Fantom (FTM) price has fallen 20% in the last 24 hours amid a broader market downturn. At press time, the altcoin was trading at $0.29 and is now trading at a low last seen in October 2023.

FTM’s price drop over the past 24 hours has resulted in losses for many holders. Its spot market has seen fewer profitable transactions, while its derivatives market has seen a surge in long liquidations.

Fantom traders sell at a loss

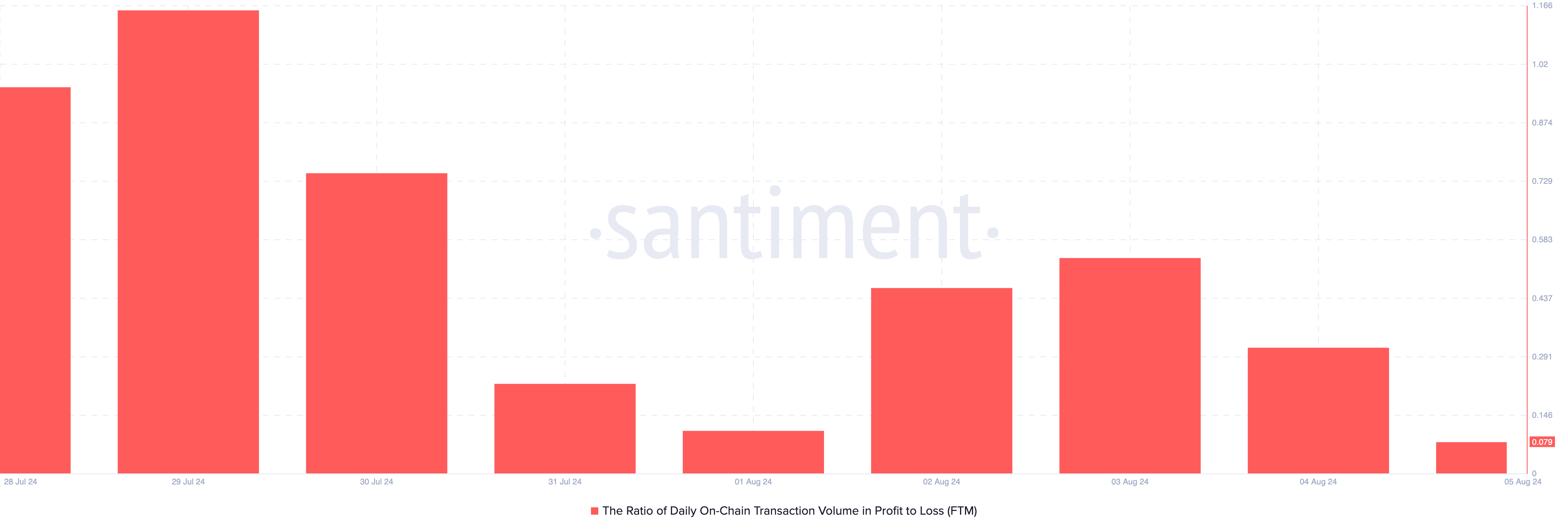

An evaluation of the daily FTM transaction volume on the network in profit to loss ratio shows that coin holders have seen more losses than profits over the last 24 hours. At press time, the metric stands at 0.07.

This metric measures the total volume of FTM transactions that are profitable for the sender compared to the total daily transaction volume on the chain. At 0.07, this means that for every transaction that resulted in a loss today, only 0.07 transactions were profitable.

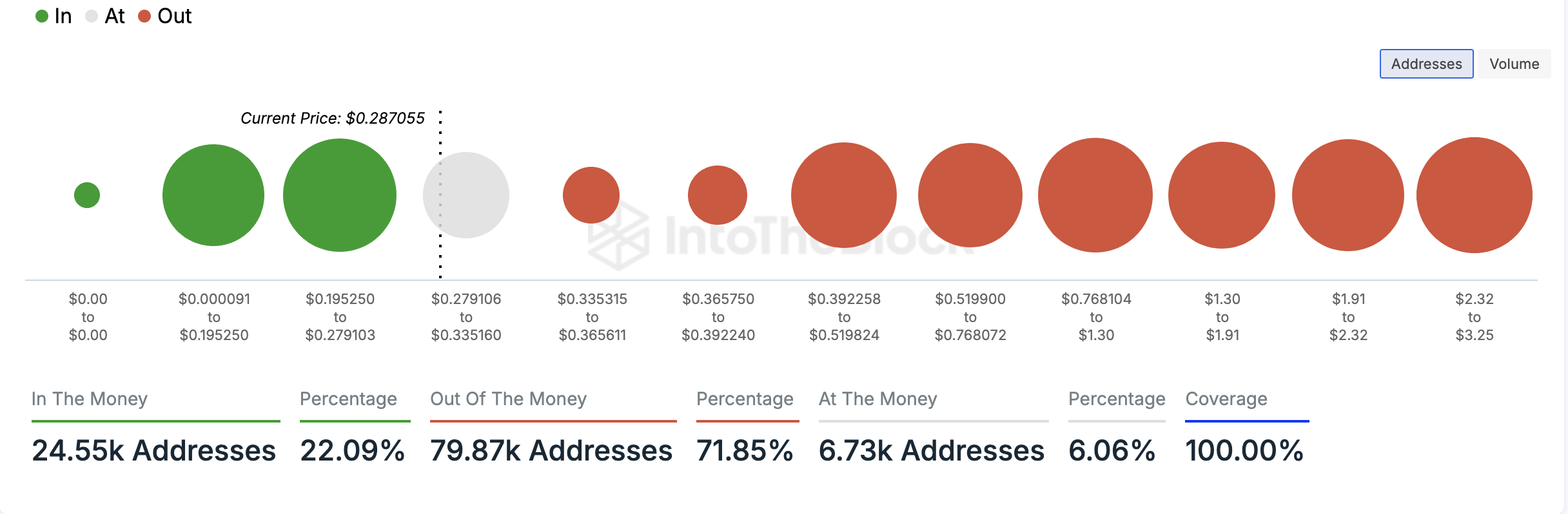

Currently, 80,000 wallet addresses, representing 72% of all holders, are “out of the money.” According to IntoTheBlock, an address is considered out of the money if the current market price of the asset is lower than the average price at which the address purchased (or received) the tokens it currently holds.

In contrast, only 23,000 addresses, representing 23% of all FTM holders, hold their coins at a profit.

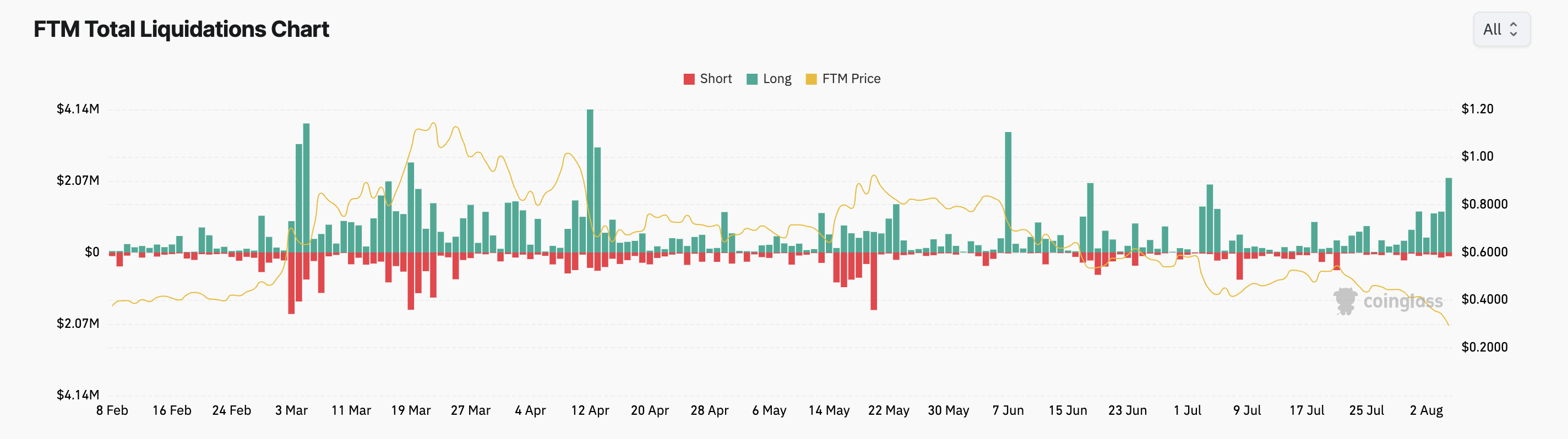

Derivatives traders in the coin have not escaped losses. According to Coinglass, several long positions have been liquidated in the last 24 hours. At the time of writing, the total amount is $2.16 million, which represents the largest one-day liquidation of long positions in the coin in two months.

Read more: What is Phantom (FTM)?

FTM Price Forecast: More Trouble Ahead

As the daily chart shows, FTM’s key technical indicators are hinting at the possibility of further price declines. For example, the coin’s Elder-Ray index signals that the bearish sentiment that follows it is significant. At press time, the indicator’s value is -0.19.

The Elder-Ray Index measures the balance between the strength of buyers and sellers in a market. When its value is below zero, it means that bearish strength dominates the market.

Additionally, FTM is trading below its 20-day exponential moving average (EMA), signaling a decline in buying activity. The 20-day EMA measures the average price of an asset over the past 20 days. When the asset price falls below it, it signals a surge in selling pressure.

If this trend continues, its value may fall to $0.25.

However, if the trend corrects and demand for it increases, this could lead to the price rising to $0.48.