Ethereum recently experienced a surge in buying activity, finding strong support at the critical $3.5K level, triggering a bullish rebound.

Despite this recovery, the $4K resistance remains a major barrier that ETH buyers are looking to overcome in the medium term.

Technical analysis

Author: Shayan

Daily chart

Ethereum price action was characterized by a notable recovery after meeting support at the crucial $3.5 thousand level. This region served as a major accumulation zone, contributing to increased buying pressure and subsequent growth. As the price rises, the $4,000 resistance becomes a critical psychological and technical barrier, requiring a decisive breakout to establish a sustainable upward trajectory.

Ethereum is currently consolidating in the $3.5-$4k range, indicating a potential breakout in either direction. Successfully crossing the $4 thousand threshold could pave the way for a new rally and confirm bullish sentiment. Conversely, a deviation at this level could lead to further consolidation or retracement within the existing range.

4 hour chart

On the lower timeframe, Ethereum’s decline found strong support within the key Fibonacci retracement levels of 0.5 ($3.2K)–0.618 ($3K). This support zone attracted significant buying interest, halting the downtrend and sparking a bullish recovery.

The subsequent accumulation phase turned into a bullish surge, and Ethereum now faces critical resistance at $4,000. This level, coinciding with a previous significant swing high, is expected to become an area of strong selling pressure.

Ethereum’s price action at $4K will determine its future trajectory. A successful break above this resistance could lead to a strong rally, while a failure could lead to extended consolidation or a potential retest of lower support levels around $3.5K.

On-chain analysis

Author: Shayan

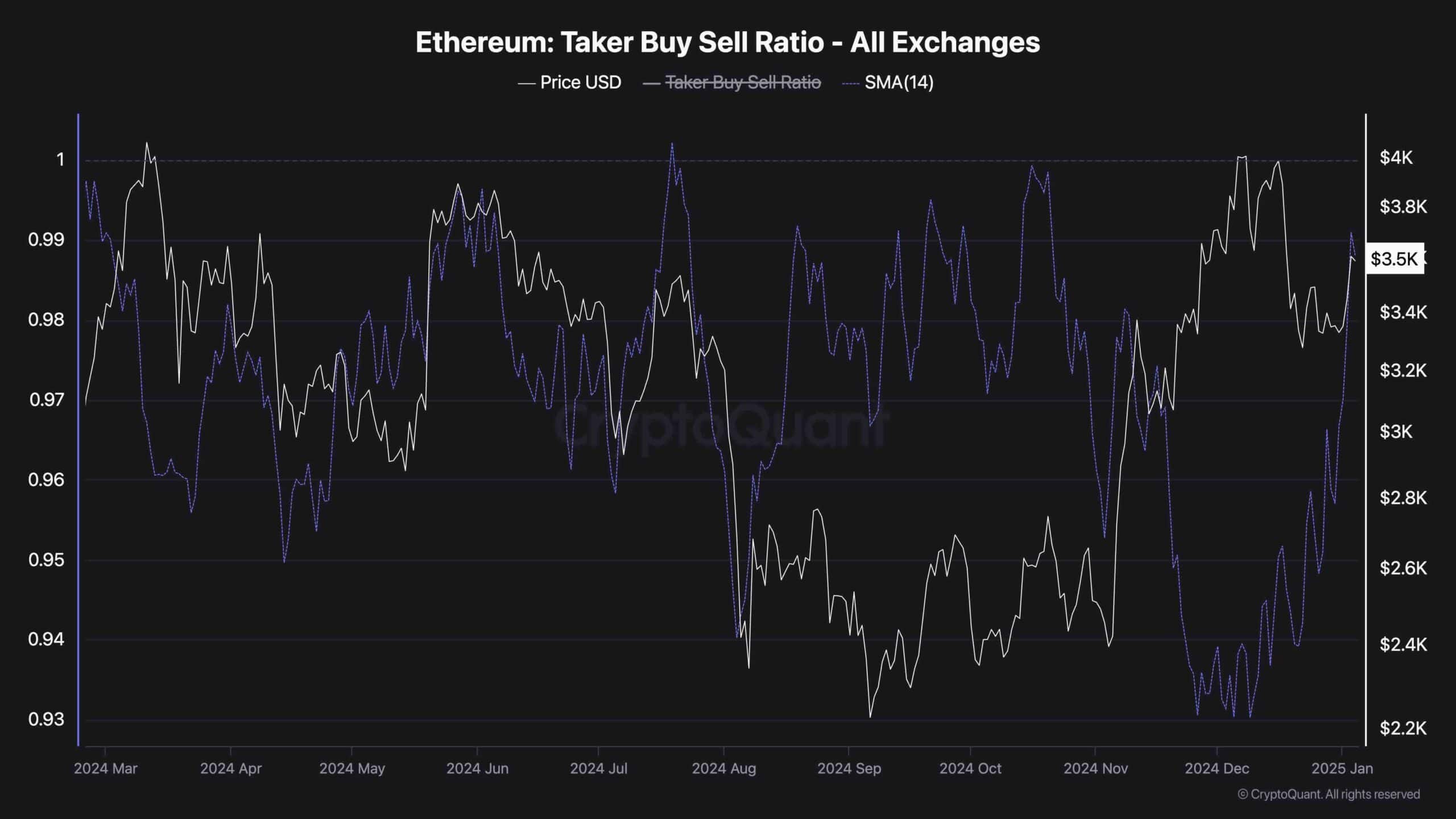

The taker buy/sell ratio, a key indicator for assessing sentiment in the futures market, provides insight into whether buyers or sellers are more aggressive in executing market orders. After Ethereum’s bullish bounce near the $3K support, the metric saw a notable increase, indicating a surge in market buy orders in the futures market.

This trend suggests futures market participants are increasingly bullish on Ethereum’s near-term price trajectory, expecting the asset to rise towards the $4,000 resistance.

A taker buy/sell ratio greater than 1 means that buyers are dominant, which often corresponds to the start of a bullish trend. Current data underscores this change in sentiment, reflecting increased confidence among traders and expectations for continued upward momentum.