The price of Ethereum today has experienced a mass accident, sending shock waves all over the crypto market.

Many investors are now wondering if this is the beginning of a new bear or a significant short -term liquidation event.

Technical analysis

Edris Depingrage.

Daily diagram

As the daily schedule suggests, the price of Ethereum fell up to the level of $ 2100 before experiencing a rebound. The level of 3000 dollars and a 200-day sliding average, located at about the same price, were defeated yesterday.

This was one of the main factors that contribute to today’s accident, at least in the technical side of events, since the 200-day sliding average is a key indicator of the trend, and if the market cannot soon return, longer and longer and can be expected even more deep correction.

4-hour table

On a 4-hour graphics, it is obvious that the price recently tried to break above the large falling wedge, but the breakthrough was false.

This bull trap led to a significant fall, since the level of $ 2800 is also lost and can now be considered as a resistance zone. Therefore, if the rapid recovery does not occur, the consolidation between levels of $ 2800 and $ 2400 probably occurs in the coming weeks.

Analysis of moods

Edris Depingrage.

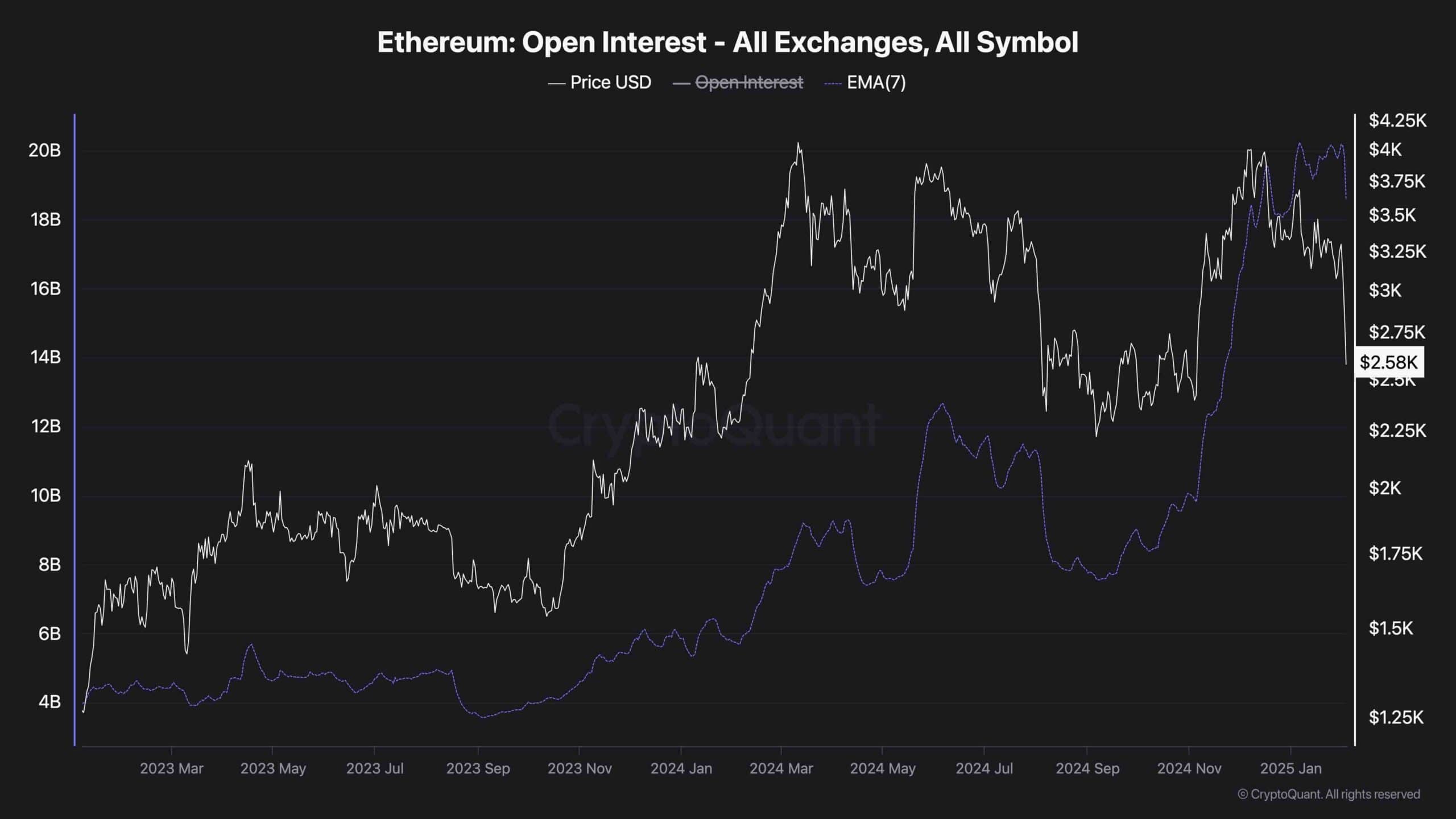

Ethereum open interest

While the price action of Ethereum indicated some tips that indicated today’s collapse on the market, it is necessary to conduct additional research on the basic dynamics of the market. Analysis of the futures market indicators can give a clear picture of the current situation.

This schedule represents the price of ETH and a 7-day exponential sliding average indicator of an open percentage, which measures the total number of open eternal futures contracts on centralized exchanges.

As the diagram demonstrates, while the asset is experiencing a huge fall, the open interest still does not demonstrate a significant decrease. Therefore, if the accident is considered as a liquidation cascade, the futures market has not yet cooled down, and in the short term there may be more liquidations and falls in the short term if the current pressure of sales remains.