The 50-day EMA, a crucial technical level that serves as strong support for bullish momentum, has been broken by Ethereum. The asset is at an inflection point and the sustainability of its bullish trend is in question, as is its ability to sustain the recent recovery.

When this level is lost, the market structure weakens and the bears can take control of the situation. The declining momentum of the RSI, which further dropped into neutral territory, indicates easing buying pressure, also consistent with a fall. Ethereum may further refuse to test the 100 EMA somewhere around $3,100 if it fails to quickly recover the 50 EMA.

If this level is broken, the sell-off could extend towards the 200 EMA at $3,044, the last significant support area before a larger correction. Between $3,100 and $3,400, Ethereum could trade sideways as it enters a consolidation phase. This situation could indicate market indecision as traders wait for stronger catalysts for ETH to move in either direction.

Ethereum’s upward trajectory could be confirmed if there is a rapid recovery above the 50 EMA or higher volumes. If momentum picks up again, Ethereum could rise to $3,800. In this scenario, the next resistance level could be $3,500. Subsequent trading sessions will be very important for Ethereum.

To prevent increased selling pressure, the 50 EMA needs to be restored. However, ETH could enter a more severe correction phase if pessimism persists and there is no buying support. Ethereum is currently at an inflection point, and how well it can recover from losses will determine its course for the coming year.

Solana under pressure

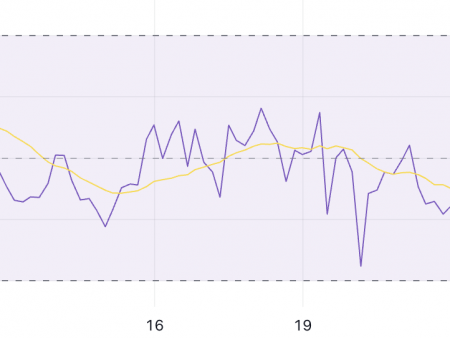

When the price approaches the 200 EMA, Solana has reached its limit. The 200-day EMA, currently trading at $175, could be a key indicator of whether Solana can stabilize or face more downward pressure after a prolonged decline.

The 200 EMA has historically served as a buffer against bearish trends. Before attempting to recover, SOL could indicate a possible reversal or at least a period of consolidation if it can hold above this level. The price could return to the resistance levels at $195 and $215 if it bounces from this level.

However, Solana’s current downward trend and rising sales volume cast doubt on its ability to maintain this support. Conversely, the next major support area is located around $150 if Solana fails to hold the 200 EMA. Accelerated selling could result from a break below $175, pushing the price into unheard of territory this cycle. In this case, Solana may take longer to regain its bullish trajectory and market confidence will likely be further eroded.

A possible price increase is indicated by the RSI indicator indicating an oversold state. However, the current weak buying volume is a worrying sign. If buyers don’t intervene quickly, the bearish narrative could take over and lead to big losses. The price movement of SOL will be very important in the coming days. To maintain any hope of recovery, it is necessary to hold above the 200 EMA.

To gauge market sentiment, traders should keep a close eye on the $175 level and pay attention to any noticeable changes in volume and RSI. Solana is currently at a turning point in its history, and its future will depend on its ability to retain important support.

Shiba Inu at critical level

The Shiba Inu price is hovering around the 200 EMA, a level that is often used as an indicator of a long-term trend. The Shiba Inu is approaching a turning point. This area is currently hovering around $0.000020 and represents the asset’s overall failure to maintain the momentum of the latest bull run and also serves as an important support level.

Given that the higher moving averages have been broken, SHIB has entered a bearish phase, casting doubt on its near-term recovery prospects. The decline towards the 200 EMA essentially reverses the SHIB’s uptrend, indicating that selling pressure has replaced speculative euphoria. If the price falls below this level, there could be significant psychological and technical barriers to the token, which could indicate further losses and possibly push it down to $0.000018 or even $0.000016.

If SHIB is able to maintain its position above the 200 EMA and recover to $0.000022, it could spark fresh interest and offer some respite to the token’s falling price. SHIB sees this stage as a chance for a fresh start, as well as the end of the recent rally. The rest of his future will be determined by the clear actions taken from this point on.

SHIB could resume its upward trajectory if speculative interest returns. Otherwise, there is a chance that investor confidence will decline further and lower levels will become the new focus. Whether SHIB’s story is one of recovery or continued decline will be determined in the coming days.