The price of the chain line (link) was among the 100 best coins over the past 90 days for popular cryptors with significant market capitalization.

Link has acquired more than 37% over the past three months, positioning it among altcoins with huge potential if Altseason will occur in the first quarter of the year, which can potentially occur at the beginning of Q2.

The price price of the chapic supports above keys

Analysis of the price range of Link in a 3-day period of time showed the potential for future price movements to growth.

Currently, the link is traded above the decisive support level of about 18 dollars. Which has repeatedly operated both support and resistance earlier.

The last price action showed that maintaining Link is above this level, assuming a strong interest in the buyer and the possible phase of accumulation in this price area.

If Link continues to maintain a support level of 18 US dollars, confirming a successful repeated test, Link will be located for a bouncer up to $ 34.

This target worth $ 34 corresponds to the previous resistance peaks, noting a significant obstacle to future movements.

However, if Link does not support support from above $ 18, the price may encounter a descending trend, which potentially repeated the lower support levels of about $ 9.32, which historically acted as a consolidation zone to subsequent rallies.

Such a decrease can reflect a wider bearish in the link market, which will lead to a decrease in investors’ trust and a decrease in purchase pressure.

The inability to maintain this level, however, may indicate that the pressure in the sale, suppressing the purchase impulse, which will lead to a further fall, increasing bear prospects in the near future.

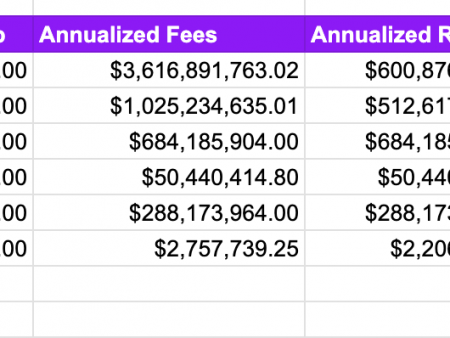

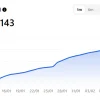

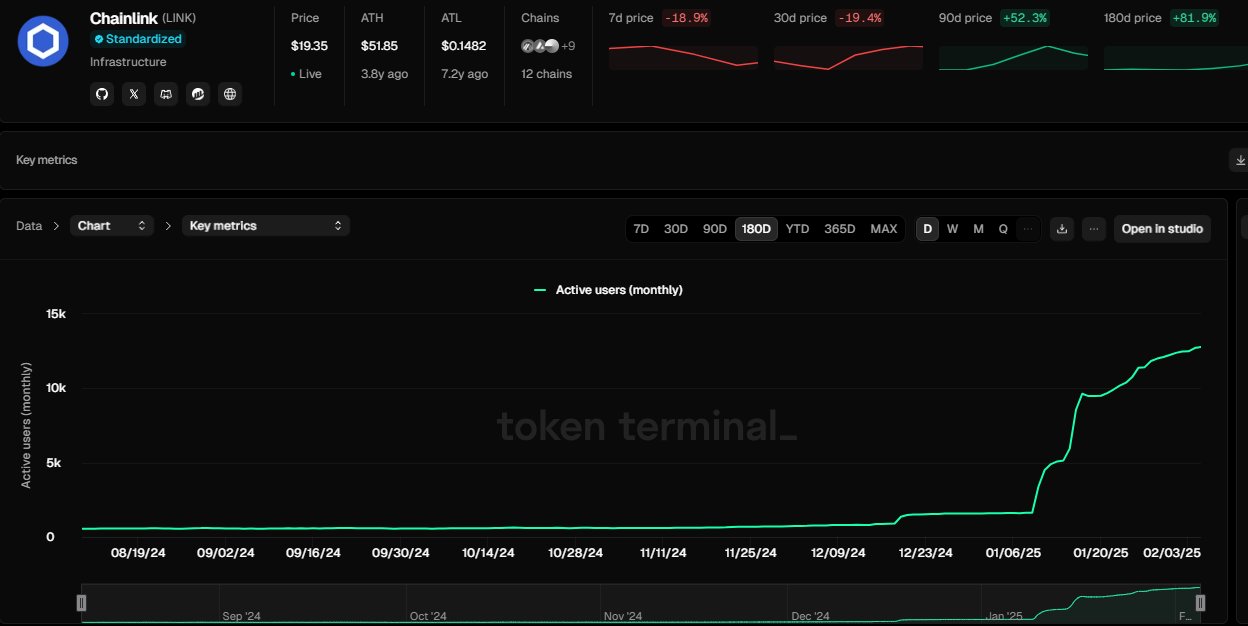

Monthly Chainlink users grow

Also, the analysis at the Token terminal showed an amazing upward trend in the number of active users on a monthly basis, which indicates a growing interaction with the network and the potentially optimistic mood of the market.

Since the beginning of January 2025, the active counting of users was about 5,000 people and showed a gradual increase in every month, and he noticed a significant jump in mid -January.

By February 2025, the number of users increased sharply to about 15,000 users. This consistent increase in active users assumed an increase in the chain network, which usually leads to an increase in demand and potential price increase.

An increase in the active number of users correlated the testing of previously broken resistance, now acting as support. The proven level of support falls about 18 dollars.

If the trend towards an increase in active users continues, the demand for token links can increase prices for a higher level of resistance, potentially about $ 34.

And vice versa, if an increase in active users does not lead to a sustainable pressure of the purchase, or if wider market conditions become bearish, Link may not hold the support level of $ 18.

A break below this can see how the price refuses, it is possible to reconsider the lower levels of support.

The growth of the user serves as an optimistic indicator, but it is important to monitor constant demand in order to confirm what kind of positive forecasts for the price.