Bitcoin (BTC) has new BTC price targets to watch as a cascade of liquidations sends cryptocurrency markets tumbling.

Thanks to regulatory enforcement actions by the United States Department of Justice, Binance, the world’s largest exchange, is about to receive a significant fine. Its chief executive, Changpeng Zhao, known informally as CZ, will be forced to resign from his position and could even face jail time.

This was a watershed moment for one of the crypto industry’s best-known names, and the markets reacted with arguably understandable concern.

BTC/USD fell to $35,600, according to data from Cointelegraph Markets Pro and TradingView (its lowest levels since November 16) before recovering thanks to the closing of short positions.

$BTC

Rinsed Longs in This Clearanceprice recovered from short closing and profit taking (OI down and delta up + price up)

PC graphics soon since I’m awake https://t.co/xqPVoFphRp pic.twitter.com/0czcBwdWMf

— Skew Δ (@52kskew) November 22, 2023

Altcoins fared worse and, at the time of writing, many large-cap tokens are still down 3% to 5% on the day.

What could happen next and how are Bitcoin market participants getting ahead of volatility? Cointelegraph takes a look at some of the popular BTC price targets currently in play.

“Maximum pain” BTC price is now $32,000

Forget a “quiet” week in crypto: Binance pump has put an end to boring Bitcoin trading, says James Van Straten.

In reaction, research and data analyst at crypto insights firm CryptoSlate warns that volatility catalysts will continue to emerge.

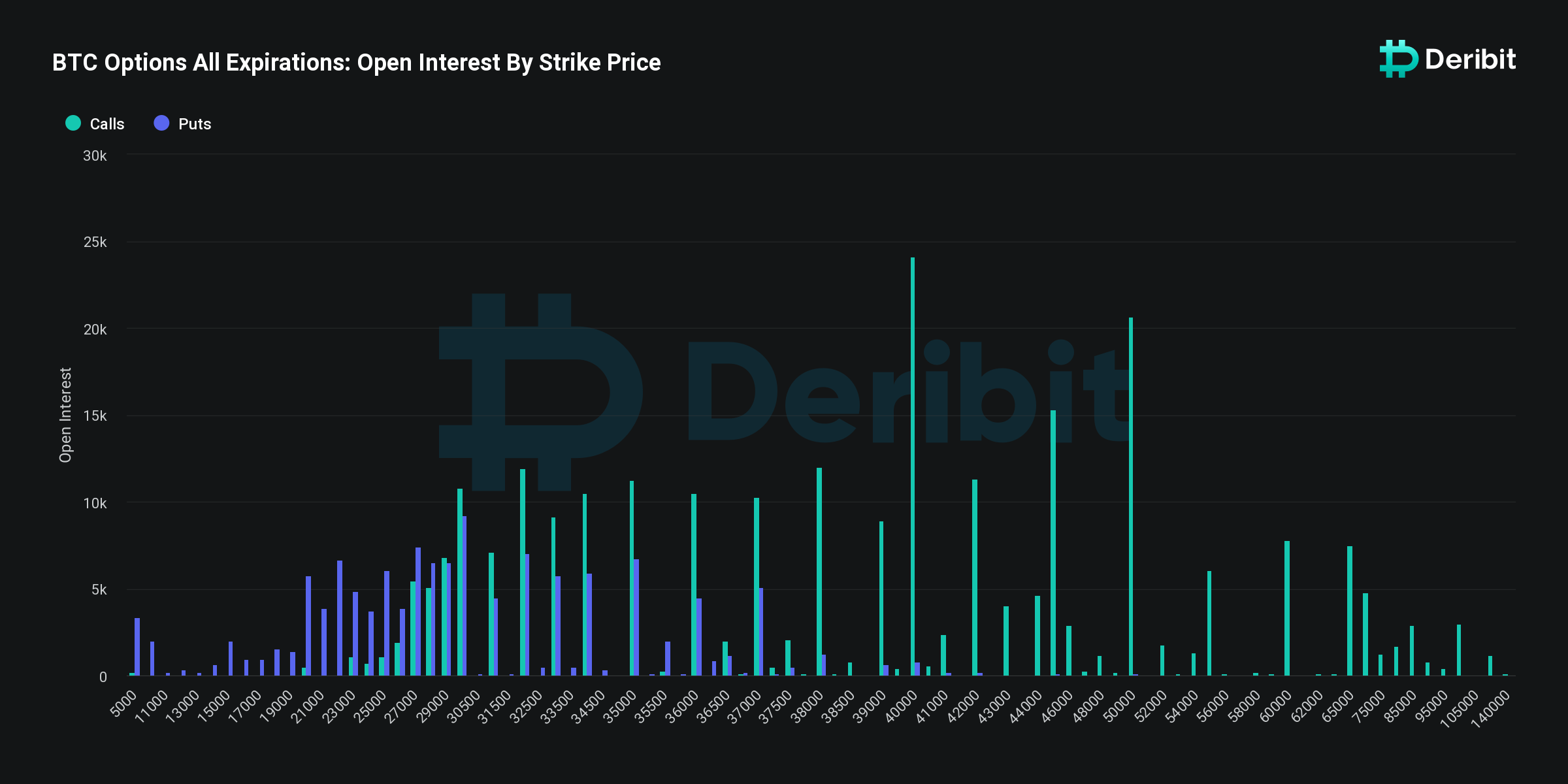

This is due to a giant $3.8 billion or 104,000 BTC options open interest expiration event the day after the US Thanksgiving holiday, which could add fresh fuel to an already nervous market environment.

Thanks to its composition, says Van Straten, the most severe drop in the price of BTC would now be from one to $32,000.

“With the put/call ratio at 0.77, the data indicates predominantly bullish sentiment, as evidenced by the largest open buying interest, approximately 58,000 Bitcoin, compared to 45,000 Bitcoin puts,” he writes.

“What is striking is the ‘peak pain price’, an important metric in the options market, set at $32,000, a figure that is currently below the market price of Bitcoin. “This suggests potential pressure on the price of Bitcoin as the expiration date approaches.”

Van Straten adds that while the options figures “indicate an expectation that the price was anticipated to hover around these levels,” Bitcoin would still be bullish if the $32,000 scenario became a reality.

“The bull market thesis would remain intact,” he said. said X subscribers.

Betting on the “Notorious BID”

Analyzing the composition of the order book, on-chain monitoring resource Material Indicators also predicts a drop closer to $30,000.

This was already in play, with analysis arguing that Bitcoin should retest areas of supply liquidity after its rapid rise to 18-month highs of nearly $38,000.

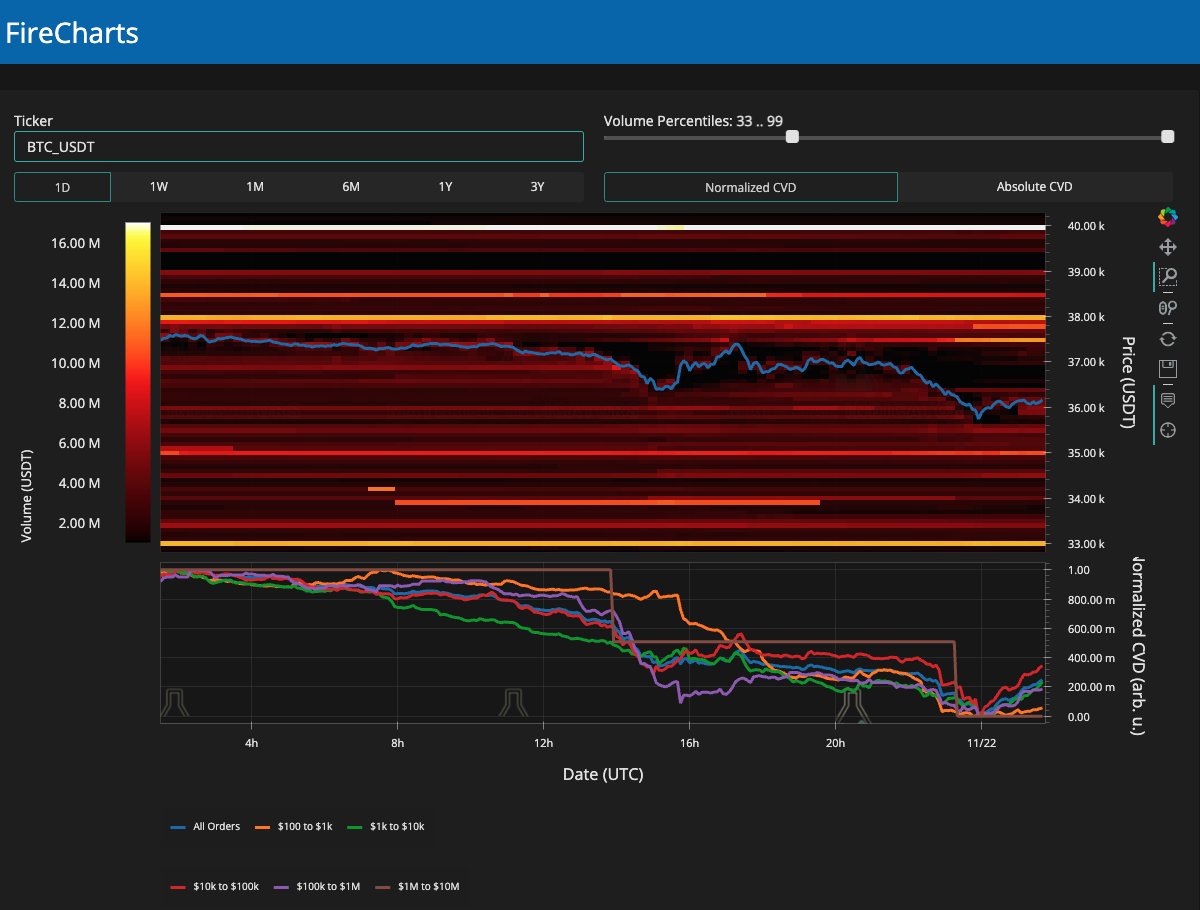

TO snapshot of BTC/USDT after news from Binance showed bids rising in the order book and moving closer to the spot price to avoid further declines.

“The order book also shows nervous sellers moving requests down towards $38,000, but that could change if the bulls can gain enough momentum to reclaim the 21-day MA. If they don’t, I hope to go down,” Material Indicators explained at the time.

He referenced the 21-day simple moving average (SMA), which now stands at $36,228, so far once again below the point.

Ultimately, he summarized, a patch of support for the $33,000 offer, which is becoming known as the “Notorious BID,” must be maintained.

“As of now, $35,000 seems like a viable goal,” the analysis concluded.

“Honestly, I really want a $33,000 retest to fail, but I’m not sure Notorious BID is going to let that happen yet.”

Binance withdrawals remain modest

As Cointelegraph reported, several bearish Bitcoin forecasts have emerged this month, even before Binance’s announcements.

Related: BTC Price Returns Key Profit Mark to Bitcoin Exchange Users of $34.7K

These include a floor of $30,900 as part of a broader BTC price channel that the bulls have yet to break out of.

Meanwhile, commenting on the market reaction overnight, the trader behind it, CryptoQuant contributor Gaah, noted a lack of sustained Binance stablecoin withdrawals as a result.

Earlier this year, liquidity concerns and a regulatory crackdown on the market led to massive withdrawals of funds.

Despite the resignation of CZ, the CEO of Binance, in recent hours there have been no significant outflows of BTC or Stablecoin since @binance

➡️You can follow this data in @cryptoquant_com https://t.co/GadYLsQIJF pic.twitter.com/c8IBKXGY44

— Gaah (@gaah_im) November 21, 2023

The views, thoughts and opinions expressed here are solely those of the authors and do not necessarily reflect or represent the views and opinions of Cointelegraph.