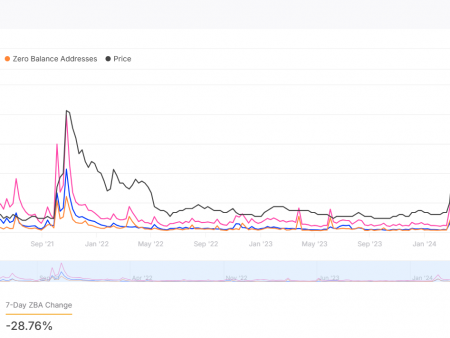

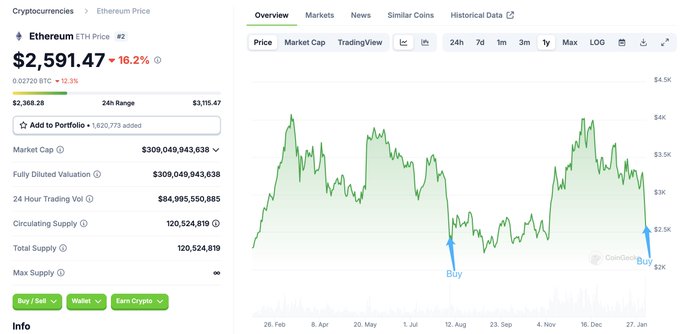

Ethereum (ETH) survived his largest daily losses in four years, sharply falling by almost 27% in one 24-hour period.

This decline reduced the price of ETH just above $ 2100, before a small recovery of to about $ 2544 during the press.

One of the largest liquidation events in recent history

The fall in the cost of Ethereum was not isolated; This was accompanied by a significant decrease in other large cryptocurrencies.

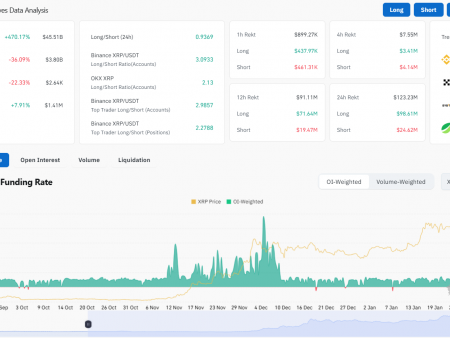

Bitcoin (BTC) fell by 6%, XRP by 22%, SOLANA (SOL) by 8%and Dogecoin (DOGE) by 23%.

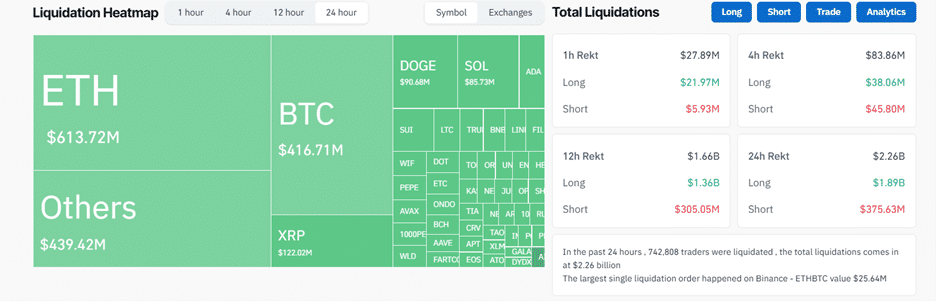

This wide sale contributed to the liquidation of more than $ 2.24 billion, which affects more than 730,000 merchants.

The largest uniform liquidation order was observed on Crypto Exchange Binance, where the ETH/BTC trade pair was eliminated for $ 25.64 million.

Ethereum traders (ETH) were the largest victims of the liquidation of today’s crypto, and the long positions of ETH lose about 613.72 million dollars.

The general elimination of cryptography for the day has already surpassed those that were observed during significant past events, such as the Covid-19 market and FTX collapse, demonstrating the seriousness of the current decline in the market.

Why did the price of the ethereum fall so much?

The catalyst of this shake of the market is apparently based on geopolitical tension, in particular, in the announcement of the new US tariffs by President Trump, aimed at importing from China, Canada and Mexico.

These tariffs imposed fears in the escalation of global trade wars, prompting investors to deviate from more risky assets, such as cryptocurrencies.

The volitional effect of these politicians was direct: the markets recorded significant losses shortly after the announcement.

The device of the investor

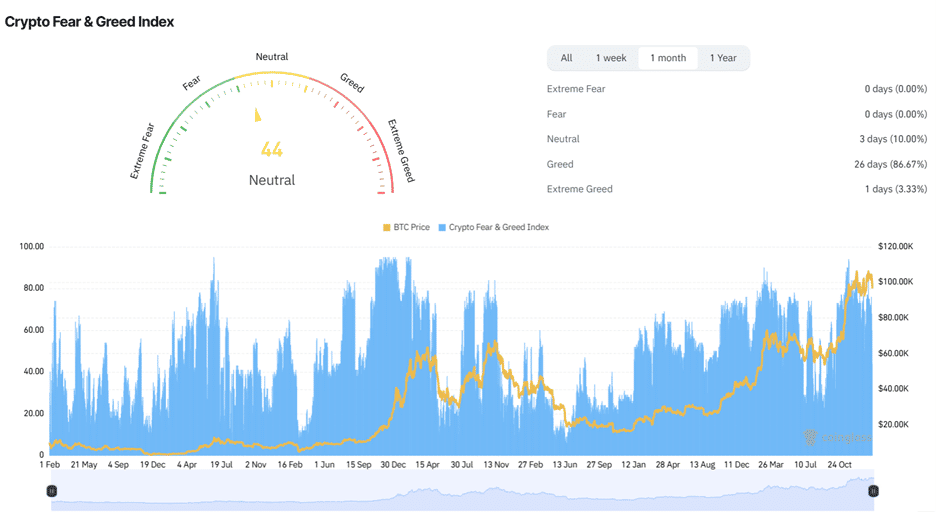

After collapse in the cryptography market, the mood of investors on the crypto market quickly moved to “fear” before returning to the “neutral”, as evidenced by the Crypto Fear & Greed index.

This fear is not unreasonable, given the rapid devaluation and the scale of losses.

Nevertheless, historical models suggest that such fear can often lead to purchase opportunities for those who believe in the main value of cryptocurrencies.

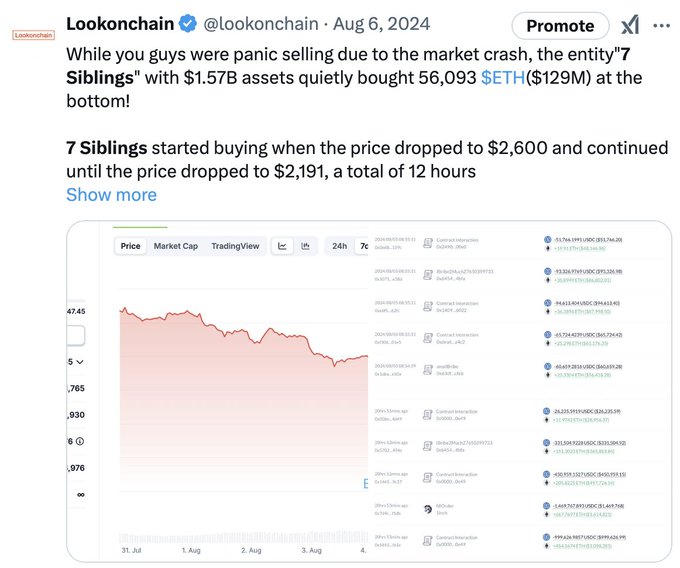

For example, the group “7 brothers and sisters”, known for its essential possessions, made a strategic purchase of 5,382 ETH, amounting to 14.5 million dollars. The United States, increasing their total amount to 50,429 ETH, worth about $ 126 million.

Another wallet “7 brothers and sisters” bought 5382 $ Eth($ 14.5 million). 7 brothers and sisters bought a total of 50,429 $ Eth(126 million dollars today. The last time 7 brothers and sisters bought a large number $ Eth Below was August 6, 2024, when the market crashed. X.com/lookonchain/st …

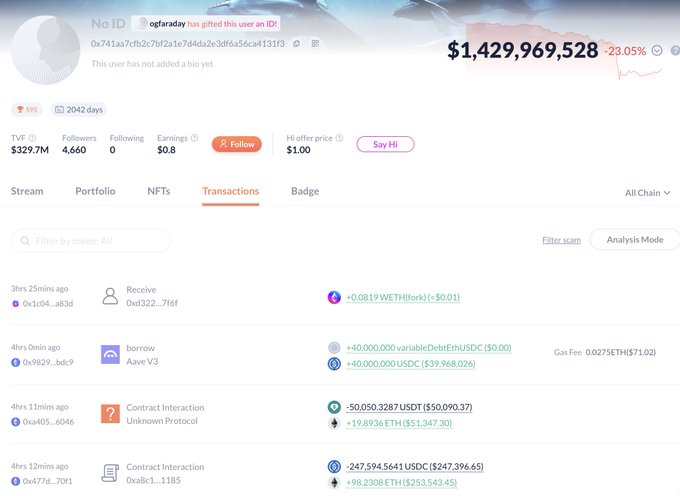

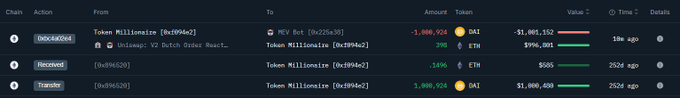

Another whale used $ 1 million. USA to buy 398 ETH at a price of $ 2515, after DAI for almost 2.5 years.

Crazy retention $ DAIThe Kit used to use $ 1 million $ DAI Buy 398 $ Eth at a price of $ 2515, after $ DAI Almost 2.5 years. Kit received these $ DAI From a fixed float 2.5 years ago. Addresses: -0xF094E2D70385F3AF3CC4BA7E6DA0DCFAC522DC -…

This accumulation of ETH, when it falls, can be interpreted as confidence in the future Ethereum, especially taking into account such significant acquisitions, often coincides with the restoration of the market.

Can Ethereum (ETH) recover?

Analysts are divided into the near future Ethereum.

Some, such as prescribed ones, consider this fall as a potential possibility of purchase, setting optimistic price purposes above $ 3,000.

$ Eth – I can not miss the purchase of one of the largest liquidation events that we saw. More sales than expected, but this is a rare opportunity to bet.

Others, such as Benjamin Cowen, indicate that ETH has reached a key long -term level of support, assuming a potential rebound.

From the technical side, Ethereum passed below 50-day and 200-day sliding medium, signaling a strong short-term bear’s trend, although the resold RSI can hint to relieve sales pressure.

It is noteworthy that Ethereum (ETH) has a recovery history; After a similar accident in 2021, it grew to $ 5,000, which indicates its ability to stability.

However, restoration is not guaranteed.

The market reaction will largely depend on the global economic events, especially how the tariff situation unfolds.

If the tension exacerbates, Ethereum may encounter further pressure down.

The Post Ethereum (ETH) journalizes the worst one-day fall in four years, shaking the crypto market appeared the first on Invezz