Franklin Templeton Investments

This was reported by Bloomberg lead analyst Eric Balchunas in a tweet

The firm has $1.5 trillion in assets under management

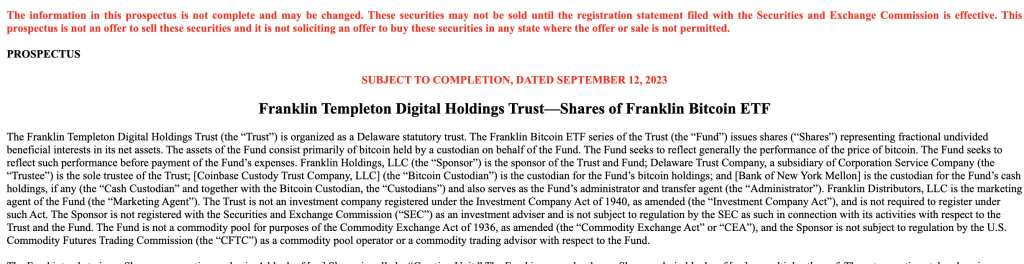

JUST IN: Franklin has filed for a spot bitcoin ETF h/t @NateGeraci pic.twitter.com/4KHSPjFkBC

— Eric Balchunas (@EricBalchunas) September 12, 2023

Franklin Templeton Investments is a well-established global investment management company with a history dating back to 1947. Here is some important information about the company:

Founding and History: Franklin Templeton Investments was founded by Rupert H. Johnson Sr. in New York City, USA, in 1947. The company initially started as Franklin Distributors, Inc. and later merged with Templeton Investment Counsel, forming the Franklin Templeton Group in 1968.

Ownership: As of my last knowledge update in September 2021, Franklin Templeton Investments was a publicly traded company. Ownership shares were held by a diverse group of individual and institutional investors. Please note that ownership structures can change, so I recommend checking the latest financial reports or news for any updates on ownership.

Key Figures: Franklin Templeton Investments has had various key figures throughout its history. Rupert H. Johnson Sr., the founder, played a significant role in its early years. The company has also had various CEOs and senior executives over time.

Global Presence: Franklin Templeton Investments is a global investment management firm, and it operates in numerous countries worldwide. It offers a wide range of investment products and services, including mutual funds, exchange-traded funds (ETFs), and separately managed accounts.

Investment Philosophy: The company is known for its active investment management approach, aiming to provide investors with a broad range of investment solutions across different asset classes and regions.

Assets Under Management (AUM): Franklin Templeton Investments is one of the largest asset management firms globally, with billions or trillions of dollars in assets under management, depending on the time frame. AUM figures can fluctuate, so it’s essential to check the latest data for accurate numbers.

Products and Services: The company offers a variety of investment products and services, including equity funds, fixed-income funds, multi-asset funds, and more. It serves both individual and institutional investors.

Philanthropy: Franklin Templeton Investments has a history of philanthropic efforts and corporate social responsibility initiatives. These efforts may vary over time and by region.

Regulatory Compliance: Like all financial institutions, Franklin Templeton Investments is subject to regulatory oversight in the countries where it operates. It must comply with relevant financial regulations and reporting requirements.

An Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product, with shares that are tradeable on a stock exchange. It combines features of both stocks and mutual funds, offering investors diversified exposure to various assets like stocks, bonds, commodities, or a mix of these.

ETFs work by pooling money from multiple investors to buy a basket of underlying assets, such as stocks or bonds. These assets are then divided into shares, which can be bought and sold on stock exchanges like individual stocks. The ETF’s market price is typically close to the net asset value (NAV) of its underlying assets.

- Diversification: ETFs offer instant diversification by holding a variety of assets within a single fund.

- Liquidity: They can be bought and sold throughout the trading day at market prices.

- Lower Costs: ETFs often have lower expense ratios compared to mutual funds.

- Transparency: ETFs disclose their holdings daily, allowing investors to see what’s in the fund.

- Tax Efficiency: They tend to generate fewer capital gains due to their unique structure.

Yes, there are various types of ETFs, including:

- Equity ETFs: Track stock market indices or sectors.

- Bond ETFs: Invest in bonds, providing fixed income exposure.

- Commodity ETFs: Invest in commodities like gold, oil, or agricultural products.

- Sector ETFs: Focus on specific industry sectors, like technology or healthcare.

- Smart Beta ETFs: Follow rules-based strategies for enhanced returns.

- Inverse and Leveraged ETFs: Seek to profit from the inverse or magnified performance of an index.

- Global ETFs: Provide exposure to international markets or regions.

You can buy and sell ETFs through a brokerage account, just like individual stocks. Simply place an order to buy or sell the desired number of shares. ETF prices fluctuate throughout the trading day, so you can trade them when the market is open.

There are two primary costs associated with ETFs:

- Expense Ratio: This is the annual fee expressed as a percentage of the fund’s assets. It covers management and operational expenses. ETFs generally have lower expense ratios compared to mutual funds.

- Brokerage Commissions: You may incur trading commissions when buying or selling ETFs through a brokerage account. Some brokerages offer commission-free ETF trading.

Yes, ETFs can be suitable for long-term investors. They offer diversification, liquidity, and can be used as core holdings in a portfolio. Long-term investors often use ETFs for passive, low-cost investing in various asset classes.

Yes, ETFs are popular for short-term trading due to their liquidity and ability to track specific market sectors or trends. Traders often use ETFs to implement short-term strategies, such as day trading or swing trading.

The risk associated with ETFs varies depending on the underlying assets. Equity ETFs can be subject to stock market volatility, while bond ETFs may face interest rate risk. It’s essential to research the specific ETF and its underlying assets to understand the associated risks.

Yes, many ETFs pay dividends. Equity ETFs often distribute dividends received from the underlying stocks to shareholders. Bond ETFs may also pay periodic interest payments. The frequency and amount of dividends can vary between ETFs.

ETFs are typically tax-efficient investment vehicles. They may generate fewer capital gains due to in-kind creation and redemption processes. Capital gains taxes are incurred when you sell your ETF shares at a profit. Dividends and interest income from ETFs are also subject to taxation at varying rates.

Yes, you can typically invest in ETFs through retirement accounts like IRAs and 401(k)s. Many brokerage firms offer access to ETFs within these tax-advantaged accounts, allowing you to benefit from their advantages while saving for retirement.

Information about specific ETFs can be found on financial news websites, the official websites of ETF providers (such as BlackRock or Vanguard), and brokerage platforms. These sources provide details on an ETF’s holdings, performance, expense ratio, and other relevant information.

While you can’t create your own ETF, you can build a diversified portfolio by selecting and investing in multiple ETFs that align with your investment goals and risk tolerance. This approach is often referred to as “ETF portfolio construction.”

ETFs can be traded like stocks, but some may have specific trading restrictions. For example, leveraged and inverse ETFs are designed for short-term trading and may not be suitable for long-term investors. Always review an ETF’s prospectus to understand any limitations or risks associated with trading.