Jupiter DEX is under increasing scrutiny as users are seeing nearly 50% transaction failures, raising concerns and questions about the platform’s performance. Many are looking for an explanation and wondering what measures are being taken to address the issue. This article will take a closer look at the situation, looking at the factors contributing to the high failure rate and what steps are being taken to improve the user experience on the platform.

Table of contents

High Bounce Rate: Causes and Problems

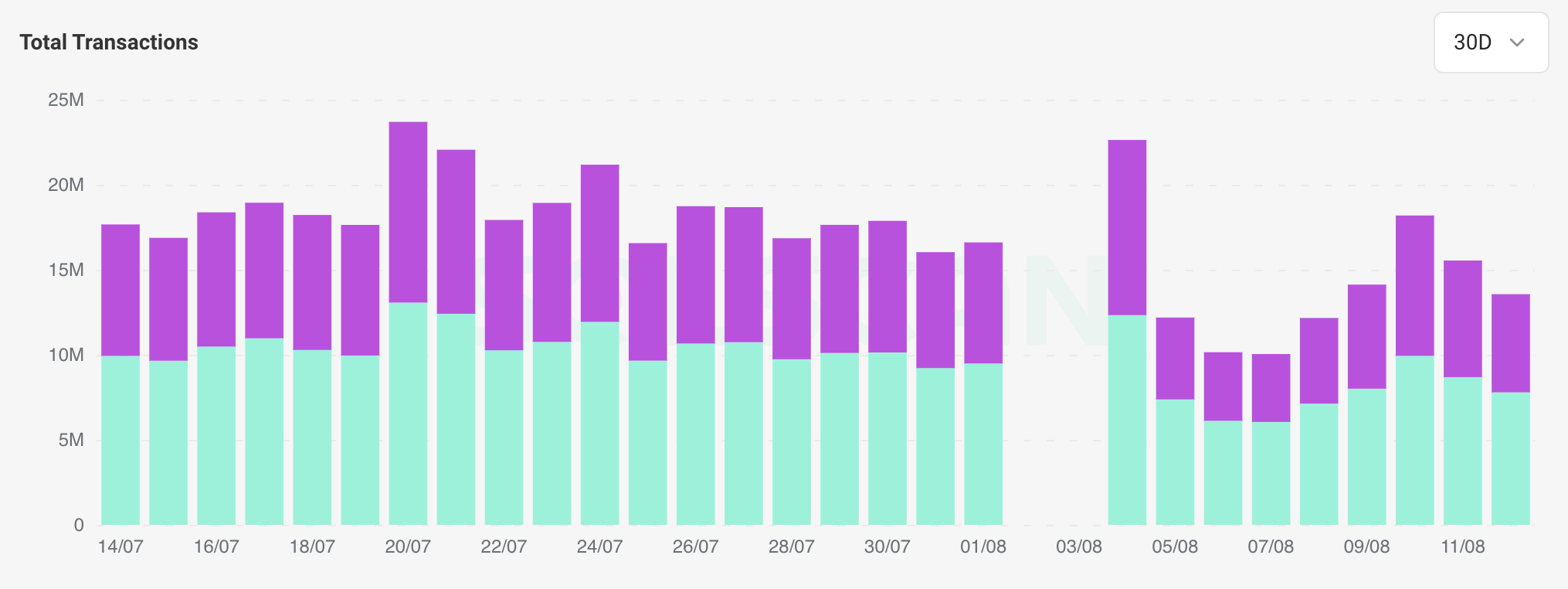

Over the past 30 days, excluding missing data for August 2 and 3, the average failure rate on Jupiter was 42.89%. This has led to more users questioning the underlying causes of these failures and seeking clarity on what steps are being taken to improve the platform’s performance.

A particular frustration for many users is that they are still charged for failed transactions. While this may seem unfair at first glance, it is an inherent aspect of blockchain technology. Every transaction, successful or not, uses network resources such as computing power and block space. Even if a transaction fails, the validator still processes it until the problem causes an error. Since the network is still being used to process the request, the fee compensates for these computing resources.

Increasing slip resistance is a risky decision

To avoid double charges, users often increase their slippage tolerance to ensure that their transactions go through. Increasing the tolerance increases the likelihood of a transaction being successful because it gives the network permission to complete the exchange even if the price is slightly different from the original quote.

However, increasing slippage opens the door to another risk: front-running bots. These bots can detect high-slippage transactions and execute their trades just before a user’s transaction, buying assets at a lower price and selling them back at a higher price set by the user’s slippage. This results in users receiving less favorable rates on their swaps, which actually costs them more than just transaction fees.

How Frontrunning Works in Smart Contract Blockchain Networks

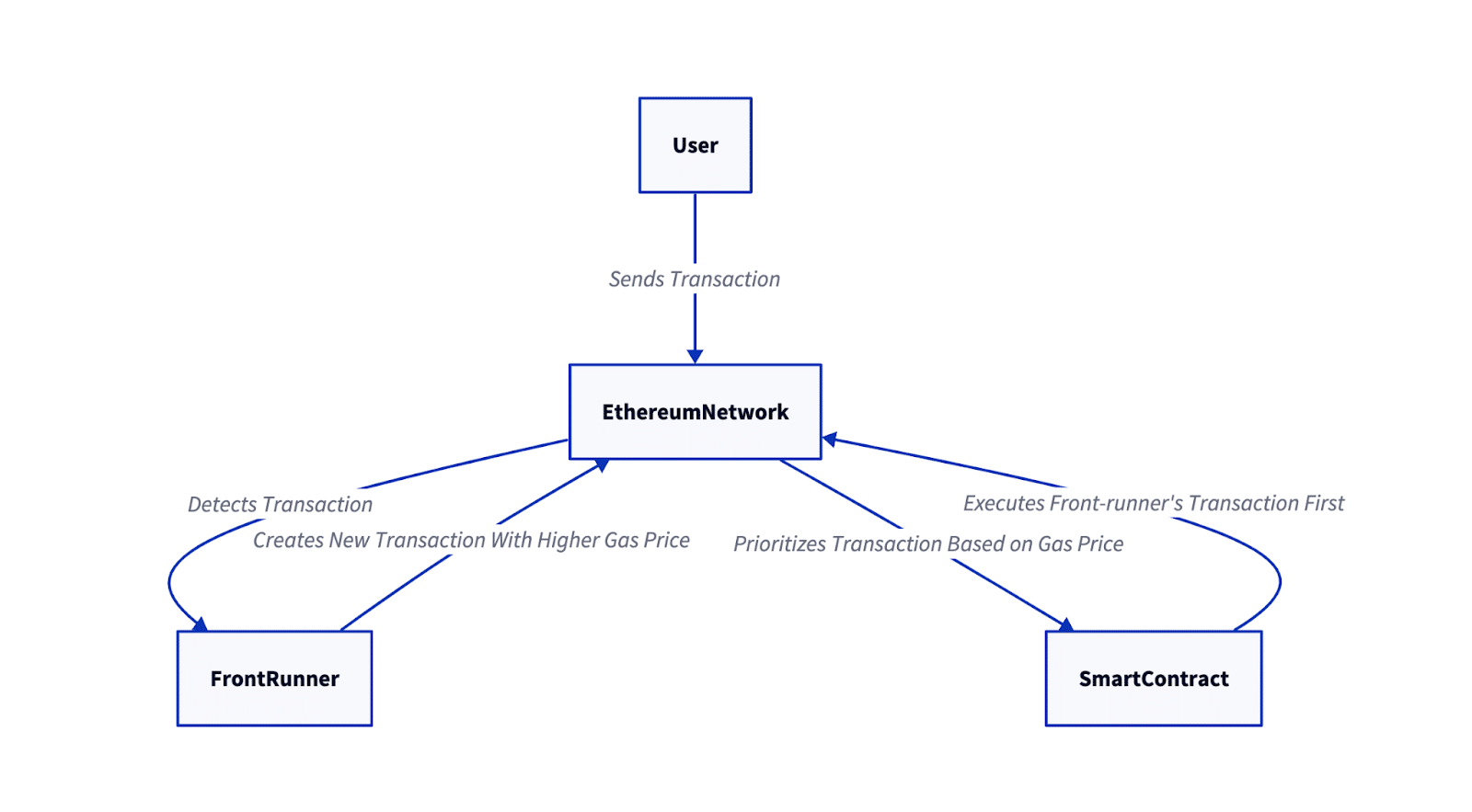

Hacken’s diagram shows how the forward-looking approach works in Ethereum, but the concept also applies to Solana and other smart contract blockchains.

- Step 1: A user initiates a transaction on the network, intending to interact with a smart contract.

- Step 2: The leader (usually a bot) monitors the network and detects user transactions.

- Step 3: The leader creates a new transaction with a higher gas price. The higher gas price incentivizes validators to prioritize processing the leader’s transaction over the user’s original transaction.

- Step 4: The blockchain network prioritizes transactions based on gas price. Since the leader’s transaction offers a higher gas price than the user’s transaction, it is processed first.

- Step 5: The user’s deal receives less favorable terms or falls through altogether, resulting in financial losses or missed opportunities.

In the words of Jupiter himself:

Most of these failed transactions come from arbitrage bots that use the program when an arbitrage opportunity is close, hoping to make a transaction when the opportunity arises – this leads to a higher failure rate. For our users on Jupiter UI, the transaction success rate is actually over 90%!

However, front-running relies heavily on the trustworthiness of the RPC (remote procedure call) providers used to interact with the network. The RPC provider is the intermediary between the user and the blockchain and relays transaction data to the network. If the RPC provider is not reputable, they could potentially allow or even participate in front-running by sharing transaction data with bots or manipulating the order in which transactions are sent. On the other hand, reputable RPC providers are expected to uphold ethical standards and ensure that they do not exploit users or allow such behavior.

Another reason for the high rate of failed transactions is the ongoing memecoin frenzy, where tens of thousands of new tokens are created every day. Many of these memecoins are not liquid, meaning there are not enough tokens in the market to make trades. When users try to buy or sell these low-liquidity tokens, transactions can fail because the trade cannot be executed.

Capacity limitations and order processing delays

While the memecoin surge contributes to the failure rate, Jupiter’s automated slippage and gas calculation features also play a role. These features, which typically work well in stable market conditions, struggle during periods of high volatility. Additionally, the platform is struggling with issues related to its free-tier quotes API, which is being exploited by users bypassing rate limits by running new machines. Such exploitation results in increased operating costs and the risk of degraded service for legitimate users.

Additionally, Jupiter’s throughput is currently insufficient, especially given the huge volume of orders it processes, causing its retry logic to slow down to over 25 seconds.

Conclusion

Jupiter DEX faces a number of serious issues, including high transaction failure rates, preemption risks, and infrastructure bottlenecks. These aren’t just small issues — they directly impact user trust and the platform’s ability to function well. The team is working hard to fix these issues, but a key question remains: can Jupiter not only solve these immediate problems, but also cope with the growing demands of the DeFi space?

Disclosure: This article does not constitute investment advice. The content and materials on this page are for educational purposes only.