Gifto is facing backlash after its recent move to mint and release GFT tokens to the market. On November 26, Binance announced the delisting of the GFT/USDT trading pair on December 10, 2024.

The delisting, part of Binance’s broader decision to remove eight altcoin spot trading pairs, has already sent shockwaves through the market.

Controversial dump of GFT tokens from Gifto

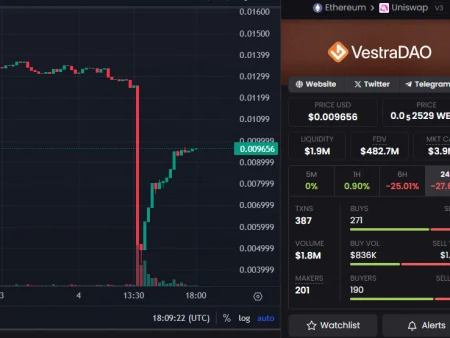

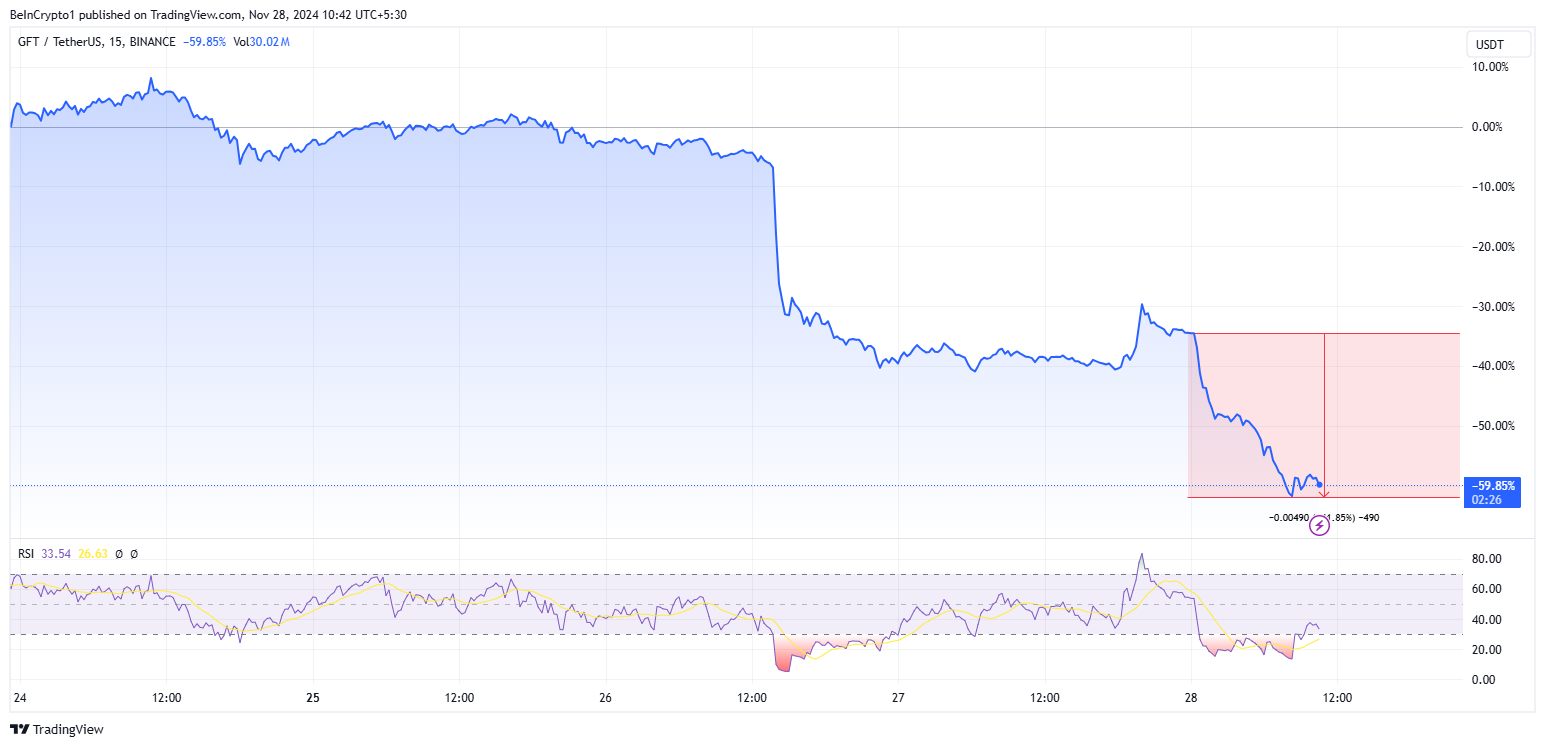

The immediate fallout from Binance’s delisting announcement on Tuesday was swift and severe. The price of the GFT token fell by about 25%, which could only be explained by a sharp decline in investor confidence. As you might expect, delisting from major exchanges such as Binance often causes panic selling as liquidity and availability of assets decreases.

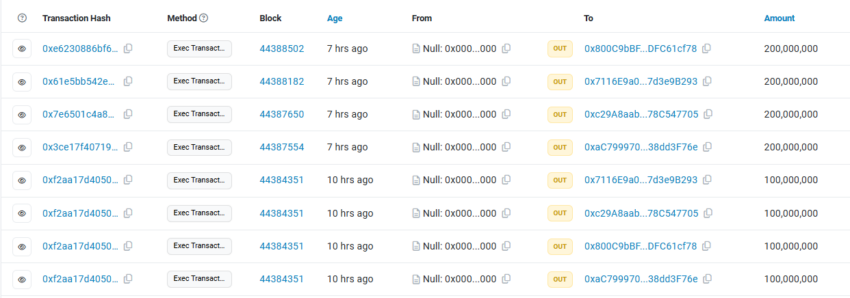

Adding fuel to the fire, Web3 data analytics tool Lookonchain on Thursday implicated Gifto in a significant token dump. The Gifto team issued 1.2 billion GFT tokens worth approximately $8.6 million within eight hours, according to the blockchain analytics company. These tokens were then listed on exchanges, which coincided with an alarming 40% drop in the GFT market price.

“Binance announced on November 26 that it will delist GFT on December 10, 2024. The Gifto team has minted 1.2 billion GFT ($8.6 million) in the last 8 hours and listed it on exchanges. Gifto may have dumped these tokens on the market and the price of GFT fell by about 40%,” Lookonchain reported.

The timing of this fundraising operation raised eyebrows. Many in the crypto community perceive this as an opportunistic exit strategy, further eroding trust in the token. One user X (formerly Twitter) criticized Gifto’s actions.

“Delisting and transferring tokens to holders… classic Web2 move. This is why we need decentralized projects that will not be able to implement such an exit. Stick to real DeFi,” the user noted.

Wider implications of Binance delisting

Binance’s decision to delist GFT and seven other altcoins reflects a growing trend in the cryptocurrency space. Exchanges continually evaluate and remove underperforming or problematic tokens. Assets that will be delisted along with Gifto include IRISnet (IRIS), SelfKey (KEY), OAX (OAX) and Ren (REN).

Delisting often has serious consequences for the affected tokens. In addition to immediate price declines, they face decreased liquidity, decreased market confidence, and barriers to entry for potential investors. In some cases, the long-term viability of a token comes into question as it loses the visibility and trading volume that exchanges like Binance provide.

For Gifto, the combination of delisting and a controversial token dump created a perfect storm. It leaves your community in disarray. Retail investors, who are often the last to react, find themselves at a disadvantage as prices plummet and large token holders lose ground.

The unfolding Gifto saga exposes critical vulnerabilities in the crypto ecosystem. Centralized control over the issuance and distribution of tokens may lead to such events. When trust is damaged, retail investors bear the brunt of poor decision-making.

This episode also serves as a cautionary tale about the risks of over-dependence of tokens on centralized exchanges. With the rise of decentralized finance (DeFi) and decentralized exchanges (DEX), momentum is growing for more transparent and sustainable alternatives. GFT holders are currently facing an uncertain future and December 10th could be a critical date.