Several issues are eroding Filecoin’s position as a leading project among decentralized physical infrastructure (DePIN) networks. Despite notable price fluctuations, with FIL hitting a yearly high of $11.46 in June, its value has since fallen nearly fourfold.

On-chain analysis shows that FIL remains a risky choice for investors. Decreased network activity, weak demand, and ecosystem bottlenecks indicate that the project’s growth potential remains limited, making it less attractive despite recent price fluctuations.

Problems arise for Filecoin as DePin’s most valuable project

Filecoin’s price, which is trading at $3.57, may indicate that the token is undervalued. However, according to Sharpe ratio data from Messari, the token may not be worth investing in the short term.

This ratio measures the risk-adjusted return of a cryptocurrency. In non-technical terms, a positive ratio means that investors have a good chance of getting a higher return on the money they spend on the asset.

However, the negative ratio indicates an extremely low risk-reward. At the time of publication, Filecoin’s Sharpe ratio is -2.95, which suggests that buying the cryptocurrency at the current price may not provide a good return on investment.

Read more: What is DePIN (Decentralized Physical Infrastructure Networks)?

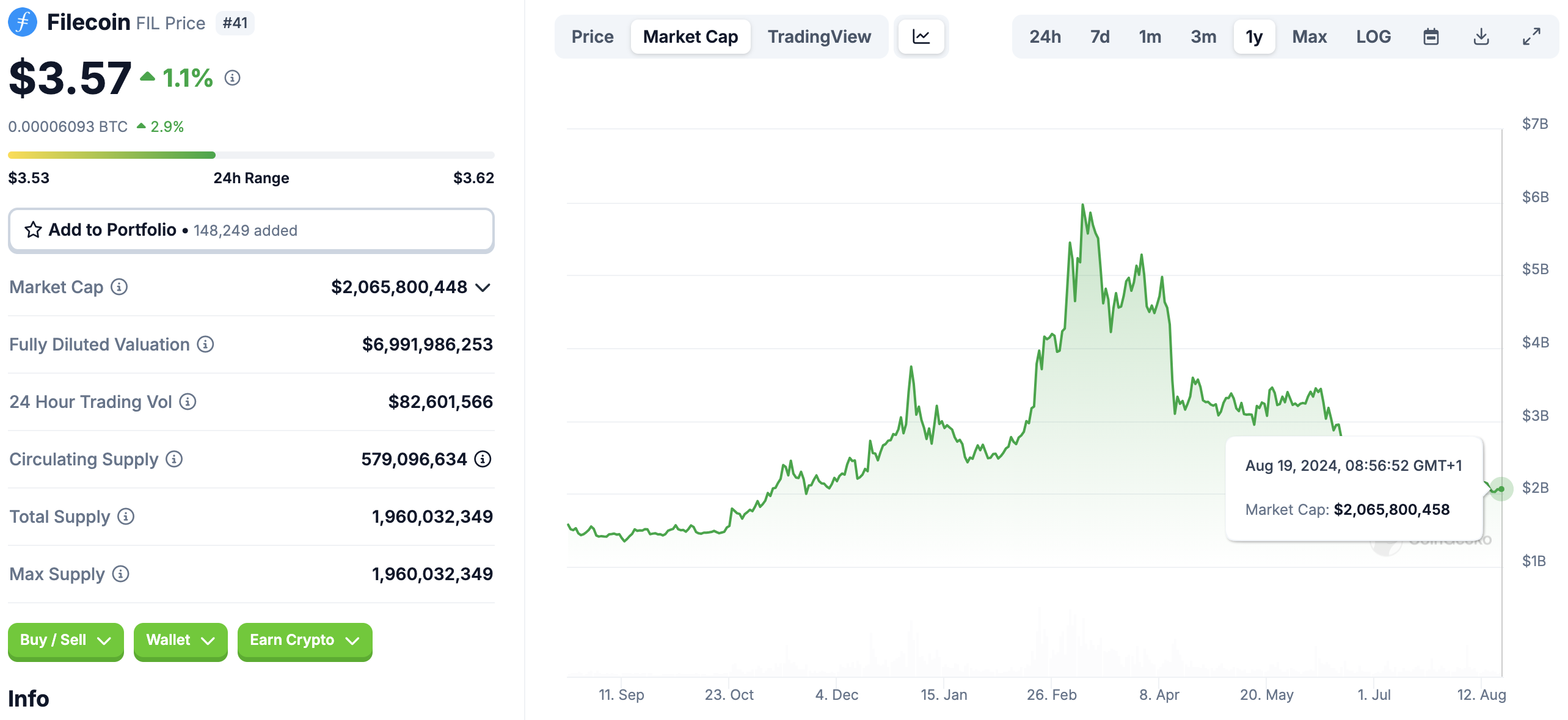

Despite the bleak outlook, Filecoin remains the most valuable DePIN project in terms of market cap. According to CoinGecko, FIL has a market cap of $2.06 billion.

However, it is important to emphasize that this value represents a threefold drop since March. Market cap is determined by multiplying the circulating supply by the price, so the decline in FIL’s market cap directly correlates with the significant correction the token has experienced in recent months.

If this continues, Filecoin risks losing its leading position to other DePIN projects such as Render (RNDR) and The Graph (GRT).

FIL Price Forecast: Falling Momentum Points to $3.25

According to the FIL/USD daily chart, the token has been trading in a downward channel since April, indicating a bearish trend. In this pattern, two downward trend lines are formed in the correction and consolidation phases, with the upper trend line acting as resistance and the lower one as support.

This corresponds to a low risk-reward ratio for FIL, especially considering that it has not yet broken out of the channel. In addition, the RSI is below the neutral line at 50.00, which suggests that bearish momentum remains dominant and the bulls are not in control.

Read More: Filecoin (FIL) Price Prediction 2024/2025/2030

Based on the above analysis, FIL price is at risk of falling further below its current level. If the momentum remains intact, the token could fall to support around $3.25. However, if there is a surge in buying pressure, FIL could rise to resistance at $4.27.