Over the past 24 hours, the price of Hedera (HBAR) has fallen by 5%, while the total correction is 22% over the past 30 days. His market capitalization is currently $ 8.5 billion. Technical indicators suggest that bear impulse still dominate, although signs of potential shift appear.

ADX shows that the ongoing descending trend loses strength, while the ICHIMOKU cloud confirms that sellers remain under control. If HBAR can maintain its restoration and violate the levels of the key resistance, a stronger upward trend may develop, but the inability to do this can lead to a further decrease.

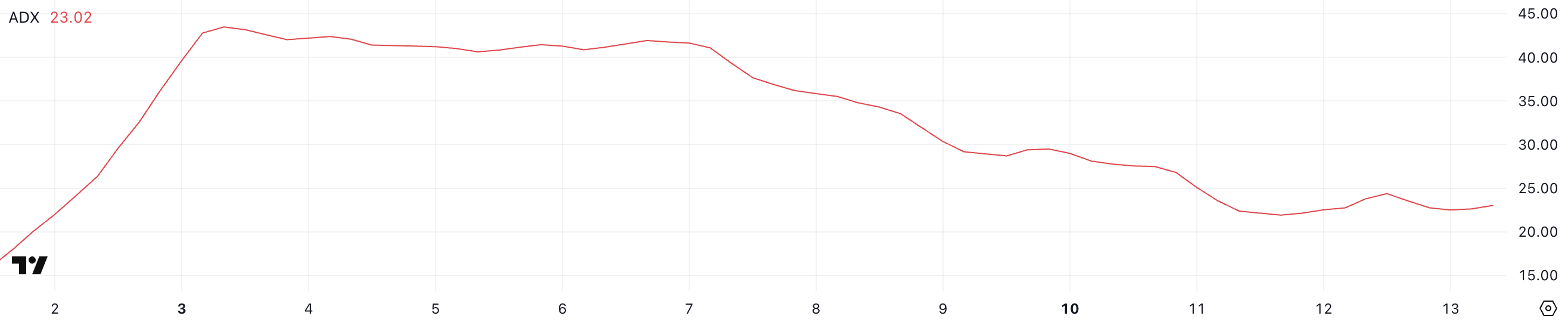

Hbar Adx shows that the descending trend is stable and not as strong as before

Hedera ADX is currently 23, compared with 28.9 three days ago and remains lower than 25. This decrease suggests that the force of the ongoing trend weakens, and sellers lose some impulse.

Since ADX measures the trend strength, and not the direction that falls ADX in the descending trend indicates that bear pressure slows down, although not yet turned.

ADX values are signaling the ADX values below 20, while those who are higher than 25 assume a strong, installed movement. With ADX HBAR to 23, the descending trend is still present, but loses intensity.

If the ADX continues to decline, the price action may move towards consolidation, and not to further acceleration of the decline. However, without a strong pressure of the HBAR purchase, a clear change in the trend remains uncertain.

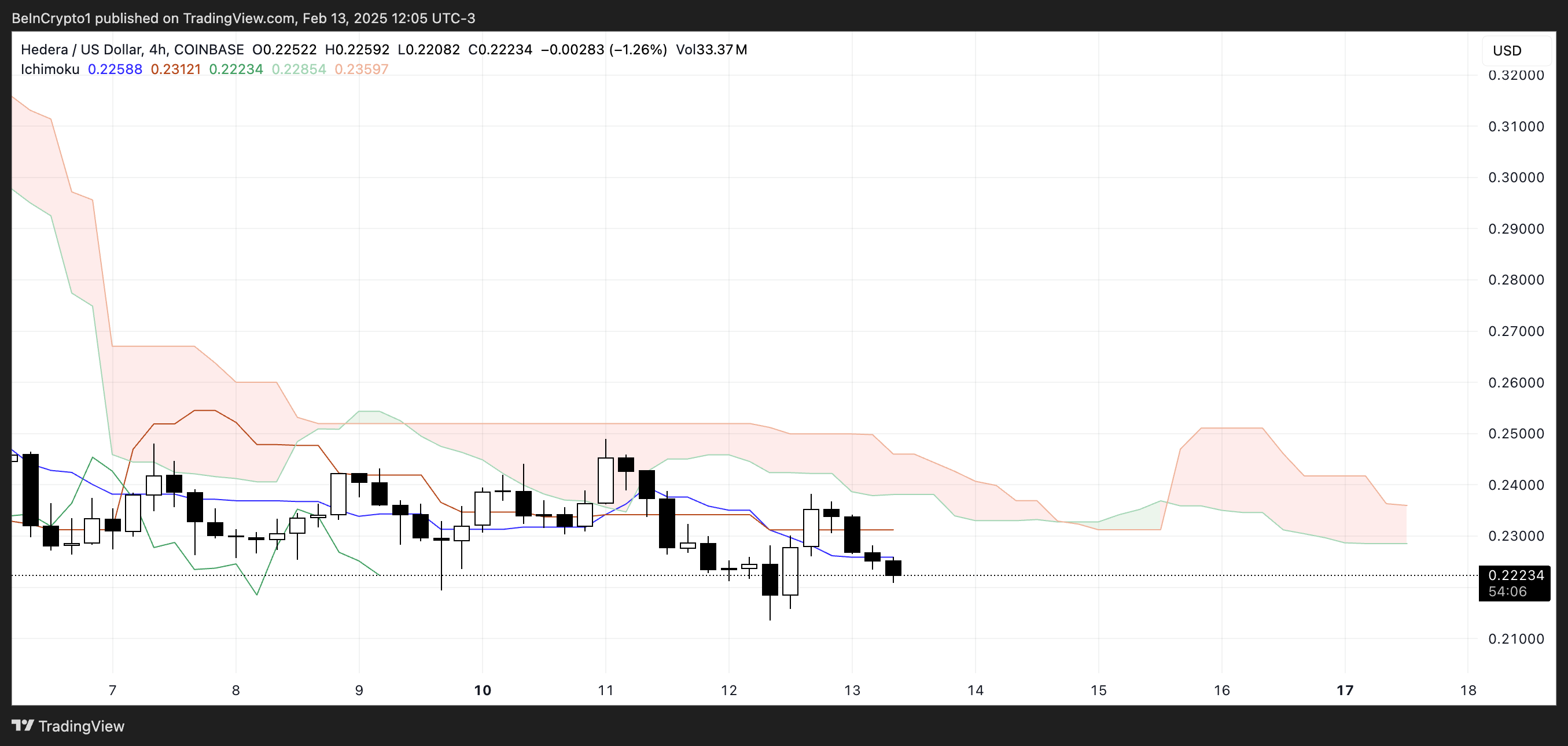

HBAR ICHIMOKU CLOUD shows bear settings, but this may change in the near future

The cloud diagram of the HBAR ICHIMOKU shows a bear installation, and the price effect remains below the cloud.

The Red Cloud suggests that the impulse dominated the bear, and numerous attempts to cross above were rejected. Tenkan-Sen (blue line) is located under Kijun-Sen (Red Line), enhancing the continuing weakness.

The predicted cloud remains bear, with the Senkou A interval (the green line) below Senkou Span B (Red Line), the alarm continued the pressure down, although the distance is narrowed.

Span Chikou (a green lag line) is also below the previous price action, confirming that the market structure is still favored by sellers. If the HBAR buyers are not included with a stronger impulse, this trend remains untouched, and the probability of continuing the bear.

HBAR price forecast: Can Hedera return $ 30 in February?

Hedera EMA lines show that short -term trends remain below long -term, strengthening the current bear installation. This alignment suggests that sellers are still under control, maintaining a decrease in pressure on the price.

If this bear trend is strengthened again, the price of HBAR can fall further, potentially checking the support of $ 0.179, which will be 19% decrease compared to current levels.

However, if the price of HBAR can turn this trend and gain a bull impulse, this can challenge resistance at 0.248 US dollars.

A breakthrough above this level can lead to a stronger recovery, which prompted the price to 0.32 dollars, noting 46% of growth. To confirm the shift in the trends, buyers will have to support the pulse and set the price effect above key resistance zones.