The cryptocurrency market experienced a turbulent day with sharp changes in key tokens. From Bitcoin mining giants making bold investments to shocking losses of meme coins, the market remains unpredictable. This brief roundup covers today’s most influential crypto stories, including Bitcoin’s sharp decline, strategic moves in DeFi, and the latest on prominent figures like Craig Wright.

Public Bitcoin Miners Bet Big on BTC

Bitcoin mining leaders MARA and Hut 8 are doubling down on their BTC investments, signaling confidence in the cryptocurrency’s future. MARA invested a staggering $1.53 billion for 15,574 BTC, funded by convertible notes—a risky but strategic bet on Bitcoin’s growing potential. Meanwhile, Hut 8 followed suit, buying $100 million and acquiring 990 BTC.

This significant investment underscores the optimism of mining companies despite current market volatility.

Solv Protocol’s revolutionary move in Bitcoin DeFi

Solv Protocol is shaking up the DeFi sector by landing a spot on the Hyperliquid auction for $130,000—remarkable considering other listings are worth millions. Backed by a total locked value of $2.5 billion and a reserve of 25,000 BTC, Solv Protocol offers unique profit opportunities with its flagship product SolvBTC. Its innovative approach positions it as a transformative force in the Bitcoin DeFi landscape.

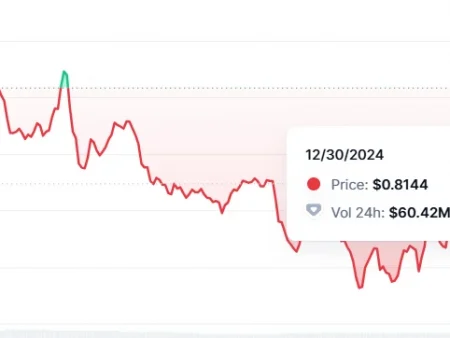

$491 million meme coin crash

The meteoric rise and fall of the HAWK token has left investors reeling. The token was once valued at $491 million, but it fell 90% within hours, wiping out significant investor funds. A lawsuit has emerged in which 12 investors claim losses of $151,000. Interestingly, social media star Hayley Welch featured in the coin’s advertisement, raising questions about the impact of celebrity endorsements on speculative assets. This story highlights the risks inherent in meme coins.

Craig Wright avoids jail time over Satoshi Nakamoto claims

Craig Wright, infamous for claiming to be the creator of Bitcoin, has avoided jail despite serving a 12-month sentence for ignoring court orders. His legal troubles stem from ongoing lawsuits alleging that the developers failed to fulfill Nakamoto’s “vision.” Since previous rulings have discredited his claims, Wright’s ongoing actions continue to cause controversy in the crypto community.

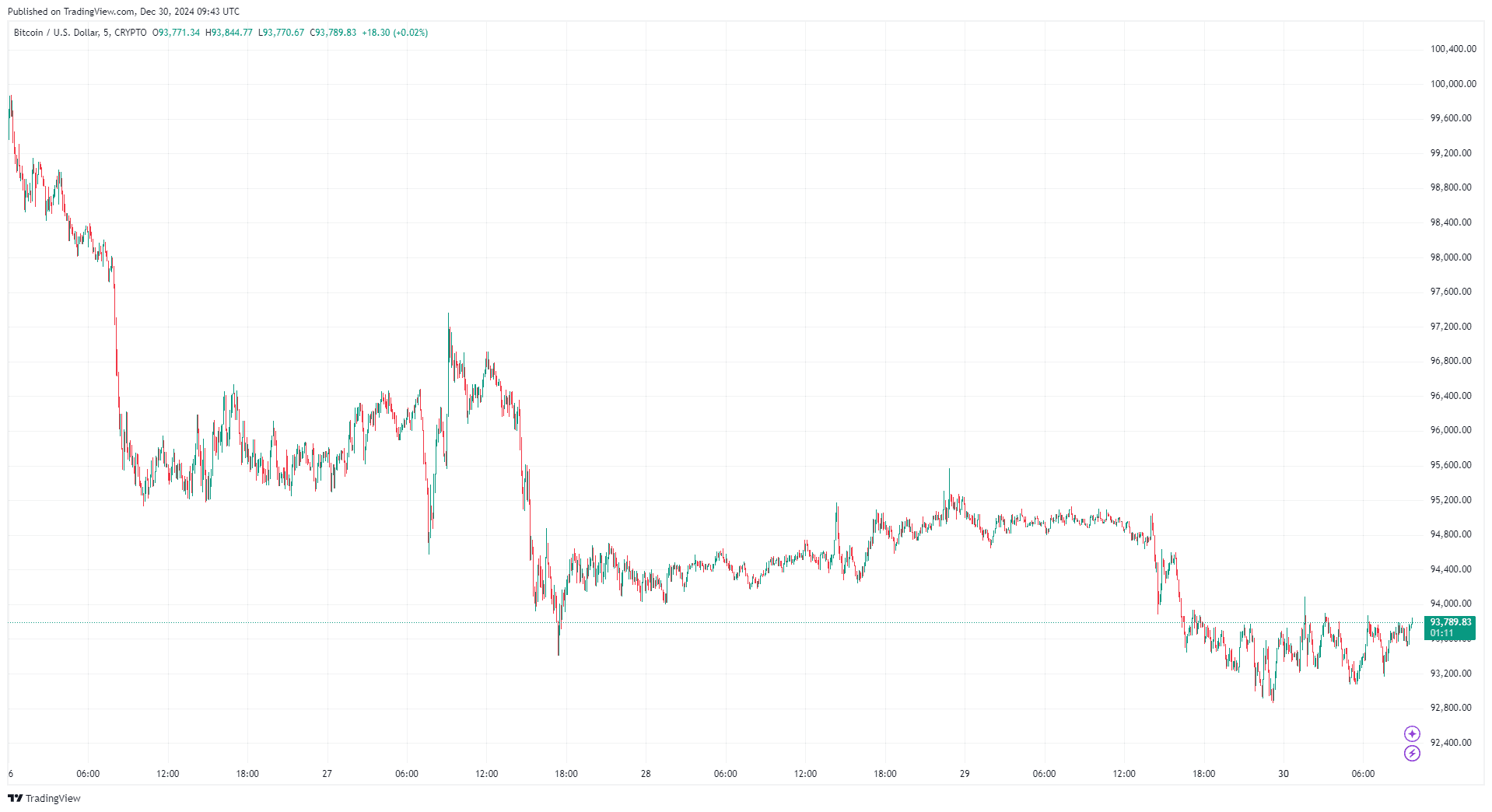

Major Crypto Bloodbath: $1.2 Billion Liquidated

The cryptocurrency market has seen a sharp decline, with $1.2 billion worth of liquidation triggered by Jerome Powell’s comments on interest rates. Bitcoin fell from $108,000 to $95,000, while Ethereum and Solana suffered double-digit losses. Panic selling intensified, with Binance reporting an outflow of $83 million, further adding to market turbulence. This bloodbath serves as a reminder of the inherent volatility of cryptocurrency and the outsized influence of macroeconomic factors.