Ethereum is faced with a decisive support range between the 100-day MA ($ 3.2 thousand) and May 200 (3 thousand US dollars), a critical region, which serves as the latest customer protection line.

It is expected that the result at this level will form the medium -term trajectory of Ethereum.

Technical analysis

Shayan

Daily diagram

Recently, ETH was faced with increased volatility when it approached a significant price range of 3.2 thousand dollars. USA, which reflects an intensive battle between buyers and sellers. The price action emphasizes sellers’ attempts to promote assets below these middle keys, signaling the potential bear rupture.

Currently, Ethereum is temporary support in this range, and the price is limited to 3.2 thousand dollars. USA and the upper border of the bull flag. The decisive breakthrough in any direction will probably determine the next main trend of Ethereum.

4-hour table

In the 4-hour Ethereum diagram, it was consolidated near the levels of compensation 0.5 (3.2 thousand US dollars) and 0.618 (3 thousand US dollars). Nevertheless, a strong percentage of purchases quickly returned the asset above the mark of 3.2 thousand dollars. USA.

This area remains key, since it is the final primary support zone for buyers. Sustainable retention is higher than 3.2 thousand dollars. The United States can revive a bull impulse aimed at recovering in the direction of resistance lines.

And vice versa, the breakdown below this range can cause liquidation, which can lead to the fact that the price of a support zone is $ 2.5 thousand. At the moment, Ethereum is consolidated near this critical region, with the battle between customers and sellers dictates the next step step.

Analysis of onchain

Shayan

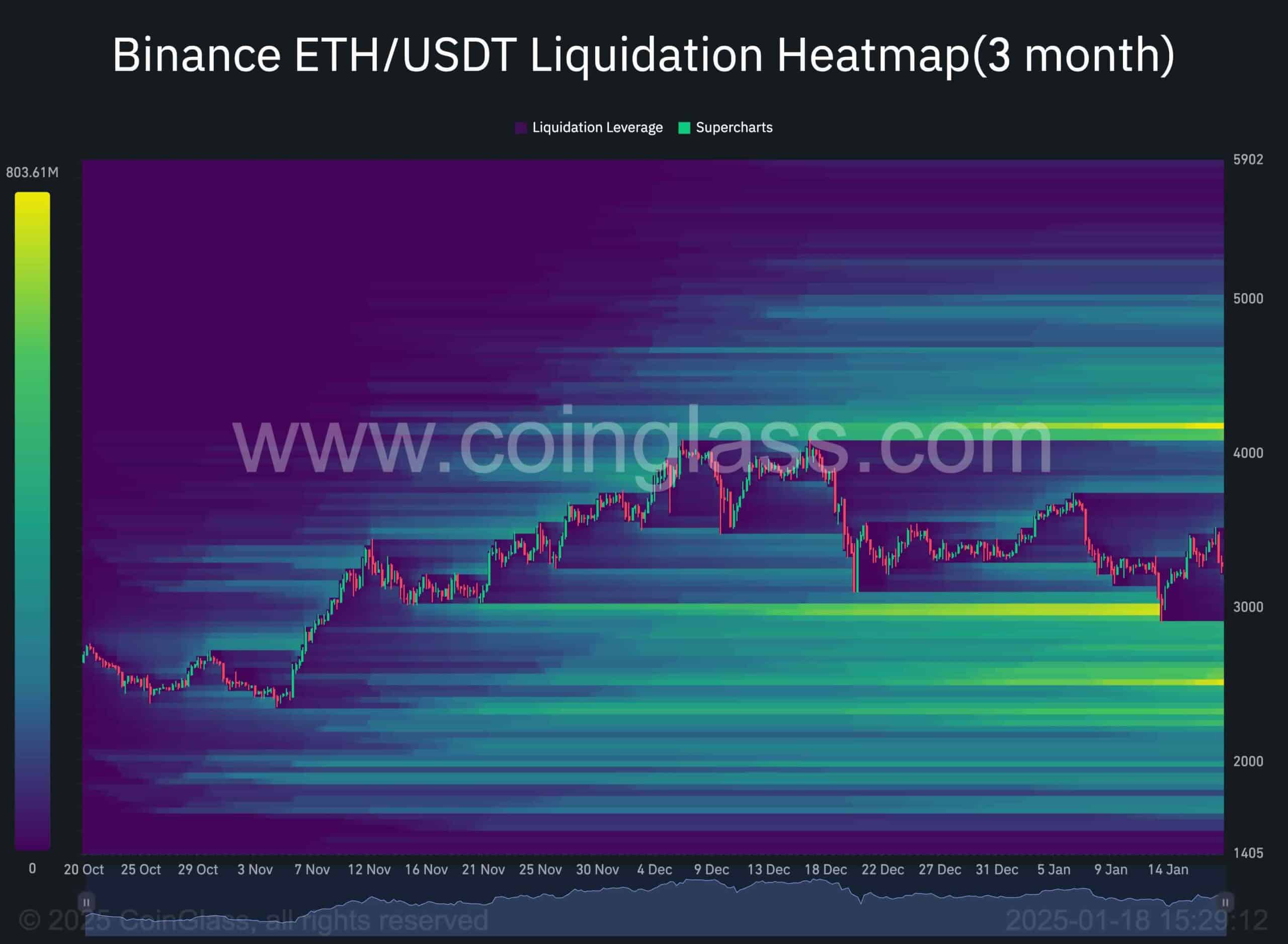

Binance heating map gives an idea of key levels where, probably, significant liquidation events. Based on clustering the liquidation levels for long and short positions, these levels often act as magnets that bring prices for them, since market participants seek to seize liquidity.

During recent shaking, Ethereum captured liquidity at a mark of 3 thousand dollars, which led to a sharp restoration of prices. A noticeable cluster of destroyed levels still exists slightly below critical support of 3 thousand dollars. USA, which is a liquidation with a long position. This makes an area of 3 thousand dollars. The United States is very attractive to bears and institutional sellers, which increases the likelihood of breaking the bear level into these levels in the medium term.

However, a significant liquidity pool also remains on the verge of 4 thousand dollars. USA, which notes the potential ultimate goal for buyers. Nevertheless, it is likely that the price can primarily capture liquidity below 3 thousand dollars, creating a shaking phase before resuming a bull trajectory up to 4 thousand dollars. USA. Although the current price action of Ethereum reflects consolidation, level 3 thousand dollars. The United States remains key. A meaningless breakthrough to capture liquidity below 3 thousand dollars. The United States is believable in short -term and environment.