- Ethereum fell to $ 2159.28, currently bargaining by $ 2,574.83, which is 16.93% at 24 hours.

- Market capitalization is $ 310.15 billion, and the volume of bidding increased by 252% to $ 83.61 billion.

Ethereum (ETH) experienced a sharp decrease, decreasing to a minimum of $ 2159.28, before restoring slightly. Currently, ETH is traded at the level of $ 2,574.83, there is a significant drop in 16.93% over the past 24 hours. The market capitalization of cryptocurrency is 310.15 billion dollars, which reflects a wider market decline.

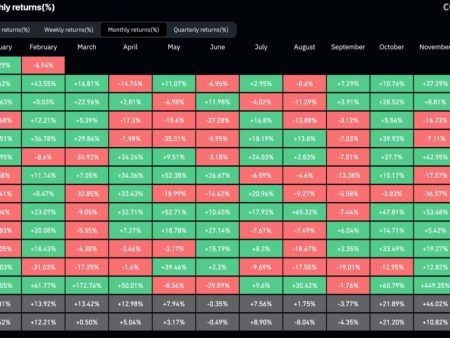

Meanwhile, the 24-hour trade volume increased by 252% to $ 83.61 billion, which indicates heavy sales. The market capitalization coefficient increased to 26.96%, emphasizing the increase in trade activity due to bearish moods.

Technical indicators reflect bear prospects

Ethereum is faced with direct support of $ 2,200, which is tested at a critical level tested during the last dive. If this support breaks down, ETH can slip further to $ 2,000, a psychological threshold that can cause a panic. Conversely, the nearest resistance level is about $ 2800, which corresponds to recent consolidation zones.

If ETH surpasses this barrier, there may be a rally of $ 3,000 on the horizon. Nevertheless, a violation of this resistance will require a strong impulse of the purchase and improvement of market moods. The relative force (RSI) index is currently 23.90, firmly in the reference area, which indicates that the sale of the sale was excessive.

The 14-day average RSI is 36.17, signaling the constant bear pulse. If RSI rises above 40, this can offer a potential price change. However, current indications emphasize the dominance of sellers in the market. The movement of mediums further enhances this bearish look.

Ethereum is traded significantly lower than the main sliding average, with a 50-day average average. Between 50-day and 200-day sliding medium, classic signal, which involved a long risk of inexpensive risk. Until ETH is restoring these average values, the bear’s trend will probably remain.

The Chaikin (CMF) cash flow indicator is 0.06, which reflects a weak percentage of purchase, despite a sharp decrease in prices. The future of Ethereum depends on whether it can stay above the critical support level of $ 2,200. The breakdown below this point can open the door for further reduction to $ 2,000.