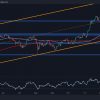

The price of Ripple (XRP) has risen significantly, rising 51.33% over the past seven days and an impressive 109.09% over the past month. This strong momentum has propelled XRP into a bullish phase, with key indicators such as EMA lines supporting its upward trajectory.

However, signs of weakening momentum, such as a decline in the RSI and a negative CMF, suggest that caution may be warranted. Whether XRP continues to rise or faces a sharp correction will depend on how the market reacts to these changing dynamics.

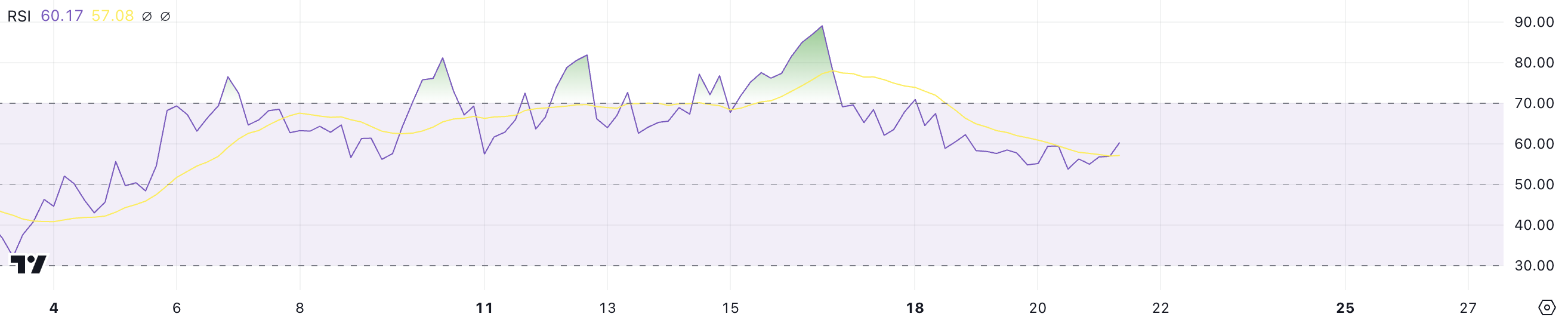

XRP RSI is below the overbought zone

XRP’s RSI fell to 60 after nearly hitting 90 on November 16 and remained above 70 between November 15 and November 17.

This decline indicates that Ripple has exited the overbought zone, where strong buying pressure had previously driven its price higher. The fall suggests the market is cooling and traders are potentially taking profits after a strong rally.

RSI measures the speed and magnitude of price changes, with values above 70 indicating overbought conditions and values below 30 indicating oversold levels. At 60 RSI, XRP is still reflecting positive momentum, but shows a more balanced sentiment compared to previous gains.

While the uptrend remains intact, a lower RSI could indicate slower growth rates with the possibility of consolidation as the market stabilizes. If buying pressure returns, XRP price could continue its upward move, but further decline in the RSI could signal weakening bullish momentum.

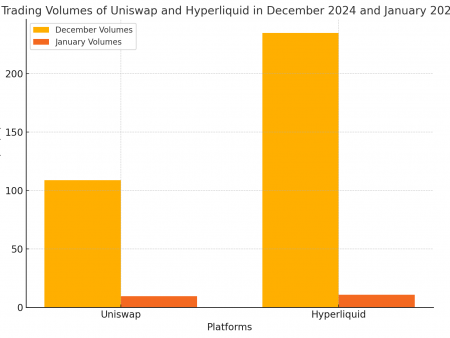

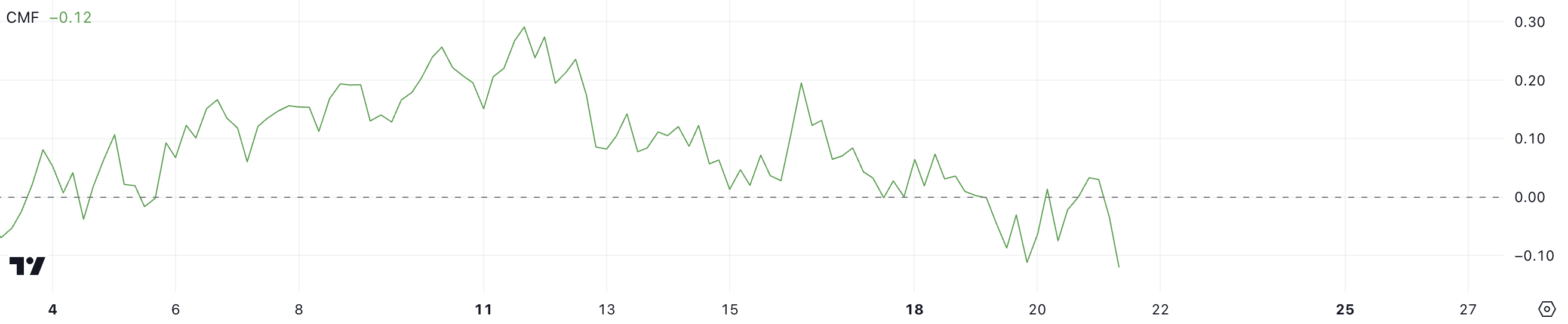

Ripple CMF is now negative after remaining positive for 14 days

XRP Chaikin Money Flow (CMF) is currently at -0.12 after showing positive levels between November 5th and November 19th. This is also the lowest level since October 31st. This shift into negative territory reflects increased selling pressure and potential capital outflows from the asset.

The move from positive CMF values earlier this month signals weakening bullish momentum as more market participants reduce exposure to Ripple.

The CMF measures the volume and flow of money into or out of an asset: positive values indicate capital inflows (bullish) and negative values indicate capital outflows (bearish).

XRP’s CMF at -0.12 suggests bearish sentiment is starting to gain momentum, potentially putting pressure on the price despite the recent uptrend. If the CMF remains negative or continues to decline, it could indicate sustained selling pressure, casting doubt on Ripple’s ability to continue its upward move.

Ripple Price Prediction: Highest Price Since 2021?

XRP’s EMA lines are currently showing a bullish sentiment, with short-term lines positioned above long-term lines and the price trading above all of them.

However, the narrowing distance between price and some of these lines suggests a potential slowdown in bullish momentum. This could signal that the uptrend is weakening, making the XRP price vulnerable to changes in market sentiment.

If a downtrend were to emerge, as indicated by a weakening RSI and negative CMF, Ripple’s price could face significant pressure and potentially fall to support at $0.49, which would represent a significant 56% correction.

On the other hand, if the uptrend recovers, XRP could rise and test the $1.27 level and potentially break out to $1.30, which would be its highest price since May 2021.