The HYPE analysis (HYPE) from a 12-hour time emerged from its long-standing trend, officially crossing the bear line of the trend.

Altcoin escaped past the resistance of $ 25.93, which limited previous rallies since the end of December 2024. This breakthrough marked the key shift in the mood of the market.

HYPE reached a local maximum of about $ 27, before leaving back to re -check the broken trend line at a speed of about $ 25.93, this is an action typical of a classic model of bull circulation.

If the price is retreating, a second test can serve as a confirmation point, suggesting that the breakthrough is genuine, and not just a false rally.

If the hype is preserved above this level, it can potentially prepare the ground for further profit, aiming at the next resistance of about $ 30.

And vice versa, if the repeated test does not pass, and the excitement retreats below the trend line, this may indicate that the breakthrough was not stable, which exposes the risk to lower support levels of about $ 25.

This scenario will probably cause the continuation of the previous descending trend, it may reduce prices. Consequently, the monitoring of this phase of re -testing is crucial for predicting the short -term price trajectory.

Hype Crypto recent mass benefits and what drives it?

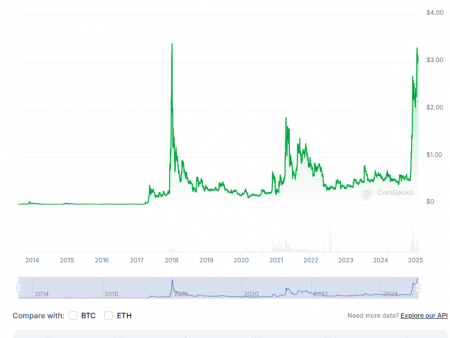

Recently, Hyperlikvid has surpassed Ethereum in accordance with the 24-hour income from the fee, which is the main indicator of trade and utility. This event is reflected in 15% of the height growth.

The increase in the price of HYPE directly correlated with stature assets by $ 1 billion and aggressive ransom strategies, increasing its liquidity and attractiveness.

Moreover, quick lists of new assets contributed to this ascending trend, attracting traders looking for rapidly developing markets and various investment opportunities.

This approach not only strengthened the volume of its transaction, but also strengthened its presence in the market against competitors such as Ethereum.

As for a wider market, some tokens showed various trends from various market moods and fundamental events specific to each project.

Nevertheless, a comprehensive topic was a noticeable ascent of the hypercil, noting the key change in the dynamics of DEX.

These data indicate that the strategic initiatives of hyperkide can be key factors in its reliable work, hinting at the potential future growth, since these efforts continue to ripen and resonate in the crypto -transic system.

Hyperilique’s Mindshare

The correlation between participation in social networks on HYPE social networks, especially in Mindshare and subscribers on Twitter, originally exploded in mid -November 2024.

This marked the first significant price increase, reaching a peak of about $ 30. Subsequently, mindshare is slightly weakened, reflecting the price of price.

From the end of December 2024 to January 2025, the Mindshare decreased sequentially, but on Twitter it followed steadily.

Nevertheless, despite this decline in Mindshare, the last few days of January, a surge in social activity has suddenly occurred when Mindshare rose by more than 5%, which is due to a sharp restoration of prices to about $ 25.

This revival in Mindshare involves an increase in public interest and potential confidence in investors.

Analyzing this model, it seems that the HYPE price sensitively reacts to its social perception and involvement.

With the recent growth of social metrics, especially mindshare, Hype is positioned for potential growth.

If this trend in an increase in mindshare is preserved, crypto -abazhotage can foresee the further price of the price, emphasizing the importance of social indicators in predicting cryptocurrency trends.