Decentralized finance (DeFi) project Solana (SOL) has attracted attention for its speed and scalability. However, recent analyses have revealed a critical issue affecting the platform: an alarmingly high rate of failed transactions.

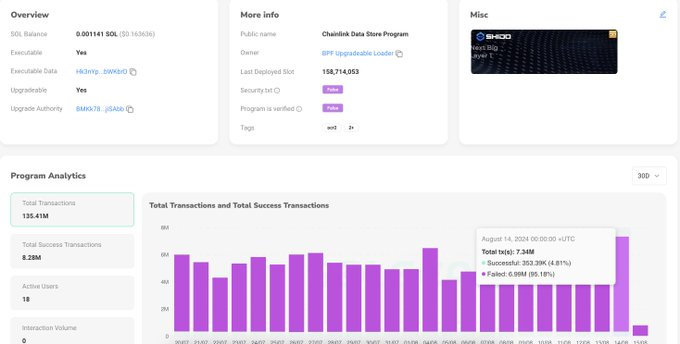

In particular, a detailed analysis of a pseudonymous Cardano (ADA) developer Dave, published in a post by X on August 19, showed that nearly 93.89% of all transactions executed through Chainlink’s data warehousing program on Solana have failed in the last 30 days. That’s roughly 127.13 million failed transactions compared to just 8.28 million successful ones.

It’s astounding how much of a financial burden these outages impose on users. According to the expert, the average fee for a failed transaction is 0.000005 SOL, which is about 635.65 SOL lost in total over the past month. According to SOL estimates at the time of publication, this amounts to a staggering $91,090.48. This amount does not include high-priority fees, which further increases the cost to users.

Given this data, the big question is how the system remains resilient despite significant disruptions. For Solana, the answer may lie in the network infrastructure, as many of these failed transactions are the result of spam or arbitrage transactions, where on-chain bots flood the network to exploit tiny inefficiencies for profit.

For these bots, the cost of spamming the network is negligible compared to the potential benefits, resulting in overload and subsequent failure of legitimate user transactions.

Solana’s traffic jam problems

Interestingly, Solana’s congestion issues are not new. The network has been struggling with these issues for some time, and recent updates are aimed at solving them. The introduction of solutions like QUIC, which are designed to improve communication between users and the network’s block leaders, is a step in the right direction.

However, this new architecture has its drawbacks, especially in limiting connections during periods of high demand. As a result, legitimate transactions are often discarded along with spam, which adds to user frustration.

Despite these challenges, the Solana ecosystem continues to thrive. The platform has seen a surge in decentralized exchange (DEX) activity and the launch of new projects like the Saga smartphone. Additionally, the network has been central to the crypto meme trend, and several popular coins have launched on the platform.

Indeed, this interest in meme coins has recently contributed to a significant rise in the price of SOL.

SOL Price Analysis

Solana has seen significant volatility in the short term, with the asset trading at $140 at press time. On the 24-hour chart, this represents a daily loss of around 3.2%, while on the weekly time frame, SOL has fallen by 3%.

At the same time, since Solana has no significant catalysts that could affect the price, the asset is dependent on the overall market trajectory. Amid this movement, the cryptocurrency is targeting a return to the $150 resistance level.

Disclaimer: The content of this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.