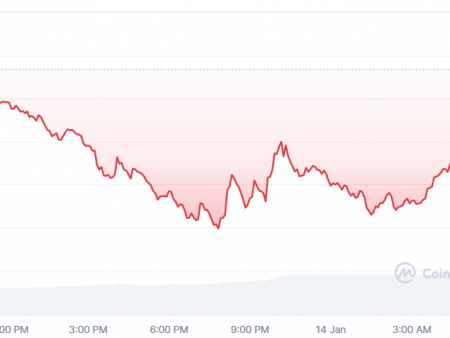

The movement (move) has fallen by about 11% over the past 24 hours, increasing its correction to 26% over the past seven days. Technical indicators, including RSI and ICHIMOKU CLOUD, indicate a very bear prospects, with trading in the level of re -alienation and much lower than the cloud.

The recent formation of the deadly cross was strengthened by the descending trend, signaling the increase in the pressure of the sale. To restore, it must break through through key resistance levels. Nevertheless, the inability to maintain its current support can lead to a further decrease.

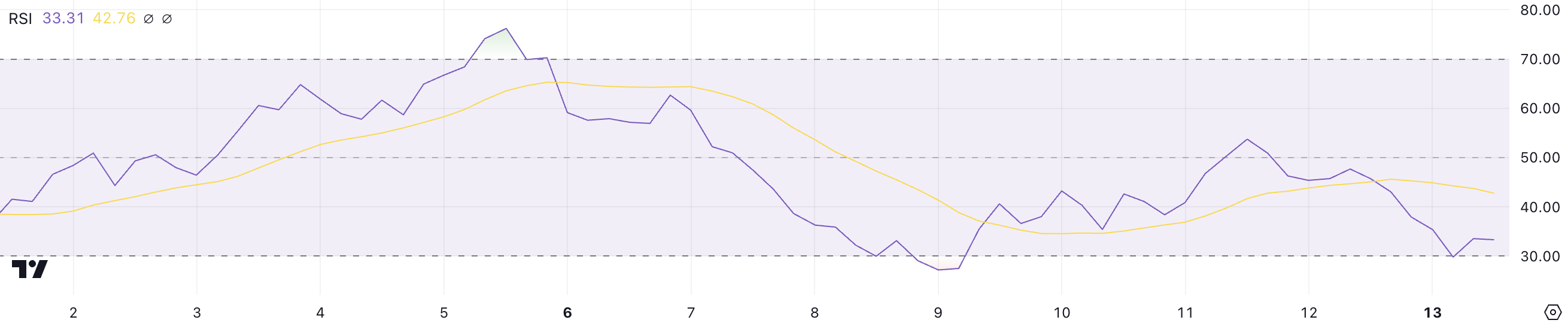

The movement of RSI is still close to the resale zone

Move RSI is currently 33.3, and has recovered a few hours ago to 29.7. This is a sharp decrease from its RSI 53 only two days ago, emphasizing the rapid shift of the asset from neutral territory to resold conditions.

RSI (relative force index) is an pulse oscillator in the range from 0 to 100, used to evaluate whether the asset is bought or resold. As a rule, the values below 30 indicate the terms of the oversupply, signaling that the asset may be underestimated, while the values above 70 suggest the excess of conditions, which indicates potential prices.

With RSI Move to 33.3, it remains next to the territory of overturning, which can attract customers looking for discounts. This level suggests that the recent sales pressure can weaken slightly, offering the potential for stabilization or price restoration.

However, if the RSI cannot rise back to neutral levels, this may indicate a constant bear impulse, maintaining the price of movement under pressure in the short term, even after Labs Labs, the company behind the movement, attracted $ 100 million in the form of financing .

Move Ichimoku Cloud, draws a bear picture

ICHIMOKU cloud diagram for moving shows a very bear configuration, and the price is located much lower than the cloud (Kumo).

The cloud is red and expands, signaling an increase in a bearish impulse and a continuation of downward pressure. This suggests that the prevailing trend is a firmly bear, without signs of weakening in the near future. This recent correction led to the fact that the course has lost its position among the 50 best altcoins who are now sitting at 59.

The transformation line (blue) remains below the base line (red), confirming the short -term bear impulse. In addition, the delay (green) is below both prices and clouds, enhancing bear prospects.

These levels on ICHIMOKU indicators suggest a constant descending trend, without the direct signs of trend changes. The general structure and lines of the cloud reflect the market environment in which sellers dominate.

To move the price forecast: will it soon restore $ 1 levels in the near future?

The price of movement recently formed a cross of death, a bear signal, in which its shortest sliding speed intersected below the longest time, which indicates an increase in the descending impulse. This technical leveling strengthens the continued bear tendency and suggests that the pressure of sales remains dominant.

If the current descending trend remains, and support at 0.70 US dollars will not succeed, the price may decrease further to $ 0.59. And vice versa, if an ascending trend appears, moving can break the resistance of $ 0.83 and potentially rally up to $ 1.15, noting 43% of growth, which can force Movemnet to return the place among the 50 best altcoins.