Table of Contents

1. FTX Creditors Debt

FTX, the cryptocurrency exchange that recently faced a liquidity crisis, has disclosed its debt, totaling at least $3 billion, in a recent court submission.

2. Creditor Claims

Among its creditors, ten entities are claiming sums exceeding $100 million, collectively owed $3.1 billion, with the largest debt amounting to $226 million.

3. Investment and Sponsorships

FTX had garnered capital from investment firms like Sequoia Capital, BlackRock, Tiger Global, and entities like the Ontario Teachers’ Pension Plan. It also engaged in sports sponsorships with NBA and MLB teams.

4. CEO’s Commitment

FTX’s new CEO, John J. Ray, expressed commitment to exploring sales and capitalization methods to ensure maximum creditor reimbursement. He mentioned solvent subsidiaries among the 130 sister companies included in the bankruptcy filing.

5. Dramatic Fall

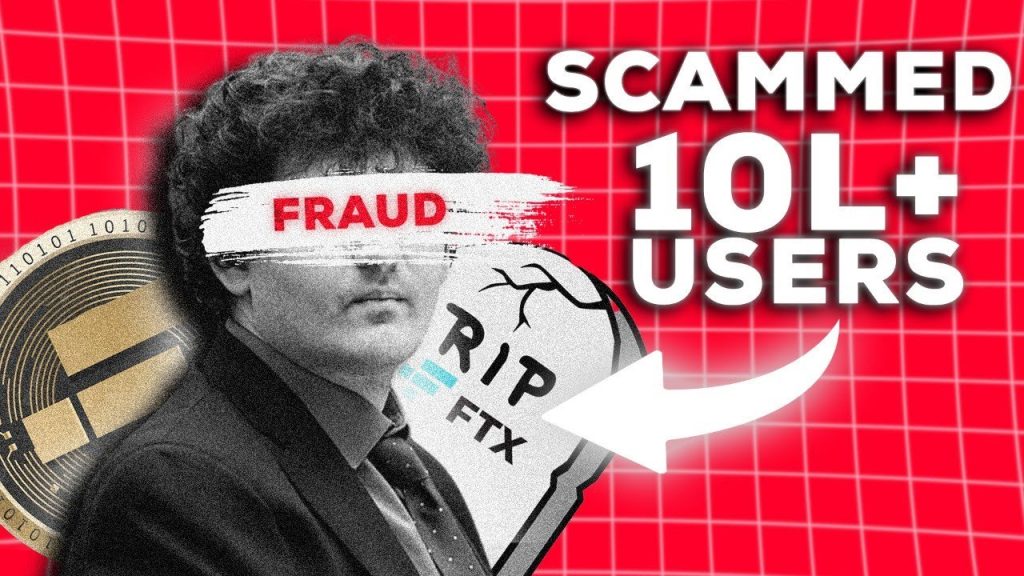

The bankruptcy filing on November 11 marked a dramatic fall for FTX, once valued at $32 billion, and its co-founder Sam Bankman-Fried.

6. Retail Customers and Creditors

Scores of retail customers join creditors in waiting for asset distribution, with an estimated number of potential creditors revised from 100,000 to 1 million.

7. Complex Obligations

Complexities in FTX’s obligations include inadequate documentation and commingling of assets between FTX entities.

8. Jurisdiction Dispute

Regulators in the Bahamas challenge the Delaware court’s authority, advocating for a different form of bankruptcy in New York.

9. Cash Management Failures

CEO John J. Ray pointed to “cash management procedural failures,” leading to FTX’s lack of an accurate list of bank accounts and account signatories.

10. Commingling of Assets

The commingling of assets is a central focus for investigators and regulators scrutinizing potential misconduct by the former CEO.

11. Regulatory Scrutiny

Congress is intensifying its inquiry, with the House Financial Services Committee scheduling a hearing next month to investigate the company’s collapse.

12. CEO’s Call for Comprehensive Investigations

John J. Ray emphasized the need for comprehensive investigations, describing the situation at FTX as “unprecedented” and highlighting a “complete failure of corporate controls.”