Digital asset investment firm Pantera Capital highlights the main reasons why it believes the altcoin market is in decline.

In his latest Blockchain Letter, Pantera Capital portfolio manager Cosmo Jiang says macroeconomic conditions are hurting the crypto market, along with concerns about oversupply and the rise of altcoin projects.

Jiang also said that recent actions by the U.S. Securities and Exchange Commission (SEC) against blockchain developer Consensys and decentralized exchange (DEX) Uniswap (UNI) over alleged securities law violations have created regulatory uncertainty for alternative projects.

“We point to several macroeconomic and cryptocurrency reasons for the decline. The main macroeconomic headwind in early April was that markets began to re-price a higher and longer rate scenario due to a still-strong economy and high inflation, versus the previous view that rates would be cut quickly.

In cryptocurrencies, markets have been largely subdued by concerns about oversupply. In Bitcoin, the German government has begun liquidating its $3 billion position, and Mt. Gox’s $9 billion distribution schedule has been confirmed. Long-tail tokens have faced supply headwinds from both the increase in new token launches, diversification of investor attention, and limited capital, as well as the continued vesting of newly launched tokens by private investors over the past year.

Additionally, the SEC investigations into Consensys and Uniswap have created some uncertainty for some protocols.”

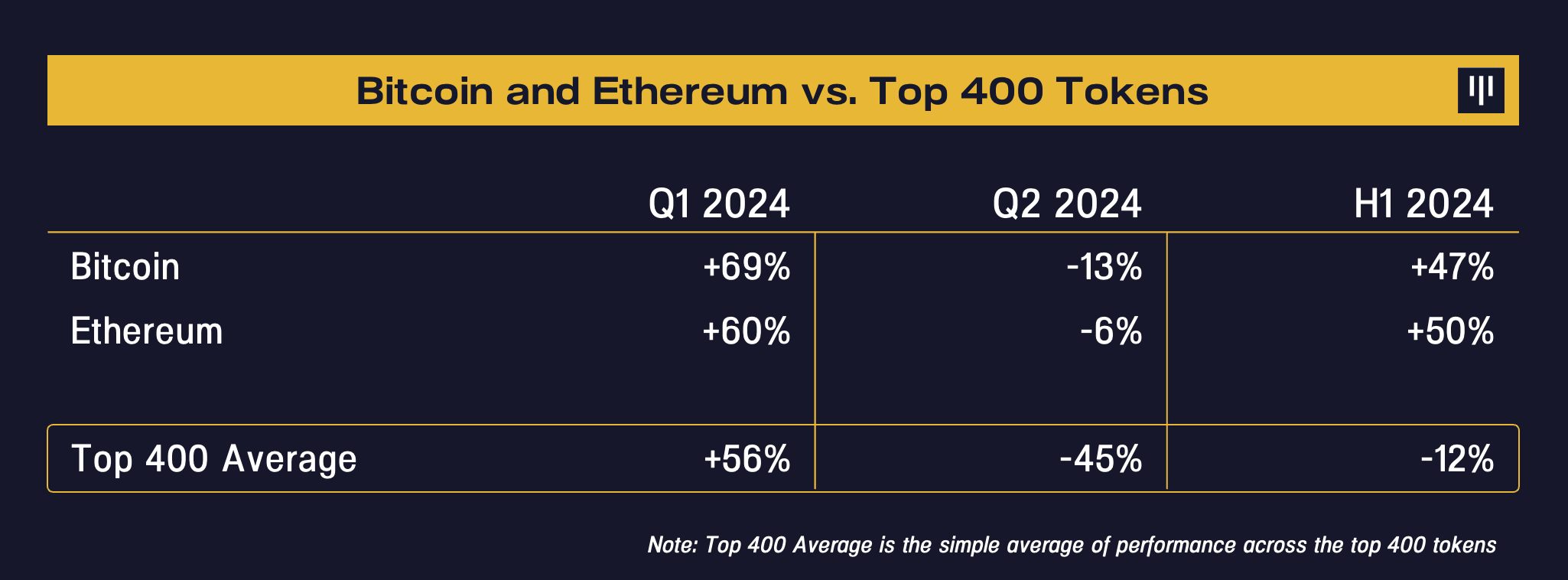

Jiang says Bitcoin (BTC) and Ethereum (ETH) will significantly outperform the broader cryptocurrency market in 2024.

“Overall, coverage has been narrow and there has been a significant lag in the broader crypto landscape year-to-date relative to Bitcoin and Ethereum, similar to the stock performance this year, the Magnificent 7 versus the rest. To illustrate this point, we’ve included below the return distributions for the top 400 tokens by market cap this year.”

At the time of writing, Bitcoin is trading at $65,314, up 1.6% over the past seven days. Meanwhile, Ethereum is trading at $3,327 at the time of writing, down nearly 2% over the past week.

Generated image: DALLE3