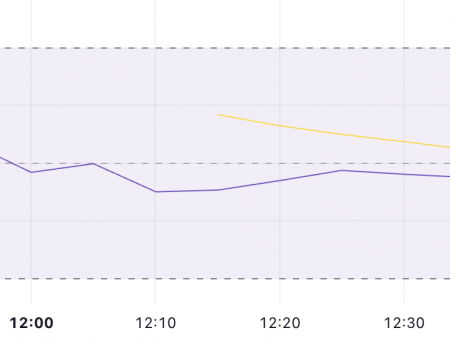

Bitcoin of the exchange of outflow continues

Bitcoin also experienced the same market mood, since centralized exchanges registered a clean outflow of more than 17,000 BTC, worth about 1.6 billion dollars. USA based on the market price of Bitcoin in the amount of $ 98,600.

According to Glassnode, this marked the largest BTC outflow with one day from April 2024.

Like Ethereum, Cryptoquant exchange data also show that all the main crypto -trading platforms recorded yesterday a total negative clean stream of 47,000 BTC. Of this, only Coinbase was attributed to 15 800 BTC.

Coinbase SPLIT 4 addresses totaling 20 949 BTC, 60 addresses: 20 x 245 BTC and 40 x 401 BTC

It seems that something is preparing, possible large purchases this week from ETFS or MSTR https://t.co/br8imlnyad– Sani | TimeChainindex.com (@saniexp) February 5, 2025

Large investors usually bring bitcoins from exchanges when they plan to hold it for the long -term perspective, that the market is considering a bull signal.

Cryptopolitical Academy: Do you make these mistakes Web3 resume? – Find out here